Rising Aging Population

The increasing aging population in the United States is a primary driver for the nonclinical homecare-software market. As individuals age, they often require more assistance with daily activities, leading to a higher demand for homecare services. According to the U.S. Census Bureau, by 2030, all baby boomers will be over 65 years old, significantly increasing the need for homecare solutions. This demographic shift necessitates efficient management of homecare services, which nonclinical homecare software can provide. The software aids in scheduling, patient management, and communication, thereby enhancing service delivery. As the population ages, The nonclinical homecare-software market will likely expand, driven by the need for tailored solutions that cater to the unique requirements of elderly care.

Technological Advancements

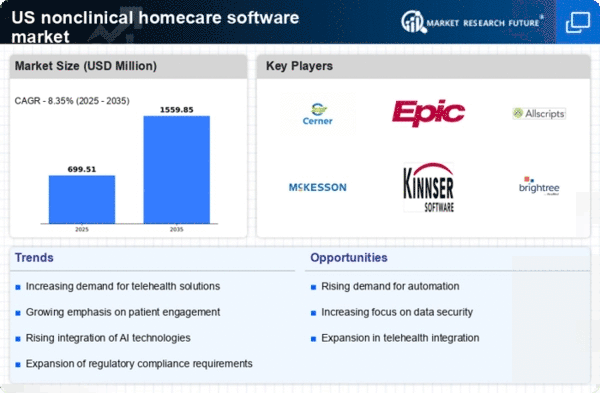

Technological advancements play a crucial role in shaping the nonclinical homecare-software market. Innovations in software development, such as cloud computing and mobile applications, enhance the functionality and accessibility of homecare solutions. These technologies enable caregivers to access patient information in real-time, improving the quality of care provided. The integration of artificial intelligence and machine learning into homecare software is also on the rise, allowing for predictive analytics and personalized care plans. As technology continues to evolve, The nonclinical homecare-software market will grow, with an increasing number of providers adopting these advanced solutions to streamline operations and improve patient outcomes.

Shift Towards Value-Based Care

The shift towards value-based care in the healthcare system is significantly influencing the nonclinical homecare-software market. This model emphasizes patient outcomes and cost-effectiveness rather than the volume of services provided. Homecare software solutions are essential in tracking patient progress, managing care plans, and ensuring compliance with regulatory standards. As healthcare providers focus on delivering high-quality care while controlling costs, the demand for nonclinical homecare software that supports these objectives is likely to increase. The market is projected to grow as more organizations recognize the importance of data-driven decision-making in enhancing patient care and operational efficiency.

Regulatory Compliance Requirements

Regulatory compliance requirements are a significant driver of the nonclinical homecare-software market. Homecare providers must adhere to various federal and state regulations, including HIPAA and Medicare guidelines, to ensure patient privacy and safety. Nonclinical homecare software solutions assist organizations in maintaining compliance by providing tools for documentation, reporting, and data security. As regulatory scrutiny increases, the demand for software that simplifies compliance processes is likely to grow. This trend indicates a robust market for nonclinical homecare software, as providers seek solutions that not only enhance operational efficiency but also ensure adherence to legal standards.

Increased Focus on Patient Engagement

An increased focus on patient engagement is driving the nonclinical homecare-software market. Engaging patients in their care processes leads to better health outcomes and higher satisfaction rates. Homecare software solutions facilitate communication between patients and caregivers, allowing for more personalized care. Features such as patient portals and mobile applications enable patients to access their health information, schedule appointments, and communicate with their care teams. As healthcare providers strive to enhance patient engagement, the demand for nonclinical homecare software that supports these initiatives is expected to rise, contributing to market growth.