Shift Towards Preventive Healthcare

The growing emphasis on preventive healthcare is reshaping the pharmacy market landscape. As consumers become more health-conscious, there is an increasing demand for preventive services such as immunizations, health screenings, and wellness programs. Pharmacies are uniquely positioned to offer these services, making them integral to community health initiatives. In 2025, it is anticipated that pharmacies will administer over 50 million vaccinations annually, reflecting a shift towards proactive health management. This trend not only enhances the pharmacy's role in public health but also drives revenue growth through service diversification. By aligning with preventive healthcare strategies, pharmacies can strengthen their market presence and foster long-term relationships with patients.

Expansion of Pharmacy Benefit Managers (PBMs)

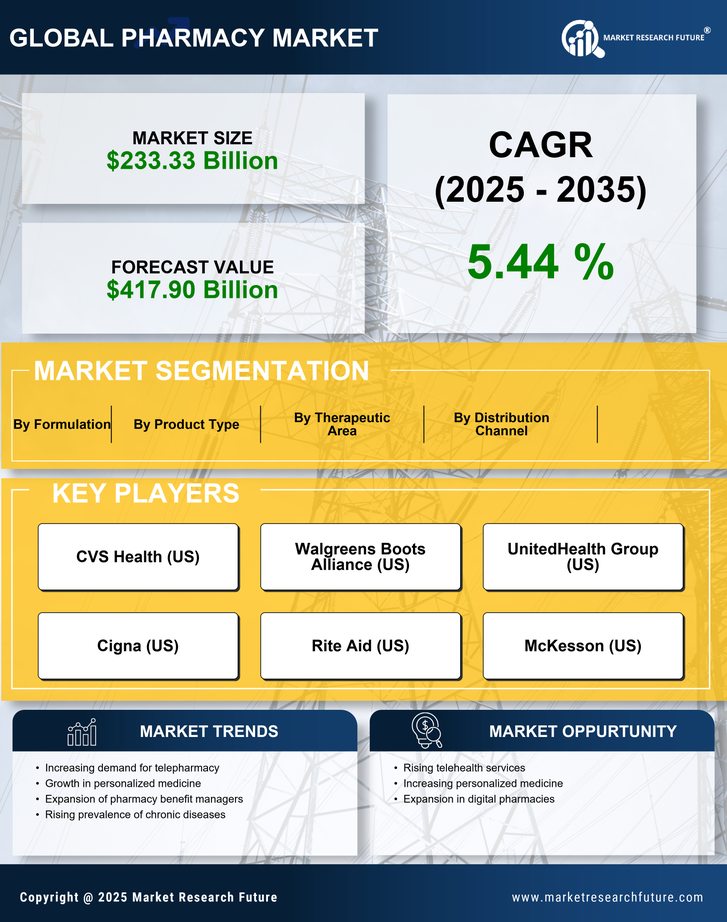

The role of Pharmacy Benefit Managers (PBMs) is increasingly pivotal in the pharmacy market, influencing drug pricing and access to medications. PBMs negotiate with drug manufacturers and pharmacies to manage prescription drug benefits for health plans. As the healthcare landscape evolves, the influence of PBMs is expected to grow, potentially impacting pharmacy revenues and patient access to medications. In 2025, it is projected that PBMs will manage over 80% of all prescription drug claims in the US. This consolidation may lead to increased competition among pharmacies, prompting them to enhance service offerings and patient engagement strategies. The dynamics introduced by PBMs could reshape the competitive landscape of the pharmacy market, necessitating adaptive strategies from pharmacies to thrive.

Regulatory Changes and Compliance Requirements

The pharmacy market is influenced by ongoing regulatory changes and compliance requirements that shape operational practices. In recent years, the US government has implemented stricter regulations regarding drug pricing, safety, and distribution. These changes compel pharmacies to adapt their business models to remain compliant while ensuring patient safety. For instance, the Drug Enforcement Administration (DEA) has increased scrutiny on controlled substances, necessitating enhanced tracking and reporting systems. As pharmacies invest in compliance measures, operational costs may rise, but this also presents opportunities for growth in specialized pharmacy services. The ability to navigate these regulatory landscapes effectively could position pharmacies as trusted healthcare providers, thereby enhancing their role in the pharmacy market.

Aging Population and Chronic Disease Management

The demographic shift towards an aging population in the US is significantly impacting the pharmacy market. By 2025, it is projected that approximately 20% of the US population will be aged 65 and older, leading to a higher prevalence of chronic diseases such as diabetes and hypertension. This demographic trend necessitates increased pharmaceutical care and medication management services. Pharmacies are likely to play a crucial role in managing these chronic conditions, providing medication therapy management and counseling services. Consequently, the demand for pharmacy services is expected to rise, potentially increasing the market size by 15% over the next five years. This driver underscores the importance of pharmacies in the healthcare continuum, particularly in supporting the health needs of an aging population.

Technological Advancements in Pharmacy Services

The pharmacy market is experiencing a notable transformation due to rapid technological advancements. Innovations such as automated dispensing systems and electronic health records are enhancing operational efficiency and patient safety. In 2025, it is estimated that over 60% of pharmacies in the US will adopt advanced technologies to streamline their services. This shift not only improves medication management but also facilitates better communication between pharmacists and healthcare providers. As a result, the pharmacy market is likely to see increased customer satisfaction and loyalty, driving growth in the sector. Furthermore, the integration of artificial intelligence in pharmacy operations may lead to more personalized patient care, thereby expanding the market's reach and potential revenue streams.