Rising Adoption in Law Enforcement

The iris recognition market is witnessing significant growth due to its increasing adoption in law enforcement agencies across the US. Law enforcement organizations are leveraging iris recognition technology to enhance their identification processes, improve criminal investigations, and streamline the management of criminal databases. The ability to accurately identify individuals in real-time has proven invaluable in various scenarios, including border control and public safety initiatives. As of 2025, it is estimated that over 30% of law enforcement agencies in the US have integrated iris recognition systems into their operations. This trend not only enhances operational efficiency but also fosters public trust in law enforcement, thereby driving further investment in the iris recognition market.

Technological Innovations in Imaging Systems

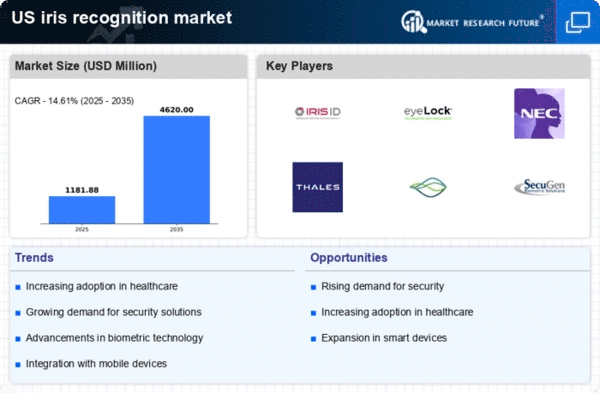

The iris recognition market is significantly influenced by ongoing technological innovations in imaging systems. Advances in camera technology, image processing algorithms, and machine learning techniques are enhancing the accuracy and speed of iris recognition systems. These innovations are making iris recognition more accessible and cost-effective for various applications, including mobile devices and access control systems. As imaging technology continues to evolve, the market is likely to see a proliferation of new products and solutions that cater to diverse consumer needs. By 2025, it is anticipated that the market for iris recognition technology will grow at a CAGR of around 20%, driven by these technological advancements that improve user experience and system reliability.

Expansion of Smart Devices and IoT Integration

The iris recognition market is poised for growth due to the expansion of smart devices and the integration of Internet of Things (IoT) technologies. As smart devices become increasingly prevalent in everyday life, the demand for secure authentication methods is rising. Iris recognition technology is being integrated into smartphones, smart home devices, and wearables, providing users with a seamless and secure experience. This trend is expected to drive the iris recognition market as manufacturers seek to differentiate their products through advanced biometric features. By 2025, it is projected that the market for iris recognition in smart devices will account for a substantial portion of the overall market, reflecting the growing consumer preference for secure and convenient authentication methods.

Increased Focus on Privacy and Data Protection

The iris recognition market is also being shaped by an increased focus on privacy and data protection regulations in the US. As consumers become more aware of their data rights, organizations are compelled to adopt biometric solutions that comply with stringent privacy laws. The implementation of iris recognition technology can enhance data security while ensuring compliance with regulations such as the California Consumer Privacy Act (CCPA). This regulatory landscape is prompting businesses to invest in iris recognition systems that not only provide security but also respect user privacy. As a result, the iris recognition market is likely to expand as organizations seek to balance security needs with compliance requirements, fostering a more responsible approach to biometric data usage.

Growing Demand for Biometric Security Solutions

The iris recognition market is experiencing a surge in demand for biometric security solutions, driven by the increasing need for enhanced security measures across various sectors. Organizations in the US are increasingly adopting iris recognition technology to safeguard sensitive data and ensure secure access to facilities. According to recent estimates, the biometric market is projected to reach approximately $50 billion by 2026, with iris recognition accounting for a notable share. This trend is particularly evident in sectors such as banking, healthcare, and government, where the need for robust security protocols is paramount. As cyber threats evolve, the iris recognition market is likely to benefit from the heightened focus on identity verification and fraud prevention, positioning it as a critical component of modern security infrastructure.