Expansion of the Food and Beverage Sector

The robust growth of the food and beverage sector in the US is significantly impacting the high intensity-sweeteners market. With the industry projected to reach a value of $1 trillion by 2026, the demand for innovative and healthier products is on the rise. High intensity-sweeteners are increasingly being utilized in a variety of applications, including soft drinks, baked goods, and dairy products. This trend is further supported by the increasing number of health-focused brands entering the market, which often prioritize the use of high intensity-sweeteners in their formulations. As the food and beverage sector continues to evolve, the high intensity-sweeteners market is expected to benefit from this expansion, providing consumers with more choices.

Growing Demand for Low-Calorie Alternatives

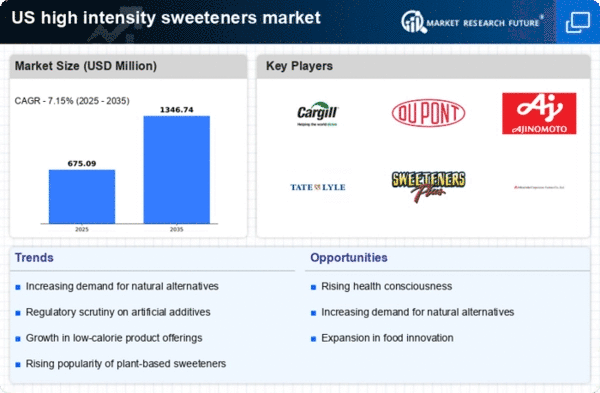

The increasing consumer preference for low-calorie and low-sugar products is driving the high intensity-sweeteners market. As health awareness rises, many individuals are seeking alternatives to traditional sugars, which are often linked to obesity and diabetes. In the US, the market for low-calorie sweeteners is projected to grow at a CAGR of approximately 5.5% from 2025 to 2030. This shift in consumer behavior is prompting food and beverage manufacturers to reformulate their products, incorporating high intensity-sweeteners to meet the demand for healthier options. Consequently, the high intensity-sweeteners market is likely to expand as more products featuring these sweeteners enter the market, catering to health-conscious consumers.

Regulatory Support for Low-Calorie Sweeteners

Regulatory support for low-calorie sweeteners is influencing the high intensity-sweeteners market positively. The US Food and Drug Administration (FDA) has recognized several high intensity-sweeteners as safe for consumption, which encourages manufacturers to incorporate these ingredients into their products. This regulatory endorsement not only boosts consumer confidence but also facilitates innovation within the industry. As regulations continue to evolve, the high intensity-sweeteners market is expected to benefit from increased acceptance and usage of these sweeteners in various food and beverage applications, further driving market growth.

Rising Awareness of Sugar-Related Health Issues

The growing awareness of health issues related to sugar consumption is a significant driver for the high intensity-sweeteners market. With rising rates of diabetes and obesity in the US, consumers are increasingly seeking alternatives to sugar-laden products. Educational campaigns and public health initiatives have highlighted the risks associated with excessive sugar intake, prompting many to turn to high intensity-sweeteners as a viable substitute. This shift in consumer mindset is likely to bolster the high intensity-sweeteners market, as more individuals opt for products that offer sweetness without the associated health risks of traditional sugars.

Technological Advancements in Sweetener Production

Technological advancements in the production of high intensity-sweeteners are playing a crucial role in shaping the market. Innovations in extraction and synthesis methods have led to the development of new sweeteners that are not only more efficient but also offer improved taste profiles. For instance, advancements in fermentation technology have enabled the production of steviol glycosides, which are gaining popularity due to their natural origin and high sweetness levels. As these technologies continue to evolve, they are likely to enhance the quality and variety of high intensity-sweeteners available in the market, thereby attracting more consumers and expanding the high intensity-sweeteners market.