Rising Healthcare Expenditure

The increasing healthcare expenditure in the US is a significant driver for the hyperglycemia treatment market. In 2023, healthcare spending reached approximately $4.3 trillion, accounting for nearly 18% of the GDP. This substantial investment in healthcare services facilitates access to advanced treatment options for patients suffering from hyperglycemia. As insurance coverage expands and more individuals seek treatment, the demand for effective hyperglycemia management solutions is likely to grow. Additionally, the focus on preventive care and chronic disease management further supports the market, as healthcare providers aim to reduce long-term costs associated with diabetes complications. The trend of rising healthcare expenditure suggests a favorable environment for the hyperglycemia treatment market, as it enables the development and distribution of innovative therapies.

Growing Awareness and Education

The increasing awareness and education surrounding diabetes and hyperglycemia management are pivotal drivers for the hyperglycemia treatment market. Public health campaigns and educational initiatives by organizations such as the American Diabetes Association have significantly improved knowledge about the importance of blood glucose control. This heightened awareness encourages individuals to seek medical advice and treatment, thereby increasing the demand for hyperglycemia management solutions. Furthermore, healthcare professionals are increasingly emphasizing the need for patient education regarding lifestyle modifications and medication adherence. As patients become more informed about their condition, they are more likely to engage in proactive management, which could lead to a higher uptake of available treatments. This trend of growing awareness is likely to bolster the hyperglycemia treatment market as more individuals recognize the importance of effective management.

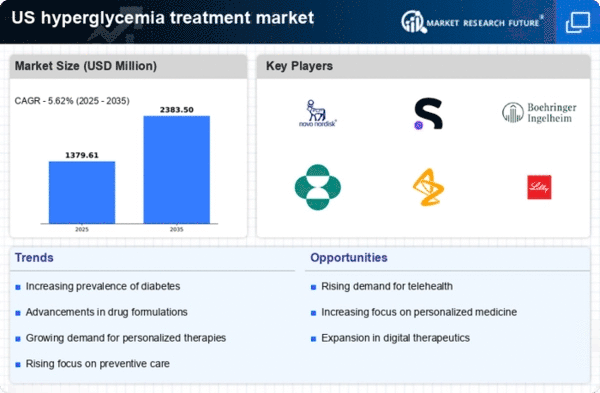

Increasing Prevalence of Diabetes

The rising incidence of diabetes in the US is a primary driver for the hyperglycemia treatment market. According to the Centers for Disease Control and Prevention (CDC), approximately 34.2 million Americans, or 10.5% of the population, have diabetes. This growing population necessitates effective hyperglycemia management solutions, thereby propelling market growth. The increasing awareness of diabetes-related complications, such as cardiovascular diseases and neuropathy, further emphasizes the need for timely and effective treatment options. As healthcare providers focus on managing blood glucose levels, the demand for innovative therapies and medications is likely to rise, contributing to the expansion of the hyperglycemia treatment market. Furthermore, the aging population, which is more susceptible to diabetes, adds to the urgency for effective treatment solutions, indicating a robust market potential in the coming years.

Advancements in Pharmaceutical Research

Ongoing advancements in pharmaceutical research are significantly influencing the hyperglycemia treatment market. The development of novel medications, including GLP-1 receptor agonists and SGLT2 inhibitors, has transformed the treatment landscape for hyperglycemia. These innovative therapies not only improve glycemic control but also offer additional benefits, such as weight loss and cardiovascular protection. The US market has witnessed a surge in the approval of new drugs, with the FDA approving several new treatments in recent years. This influx of advanced therapies is expected to enhance patient outcomes and adherence to treatment regimens. As pharmaceutical companies continue to invest in research and development, the hyperglycemia treatment market is poised for substantial growth, driven by the introduction of more effective and safer treatment options.

Technological Innovations in Monitoring

Technological innovations in glucose monitoring are transforming the hyperglycemia treatment market. The advent of continuous glucose monitoring (CGM) systems and smart insulin delivery devices has revolutionized how patients manage their blood glucose levels. These technologies provide real-time data, enabling patients to make informed decisions about their treatment. The integration of mobile applications and telehealth services further enhances patient engagement and adherence to treatment plans. As these technologies become more accessible and affordable, the demand for advanced monitoring solutions is expected to rise. This trend not only improves patient outcomes but also drives the growth of the hyperglycemia treatment market by fostering a more proactive approach to diabetes management. The ongoing development of innovative monitoring devices suggests a promising future for the market, as patients increasingly rely on technology to manage their condition.