Rise of Functional Foods

The healthy snack market is experiencing a notable shift towards functional foods, which are designed to provide health benefits beyond basic nutrition. Consumers are increasingly interested in snacks that offer specific health advantages, such as improved digestion, enhanced energy, or immune support. This trend is supported by Market Research Future indicating that functional snacks are expected to account for over 25% of the total healthy snack market by 2025. Ingredients such as probiotics, superfoods, and adaptogens are becoming more prevalent in snack formulations. This focus on functionality is likely to drive innovation and differentiation within the healthy snack market, as brands strive to meet the evolving preferences of health-conscious consumers.

Increased Health Awareness

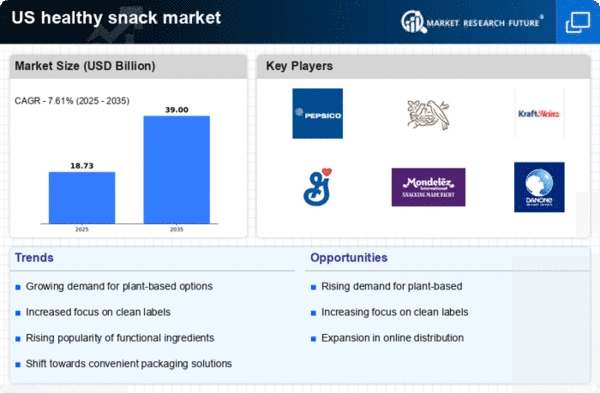

The growing awareness of health and wellness among consumers appears to be a primary driver for the healthy snack market. As individuals become more informed about nutrition and the impact of diet on overall health, they increasingly seek snacks that align with their health goals. This trend is reflected in the market data, which indicates that the healthy snack market is projected to reach approximately $32 billion by 2026, growing at a CAGR of around 8.5%. Consumers are gravitating towards snacks that are low in sugar, high in protein, and rich in essential nutrients. This shift in consumer behavior is likely to continue influencing product development and marketing strategies within the healthy snack market.

Convenience and On-the-Go Options

The demand for convenience in food choices is driving innovation in the healthy snack market. Busy lifestyles have led consumers to seek snacks that are not only nutritious but also easy to consume while on the move. This trend is evident in the increasing availability of single-serve packaging and portable snack options. According to recent data, nearly 60% of consumers report that convenience is a key factor in their snack purchasing decisions. As a result, brands are focusing on creating healthy snacks that cater to this need, thereby expanding their reach within the healthy snack market. The emphasis on convenience is likely to shape product offerings and marketing approaches in the coming years.

Emerging Trends in Dietary Preferences

The healthy snack market is being shaped by evolving dietary preferences, including the rise of gluten-free, keto, and paleo diets. As consumers adopt these specific eating patterns, there is a corresponding demand for snacks that align with their dietary restrictions and preferences. Market data shows that gluten-free snacks alone are projected to grow at a CAGR of 9% through 2027. This trend indicates that brands within the healthy snack market must be agile and responsive to changing consumer demands. By offering a diverse range of products that cater to various dietary needs, companies can enhance their market presence and appeal to a broader audience.

Influence of Social Media and Marketing

The role of social media in shaping consumer preferences cannot be understated, particularly in the healthy snack market. Platforms like Instagram and TikTok have become vital for brands to engage with their audience and promote their products. Influencer marketing, in particular, has proven effective in driving awareness and sales of healthy snacks. Data suggests that brands leveraging social media effectively can see a sales increase of up to 30%. This trend indicates that the healthy snack market must adapt to the digital landscape, utilizing innovative marketing strategies to capture the attention of health-conscious consumers. The influence of social media is likely to continue growing, impacting how brands communicate their value propositions.