Growing Health Consciousness

The US Fruit Vegetable Enzymes Market is experiencing a notable surge in demand driven by the increasing health consciousness among consumers. As individuals become more aware of the benefits of natural ingredients, there is a marked shift towards products that incorporate fruit and vegetable enzymes. These enzymes are recognized for their potential to enhance digestion, improve nutrient absorption, and promote overall wellness. According to recent data, the market for natural food additives, including enzymes, is projected to grow at a compound annual growth rate of approximately 6% over the next five years. This trend indicates a robust opportunity for manufacturers within the US Fruit Vegetable Enzymes Market to innovate and cater to the evolving preferences of health-oriented consumers.

Rising Demand for Clean Label Products

The clean label trend is significantly influencing the US Fruit Vegetable Enzymes Market. Consumers are increasingly seeking transparency in food labeling, favoring products that are free from artificial additives and preservatives. This shift is prompting food manufacturers to incorporate natural enzymes derived from fruits and vegetables as a means to meet consumer expectations. Data suggests that the clean label market is expected to reach USD 180 billion by 2026, indicating a substantial opportunity for enzyme producers. By aligning with this trend, the US Fruit Vegetable Enzymes Market can capitalize on the growing preference for clean label products, thereby enhancing its market position.

Increased Focus on Sustainable Practices

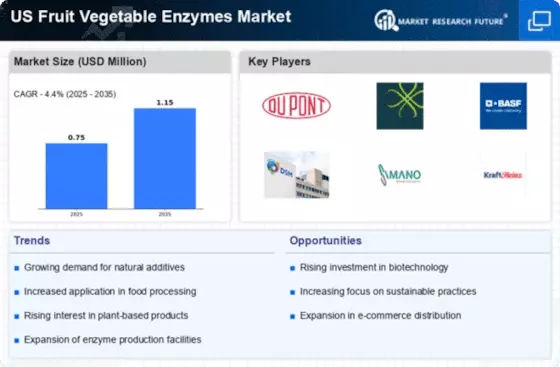

Sustainability is becoming a central theme in the US Fruit Vegetable Enzymes Market. With growing concerns about environmental impact, both consumers and manufacturers are prioritizing sustainable practices in food production. Enzymes derived from fruits and vegetables are often viewed as eco-friendly alternatives to synthetic additives, aligning with the sustainability goals of many companies. The US government has also introduced various initiatives aimed at promoting sustainable agriculture and food production, which could further bolster the market for natural enzymes. As sustainability continues to gain traction, the US Fruit Vegetable Enzymes Market is likely to benefit from increased demand for environmentally responsible products.

Expansion of the Food and Beverage Sector

The expansion of the food and beverage sector in the United States is a significant driver for the US Fruit Vegetable Enzymes Market. As the industry continues to grow, there is an increasing demand for innovative food processing solutions that enhance product quality and shelf life. Enzymes derived from fruits and vegetables are being utilized to improve texture, flavor, and nutritional value in various food applications. Recent statistics indicate that the US food and beverage market is projected to reach USD 1.5 trillion by 2026, creating a favorable environment for enzyme manufacturers. This growth presents a unique opportunity for the US Fruit Vegetable Enzymes Market to thrive as it supports the evolving needs of food producers.

Technological Advancements in Enzyme Production

Technological advancements are playing a pivotal role in shaping the US Fruit Vegetable Enzymes Market. Innovations in enzyme production processes, such as fermentation technology and biocatalysis, are enhancing the efficiency and efficacy of enzyme extraction. These advancements not only improve the yield of enzymes but also reduce production costs, making them more accessible to food manufacturers. For instance, the adoption of precision fermentation techniques has been shown to increase enzyme purity and activity, thereby expanding their application in various food products. As a result, the US Fruit Vegetable Enzymes Market is likely to witness a surge in the availability of high-quality enzymes, which could further stimulate market growth.