Advent of Plant-Based Diets

The rise of plant-based diets is emerging as a crucial driver for the pickles market. As more consumers adopt vegetarian and vegan lifestyles, the demand for plant-based condiments, including pickles, is on the rise. Pickles are naturally plant-based and align well with the dietary preferences of this growing demographic. In the US, the plant-based food market is projected to reach $74 billion by 2027, indicating a substantial opportunity for the pickles market to expand its consumer base. This trend suggests that the pickles market could see increased sales as more individuals seek out plant-based options that complement their dietary choices.

Innovative Packaging Solutions

The introduction of innovative packaging solutions is playing a pivotal role in shaping the pickles market. As consumers become more environmentally conscious, there is a growing demand for sustainable and convenient packaging options. Companies are exploring eco-friendly materials and designs that not only preserve the quality of pickles but also appeal to environmentally aware consumers. In the US, the sustainable packaging market is expected to grow at a CAGR of 7% through 2026, which could positively impact the pickles market. This trend indicates that brands that prioritize sustainable packaging may gain a competitive edge, attracting consumers who value both product quality and environmental responsibility.

Culinary Versatility of Pickles

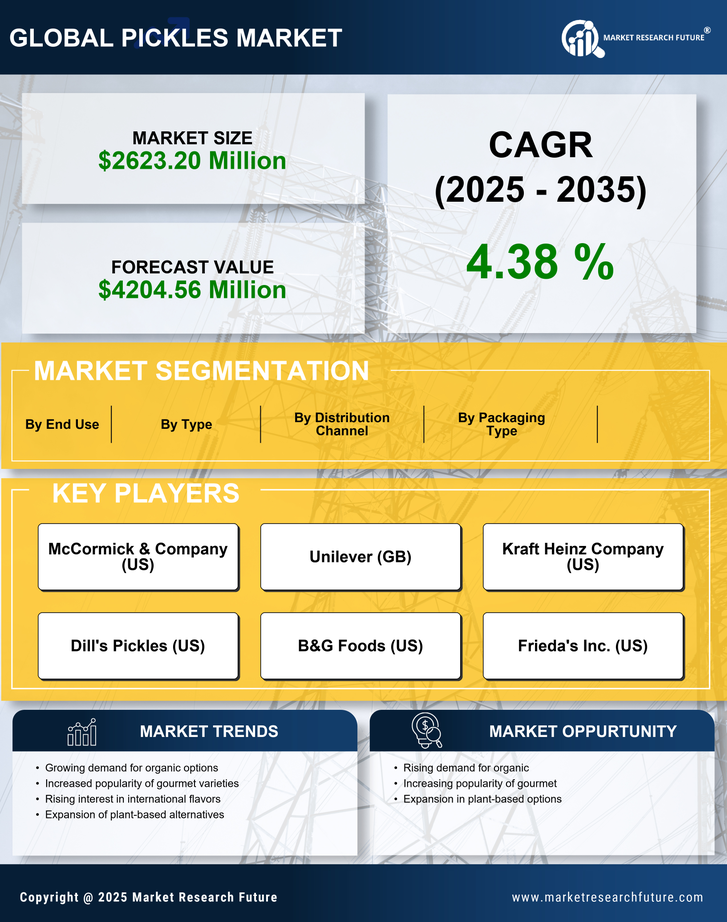

The culinary versatility of pickles serves as a significant driver for the pickles market. Pickles are not only enjoyed as a standalone snack but also as a key ingredient in various dishes, including sandwiches, salads, and gourmet recipes. This adaptability enhances their appeal across diverse consumer segments. The US food industry has seen a growing trend in incorporating pickles into innovative recipes, which has contributed to a rise in sales. In 2025, the pickles market is projected to reach a valuation of approximately $2 billion, reflecting the increasing integration of pickles into everyday meals. This trend indicates that the pickles market is well-positioned to capitalize on the evolving culinary landscape.

Increased Focus on Local Sourcing

The growing emphasis on local sourcing is influencing the pickles market significantly. Consumers are increasingly inclined to support local businesses and seek products that are made from locally sourced ingredients. This trend is particularly pronounced in the US, where farm-to-table initiatives are gaining traction. Local pickling companies are emerging, offering unique flavors and artisanal products that resonate with consumers. This shift towards local sourcing not only supports regional economies but also enhances the perceived quality of pickles. As a result, the pickles market is likely to benefit from this trend, as consumers prioritize authenticity and sustainability in their food choices.

Rising Demand for Fermented Foods

The increasing consumer interest in fermented foods is a notable driver for the pickles market. Fermented products are often associated with health benefits, including improved gut health and enhanced digestion. This trend aligns with the broader movement towards natural and minimally processed foods. In the US, the fermented foods market has been growing at a rate of approximately 8% annually, indicating a strong preference for products like pickles. As consumers become more aware of the nutritional advantages of fermented foods, the pickles market is likely to experience a corresponding surge in demand. This shift towards health-oriented eating habits suggests that the pickles market will continue to thrive as consumers seek out products that contribute positively to their overall well-being.