Health and Wellness Trends

The liquid coffee market is increasingly influenced by the health and wellness movement. Consumers are becoming more health-conscious, seeking beverages that offer functional benefits. This shift is evident in the rising popularity of liquid coffee products infused with vitamins, adaptogens, and other health-promoting ingredients. Market Research Future suggests that around 25% of consumers are willing to pay a premium for functional beverages, indicating a lucrative opportunity for brands to innovate. Additionally, the demand for low-calorie and sugar-free options is on the rise, as consumers prioritize healthier choices. This focus on health and wellness is likely to drive product development and marketing strategies within the liquid coffee market.

Impact of E-commerce Growth

The liquid coffee market is significantly impacted by the rapid growth of e-commerce. As online shopping becomes increasingly prevalent, consumers are turning to digital platforms for their coffee purchases. This shift is evidenced by a reported 40% increase in online coffee sales over the past year. E-commerce provides convenience and access to a wider variety of products, allowing consumers to explore different brands and flavors from the comfort of their homes. Additionally, subscription services are gaining popularity, offering consumers a hassle-free way to receive their favorite liquid coffee products regularly. This trend is likely to reshape the distribution landscape of the liquid coffee market, as brands adapt to meet the demands of online shoppers.

Evolving Consumer Preferences

The liquid coffee market is witnessing a shift in consumer preferences, particularly among younger demographics. Millennials and Generation Z are increasingly favoring unique flavors and artisanal products, leading to a rise in specialty liquid coffee offerings. This demographic is more adventurous in their beverage choices, often seeking out innovative blends and limited-edition flavors. Market data indicates that specialty coffee sales have grown by approximately 15% in recent years, reflecting this trend. Brands are responding by launching new flavor profiles and collaborations with local roasters, aiming to capture the interest of these discerning consumers. This evolution in preferences is likely to continue influencing product development within the liquid coffee market.

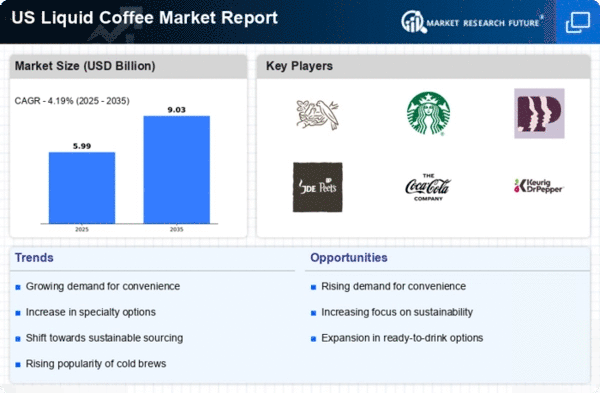

Growing Demand for Convenience

The liquid coffee market is experiencing a notable surge in demand for convenient beverage options. As consumers increasingly lead busy lifestyles, the preference for ready-to-drink coffee products has intensified. This trend is reflected in This trend is reflected in data indicating that the ready-to-drink segment accounts for approximately 30% of total liquid coffee sales in the US., indicating that the ready-to-drink segment accounts for approximately 30% of total liquid coffee sales in the US. The appeal of grab-and-go options aligns with the fast-paced nature of modern life, driving innovation in packaging and product offerings. Brands are responding by introducing single-serve formats and portable packaging, catering to on-the-go consumption. This growing demand for convenience is likely to continue shaping the liquid coffee market, as consumers seek products that fit seamlessly into their daily routines.

Technological Advancements in Production

Technological advancements are playing a crucial role in shaping the liquid coffee market. Innovations in brewing techniques, extraction methods, and packaging technologies are enhancing product quality and shelf life. For instance, cold brew technology has gained traction, allowing for smoother and less acidic coffee options that appeal to a broader audience. Furthermore, advancements in packaging, such as vacuum-sealed containers, are improving freshness and convenience. These technological improvements not only enhance the consumer experience but also enable brands to differentiate themselves in a competitive market. As technology continues to evolve, it is expected to further influence the liquid coffee market, driving efficiency and quality.