Focus on Personalized Medicine

The shift towards personalized medicine is a significant driver in the US Molecular Diagnostics For Transplant Market. Personalized medicine tailors treatment plans based on individual genetic profiles, which is particularly relevant in transplant scenarios where compatibility is crucial. Molecular diagnostics enable healthcare providers to assess the genetic makeup of both donors and recipients, thereby optimizing transplant outcomes. This trend is supported by an increasing body of research demonstrating that personalized approaches can reduce the risk of rejection and improve long-term success rates. As healthcare systems in the US continue to embrace personalized medicine, the demand for molecular diagnostic tools is expected to rise. This shift not only enhances patient care but also aligns with broader healthcare goals of improving efficiency and reducing costs associated with transplant procedures.

Increased Awareness and Education

Increased awareness and education regarding the importance of molecular diagnostics in transplantation is a key driver for the US Molecular Diagnostics For Transplant Market. Healthcare professionals are becoming more knowledgeable about the benefits of molecular testing, leading to greater adoption in clinical practice. Educational initiatives and training programs are being implemented to inform clinicians about the latest advancements in molecular diagnostics and their applications in transplant medicine. This heightened awareness is fostering a culture of evidence-based practice, where decisions are increasingly guided by molecular data. As healthcare providers recognize the value of these diagnostics in improving transplant outcomes, the demand for molecular diagnostic tests is expected to grow. This trend is likely to enhance the overall quality of care in transplant programs across the United States.

Rising Incidence of Chronic Diseases

The US Molecular Diagnostics For Transplant Market is also influenced by the rising incidence of chronic diseases, which often lead to organ failure and the need for transplants. Conditions such as diabetes, hypertension, and liver disease are becoming increasingly prevalent in the US population, necessitating more organ transplants. According to the Organ Procurement and Transplantation Network (OPTN), the number of transplants performed annually has been steadily increasing, highlighting the growing demand for effective diagnostic tools. Molecular diagnostics play a critical role in ensuring the success of these transplants by providing essential information about donor-recipient compatibility. As the prevalence of chronic diseases continues to rise, the market for molecular diagnostics in transplant settings is likely to expand, driven by the need for improved patient management and outcomes.

Regulatory Support and Reimbursement Policies

The US Molecular Diagnostics For Transplant Market benefits from robust regulatory support and favorable reimbursement policies. The Food and Drug Administration (FDA) has established clear guidelines for the approval of molecular diagnostic tests, which facilitates quicker market entry for innovative products. Additionally, the Centers for Medicare & Medicaid Services (CMS) has recognized the importance of molecular diagnostics in transplant procedures, leading to improved reimbursement rates for these tests. This regulatory environment encourages investment in research and development, as companies are more likely to pursue new diagnostic solutions knowing that they will receive support from regulatory bodies. The combination of regulatory clarity and financial incentives is likely to drive market growth, as healthcare providers increasingly adopt molecular diagnostics to enhance patient care in transplant settings.

Technological Advancements in Molecular Diagnostics

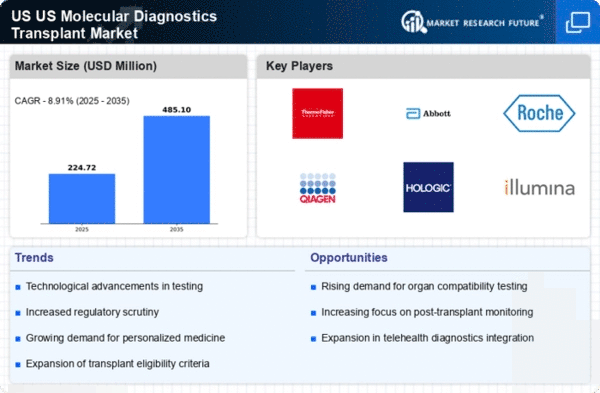

The US Molecular Diagnostics For Transplant Market is experiencing rapid growth due to technological advancements in diagnostic tools. Innovations such as next-generation sequencing (NGS) and polymerase chain reaction (PCR) techniques have enhanced the accuracy and speed of transplant compatibility testing. These technologies allow for the identification of genetic markers that predict transplant rejection, thereby improving patient outcomes. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years, driven by the increasing adoption of these advanced diagnostic methods. Furthermore, the integration of artificial intelligence in data analysis is expected to streamline the diagnostic process, making it more efficient and reliable. As a result, healthcare providers are increasingly investing in these technologies to enhance their transplant programs.