Growing Regulatory Pressures

The healthcare electronic-data-interchange market is significantly impacted by growing regulatory pressures aimed at improving data security and patient privacy. Regulatory bodies in the US are implementing stringent guidelines that mandate healthcare organizations to adopt secure data interchange practices. For instance, compliance with the Health Insurance Portability and Accountability Act (HIPAA) is essential for safeguarding patient information. As organizations strive to meet these regulatory requirements, investments in electronic-data-interchange solutions are expected to rise. In 2025, it is anticipated that compliance-related expenditures will constitute a substantial portion of healthcare IT budgets, thereby driving growth in the market. This trend underscores the critical role of electronic-data-interchange systems in ensuring regulatory compliance while enhancing operational efficiency.

Expansion of Telehealth Services

The healthcare electronic-data-interchange market is experiencing growth due to the expansion of telehealth services across the US. As telehealth becomes an integral part of healthcare delivery, the need for efficient data interchange systems to support remote consultations and patient monitoring is increasingly evident. In 2025, the telehealth market is projected to reach $20 billion, with electronic-data-interchange solutions playing a vital role in facilitating communication between patients and providers. This expansion necessitates the integration of various data sources, including electronic health records and wearable devices, into cohesive systems that ensure seamless information flow. Consequently, the demand for electronic-data-interchange solutions is likely to rise, as healthcare organizations seek to enhance the quality of care delivered through telehealth platforms.

Increased Focus on Patient-Centric Care

The healthcare electronic-data-interchange market is significantly influenced by the growing emphasis on patient-centric care. Healthcare providers are increasingly recognizing the importance of engaging patients in their own care processes, which necessitates seamless data sharing among various stakeholders. In 2025, it is estimated that patient engagement technologies will account for nearly 25% of the overall healthcare IT market. This shift towards patient-centric models requires robust electronic-data-interchange systems that facilitate real-time access to patient data, enabling personalized treatment plans and improved health outcomes. As healthcare organizations strive to enhance patient satisfaction and adherence to treatment protocols, the demand for effective data interchange solutions is expected to rise, thereby driving growth in the market.

Rising Demand for Efficient Data Management

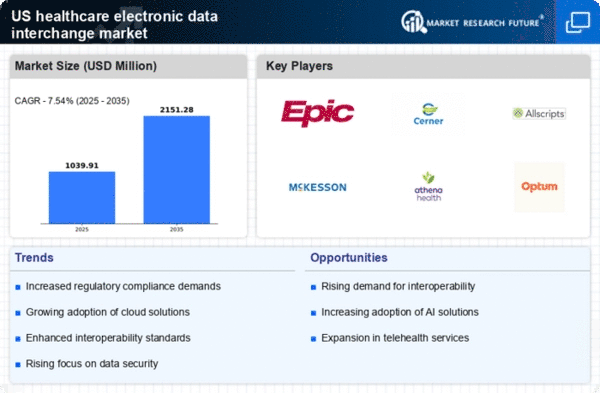

The healthcare electronic-data-interchange market is experiencing a notable surge in demand for efficient data management solutions. As healthcare providers increasingly seek to streamline operations, the need for effective data interchange systems becomes paramount. In 2025, the market is projected to reach approximately $3 billion, reflecting a compound annual growth rate (CAGR) of around 10% from previous years. This growth is driven by the necessity for timely access to patient information, which enhances decision-making and improves patient outcomes. Moreover, the integration of advanced technologies such as artificial intelligence and machine learning into data management systems is likely to further propel the market. Consequently, organizations are investing in electronic-data-interchange solutions to optimize workflows and reduce administrative burdens, thereby fostering a more efficient healthcare environment.

Technological Advancements in Healthcare IT

The healthcare electronic-data-interchange market is poised for growth due to rapid technological advancements in healthcare IT. Innovations such as blockchain, artificial intelligence, and advanced analytics are transforming how healthcare data is exchanged and managed. In 2025, the healthcare IT market is projected to exceed $200 billion, with electronic-data-interchange solutions playing a crucial role in this expansion. These technologies not only enhance the security and integrity of data but also improve interoperability among disparate systems. As healthcare organizations adopt these advanced technologies, the demand for sophisticated electronic-data-interchange solutions is likely to increase, facilitating more efficient and secure data sharing across the healthcare ecosystem.