Rising Incidence of Chronic Diseases

The increasing prevalence of chronic diseases in the United States is significantly impacting the microsurgery market. Conditions such as diabetes, cardiovascular diseases, and cancer often require surgical interventions, many of which can be addressed through microsurgical techniques. According to recent statistics, chronic diseases affect nearly 60% of the US population, leading to a higher demand for specialized surgical procedures. This trend suggests that the microsurgery market will continue to grow as healthcare providers seek effective solutions for managing these complex health issues. The integration of microsurgery into treatment plans is likely to become more common, further driving market expansion.

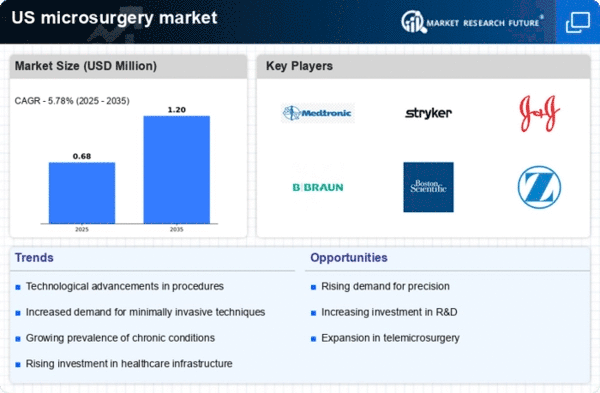

Growing Awareness of Microsurgical Benefits

There is a notable increase in awareness regarding the benefits of microsurgery among both healthcare professionals and patients. Educational initiatives and outreach programs are effectively communicating the advantages of microsurgical techniques, such as reduced recovery times and minimized scarring. This heightened awareness is contributing to a growing acceptance of microsurgery as a viable option for various surgical procedures. As a result, the microsurgery market is likely to expand, with an estimated growth rate of around 8% annually. Patients are increasingly seeking out these advanced surgical options, which could lead to a higher volume of procedures performed in the coming years.

Increased Investment in Healthcare Infrastructure

The microsurgery market is experiencing a surge in investment aimed at enhancing healthcare infrastructure across the United States. This trend is driven by both public and private sectors recognizing the need for advanced surgical facilities equipped with state-of-the-art technology. As hospitals and surgical centers upgrade their capabilities, the demand for microsurgical procedures is likely to rise. In 2025, healthcare spending in the US is projected to reach approximately $4.3 trillion, with a significant portion allocated to surgical advancements. This investment not only improves patient outcomes but also fosters innovation within the microsurgery market, as new techniques and tools are developed to meet the evolving needs of healthcare providers.

Advancements in Surgical Instruments and Techniques

The continuous evolution of surgical instruments and techniques is a key driver for the microsurgery market. Innovations such as robotic-assisted surgery and enhanced imaging technologies are transforming the landscape of microsurgical procedures. These advancements not only improve precision and outcomes but also expand the range of conditions that can be treated effectively. In 2025, the market for surgical instruments is expected to exceed $12 billion, with a significant portion attributed to microsurgical applications. As these technologies become more accessible, the adoption of microsurgery is likely to increase, further propelling the growth of the market.

Supportive Regulatory Environment for Surgical Innovations

The regulatory landscape in the United States is increasingly supportive of innovations in surgical techniques and devices, which is beneficial for the microsurgery market. Regulatory bodies are streamlining approval processes for new technologies, allowing for quicker access to advanced surgical solutions. This supportive environment encourages research and development, fostering a culture of innovation within the microsurgery field. As new devices and techniques receive faster approvals, healthcare providers are more likely to adopt these advancements, leading to an anticipated growth in the market. The potential for increased efficiency and improved patient outcomes positions the microsurgery market favorably for future expansion.