Rising Awareness of Crop Health and Quality

There is a growing awareness among farmers regarding the importance of crop health and quality, which is driving the plant hormones market. Farmers are increasingly recognizing that the application of plant hormones can lead to enhanced crop resilience, improved nutritional content, and better overall quality. This trend is particularly evident in high-value crops, where quality is paramount. The US market for high-value crops is expected to grow by 6% annually, indicating a potential increase in the adoption of plant hormones to meet quality standards. This heightened focus on crop quality is likely to bolster the plant hormones market.

Increasing Demand for Sustainable Agriculture

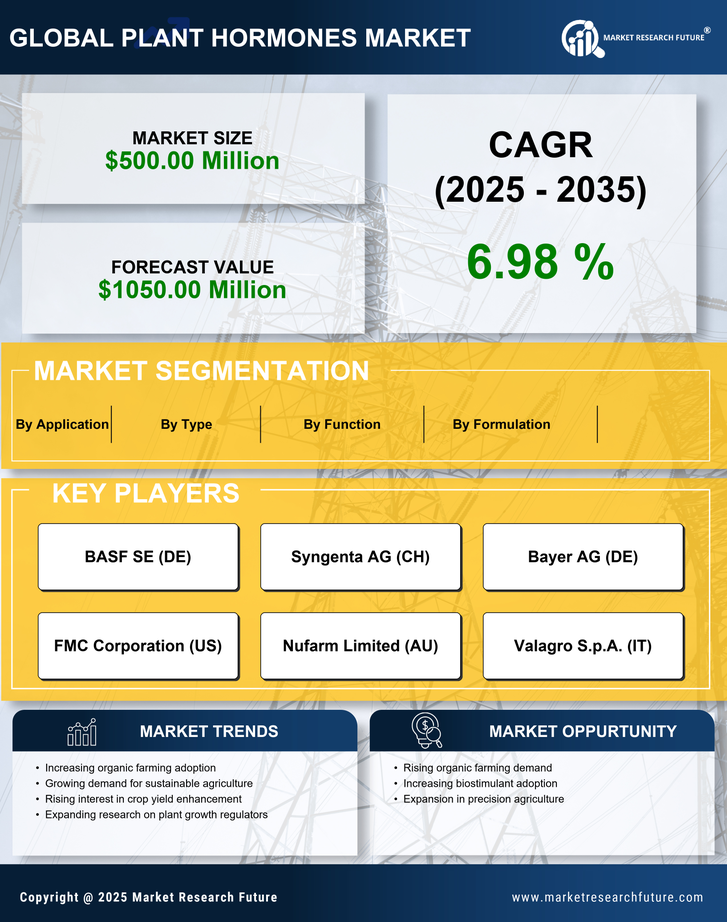

The plant hormones market is experiencing a notable surge in demand driven by the increasing emphasis on sustainable agricultural practices. Farmers are increasingly adopting plant hormones to enhance crop yield while minimizing environmental impact. This shift is largely influenced by consumer preferences for sustainably sourced products. According to recent data, the market for sustainable agriculture in the US is projected to grow at a CAGR of approximately 10% over the next five years. This trend indicates a growing recognition of the role that plant hormones play in achieving sustainable farming goals, thereby propelling the plant hormones market forward.

Technological Advancements in Crop Management

Technological innovations in crop management are significantly influencing the plant hormones market. The integration of advanced technologies such as precision agriculture and data analytics allows for more effective application of plant hormones. These technologies enable farmers to optimize hormone usage, leading to improved crop health and productivity. The US agricultural technology market is expected to reach $22 billion by 2026, suggesting a robust growth trajectory that will likely benefit the plant hormones market. As farmers increasingly rely on technology to enhance their operations, the demand for plant hormones is expected to rise correspondingly.

Expansion of Research and Development Activities

The plant hormones market is benefiting from an expansion in research and development (R&D) activities aimed at discovering new applications and formulations. Increased investment in agricultural R&D is fostering innovation in plant hormone products, leading to more effective solutions for crop management. The US government has allocated substantial funding for agricultural research, with an emphasis on enhancing food security and sustainability. This investment is expected to yield new plant hormone products that cater to evolving agricultural needs. As R&D continues to advance, the plant hormones market is likely to experience significant growth, with new products entering the market.

Regulatory Support for Biopesticides and Biostimulants

Regulatory frameworks in the US are increasingly supportive of biopesticides and biostimulants, which include various plant hormones. This regulatory environment encourages the development and commercialization of innovative plant hormone products. The US Environmental Protection Agency (EPA) has streamlined the approval process for biopesticides, which is likely to enhance market access for plant hormones. As a result, the plant hormones market is poised for growth, with an anticipated increase in product offerings and market penetration. This supportive regulatory landscape may lead to a projected market growth of 8% annually over the next five years.