US Freight Forwarding Market

US Freight Forwarding Market Research Report By Delivery Mode (Roadways, Airways, Railways, Seaways), By Services (Transportation, Warehousing, Packaging, Documentation, Other Services), and By Application (Retail, Food & Beverages, Healthcare, Industrial and Manufacturing, Military, Oil & Gas, Other Application) - Forecast to 2035

US Freight Forwarding Market Trends

Growing globalization and the expansion of e-commerce are driving major market trends in the US freight forwarding industry. Freight forwarders are being forced to use cutting-edge technologies as a result of the increased demand for effective shipping solutions brought on by the growth in online shopping.

These technological advancements improve shipment speed and accuracy by streamlining logistical procedures through the use of digital platforms and automation solutions. Additionally, there is now more focus on supply chain visibility and openness as companies look to improve customer happiness by offering real-time shipment monitoring.

One of the primary factors driving the US freight forwarding market is the need for companies to improve their supply chains in order to stay competitive. Freight forwarders now need to be flexible and responsive to changing market conditions due to the constant changes in trade laws and tariffs.

Concerns about sustainability are also influencing how businesses handle logistics. Many freight forwarders are looking at environmentally friendly transportation solutions and alternatives as the US government supports measures targeted at lowering carbon emissions.

Market niches that serve specialized freight services, such cold chain logistics for perishables and medications, offer opportunities. Given that environmentally conscious customers are influencing shipping methods, the emphasis on green logistics also creates opportunities for expansion.

According to recent trends, freight forwarders, carriers, and technology companies are working together more and more to deliver integrated solutions that can react swiftly to customer needs and market changes.

The changing environment guarantees that the US freight forwarding market will continue to be vibrant, with ongoing enhancements to satisfy the intricate requirements of both consumers and enterprises.

Market Segment Insights

US Freight Forwarding Market Segment Insights

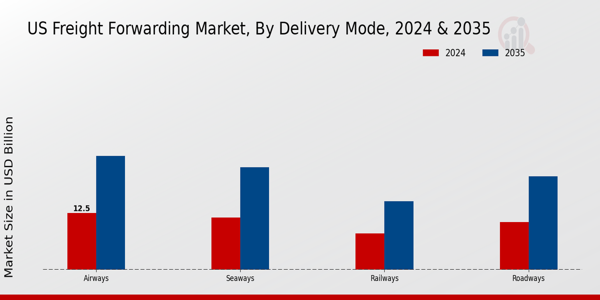

Freight Forwarding Market Delivery Mode Insights

The Delivery Mode segment within the US Freight Forwarding Market is essential for facilitating trade across different transportation mediums. The overall market is expected to showcase robust growth and continues to evolve with shifting consumer preferences and advancements in technology.

Roadways play a crucial role in facilitating the movement of goods over short to medium distances, characterized by flexibility and accessibility. This mode is instrumental for delivering freight directly to end-user locations, thereby improving distribution efficiency.

The demand for road transportation is bolstered by the increasing prevalence of e-commerce and the need for rapid delivery, which drives the necessity for logistics providers to integrate efficient road networks into their offerings.

Airways serve as a critical component for expedited freight services, primarily for high-value and time-sensitive commodities. The ability to transport goods across vast distances in a matter of hours highlights the significance of air transport in industries like electronics, pharmaceuticals, and fashion, where timely deliveries can have substantial impacts on revenue and inventory management.

Railways, while traditionally viewed as slow, are gaining traction due to their cost-effectiveness and capacity for handling bulky items over longer distances, making them a vital player in intermodal transportation strategies.

The increasing push for sustainability also elevates rail transportation’s importance, as it generally emits less carbon per ton-mile compared to other modes. Seaways are another cornerstone of the US Freight Forwarding Market, enabling the transport of enormous volumes of cargo between domestic and international ports.

Given the vast coastline of the US and its significant international trade relationships, maritime transport is crucial for facilitating economic engagement with global markets, particularly with containerized cargo. The increasing capacities and improvements in port infrastructure further enhance the efficiency of seaborne trade, establishing it as a resilient and vital segment in freight forwarding logistics.

Overall, the interplay between these delivery methods creates a comprehensive and interconnected network that meets varied consumer demands and supports economic growth through enhanced trade capabilities.

As these modes continue to adapt to modern challenges such as sustainability and technological advancements, they are expected to play pivotal roles in driving efficiency and reliability in the US Freight Forwarding Market.

The need for an integrated approach combining these delivery modalities will only heighten, as businesses increasingly seek to optimize their logistics operations to maintain competitive advantage. Factors such as enhanced tracking systems, improved logistics coordination, and rising demand for faster delivery timelines will further shape the Delivery Mode segment.

Each mode thus contributes not just to the functionality of freight forwarding but also stands as a testament to the evolving nature of supply chain dynamics in response to changing market conditions and consumer expectations.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Freight Forwarding Market Services Insights

The Services segment of the US Freight Forwarding Market plays a vital role in facilitating seamless trade and logistics within the region. Transportation is critical as it encompasses the movement of goods through various modalities, ensuring timely deliveries.

Warehousing supports inventory management and acts as a buffer in the supply chain, reflecting the growing trend of e-commerce and just-in-time delivery. Packaging ensures products are adequately secured for transit, which is increasingly essential as businesses emphasize sustainability through innovative packaging solutions.

Documentation is also essential as it involves handling necessary paperwork, compliance, and regulatory requirements, which reducing the risk of delays in transit. Other Services, including customs brokerage and freight insurance, offer additional value, addressing the complexities of international shipping.

The combined efficiency and integration of these services not only streamline operations but also enhance customer satisfaction in the US Freight Forwarding Market. As the industry adapts to new technologies and increased demand for efficiency, these services continue to evolve, demonstrating their significance in sustaining market growth and meeting customer expectations.

Freight Forwarding Market Application Insights

The Application segment of the US Freight Forwarding Market plays a critical role in the overall functioning and efficiency of supply chains across various industries. Within this segment, retail remains a significant player, driven by the continual demand for timely and reliable delivery services to meet consumer expectations.

In the food and beverages sector, the requirement for temperature-controlled logistics highlights the importance of specialized transportation solutions and regulatory compliance. Healthcare benefits from efficient freight forwarding through the timely delivery of medical supplies and pharmaceuticals, which is crucial for patient care and safety.

Industrial and manufacturing applications rely on robust logistics networks to optimize production schedules and reduce downtime. The military sector requires highly secure and strategic freight solutions, accommodating sensitive cargo and ensuring national security.

Subsequently, the oil and gas industry presents unique challenges, necessitating specialized handling and transportation options for hazardous materials. Other applications continue to emerge as businesses expand their logistics needs, driving innovation in freight forwarding solutions.

Overall, the diversity within this segment reflects the complexity and dynamism of the US market, underscored by the increasing importance of efficient logistics to support economic growth and market demands.

Key Players and Competitive Insights

The US Freight Forwarding Market is characterized by intense competition, with numerous players striving for optimal market share while enhancing service offerings. The landscape is shaped by a combination of traditional logistics providers and newer entrants utilizing technology-driven approaches to streamline the supply chain processes.

Companies are continually looking to improve efficiency, reduce costs, and expand their geographical reach, all while adhering to stringent regulatory compliance and fostering relationships with customs authorities.

The adaptability to market demands, innovations in technology, and enhanced customer service capabilities are pivotal for success in this sector. Various trends, such as e-commerce growth and the need for sustainability, are also influencing competitive strategies, pushing companies to evolve and reinvent their service models effectively.

Panalpina has established a strong presence in the US Freight Forwarding Market, leveraging its extensive network and wide-ranging expertise. The company is recognized for its robust air and ocean freight services, offering tailored solutions that cater to diverse industries, including automotive, healthcare, and technology.

Panalpina’s strengths lie in its operational efficiency, commitment to customer service, and innovative logistics solutions that enhance the supply chain experience. Its significant investments in technology and digital platforms bolster its competitive edge by improving process automation and real-time tracking capabilities.

As the company navigates the complexities of freight forwarding within the US market, it focuses on sustainability initiatives, making environmental efficiency a priority that resonates with modern consumers and regulatory expectations.

Expeditors International is another key player in the US Freight Forwarding Market, renowned for its comprehensive logistics solutions and strong performance across various transportation modes. The company’s key services encompass air and ocean freight, customs brokerage, and supply chain management, all designed to provide seamless logistics solutions to its clients.

Expeditors International’s competitive strengths stem from its customer-centric approach, extensive global network, and solid relationships with carriers and associated service providers. This allows the company to maintain flexibility and responsiveness to market fluctuations and customer needs.

The organization has engaged in strategic mergers and acquisitions, enhancing its market presence and operational capabilities within the US logistics landscape. Its focus on technological innovation also enables improved visibility and service reliability, positioning Expeditors as a leader in the industry.

Industry Developments

The US Freight Forwarding Market has recently seen significant activity, particularly with companies like UPS Supply Chain Solutions and DHL Global Forwarding, focusing on improving their operational efficiencies and technological advancements to adapt to evolving consumer expectations.

In terms of mergers and acquisitions, September 2023 marked the acquisition of Seko Logistics by the larger company Kuehne + Nagel, enhancing its market footprint and service offerings. Additionally, in June 2023, Expeditors International announced its plans to expand its service portfolio, responding to surging demand in e-commerce logistics.

The inclusion of sustainability practices has been increasingly critical, with major players like DB Schenker and Agility Logistics investing in greener supply chain solutions. Growth in market valuation for these companies is driven by heightened demand for reliable logistics services, especially post-COVID-19, which is impacting their operational strategies.

Furthermore, the US freight forwarding industry has seen increased capital being funneled into technology and automation, aiming to reduce lead times and improve service delivery. With the ongoing fluctuations in global trade due to geopolitical tensions, the competitive landscape is poised for notable changes.

Market Segmentation

Freight Forwarding Market Services Outlook

- Transportation

- Warehousing

- Packaging

- Documentation

- Other Services

Freight Forwarding Market Application Outlook

- Retail

- Food & Beverages

- Healthcare

- Industrial and Manufacturing

- Military

- Oil & Gas

- Other Application

Freight Forwarding Market Delivery Mode Outlook

- Roadways

- Airways

- Railways

- Seaways

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2023 | 40.13(USD Billion) |

| Market Size 2024 | 42.5(USD Billion) |

| Market Size 2035 | 83.0(USD Billion) |

| Compound Annual Growth Rate (CAGR) | 6.274% (2025 - 2035) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 - 2024 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | Panalpina, Expeditors International, C.H. Robinson, DHL Global Forwarding, Agility Logistics, Kuehne + Nagel, UPS Supply Chain Solutions, Saddle Creek Logistics Services, SEKO Logistics, DB Schenker, Sinotrans, Nippon Express, XPO Logistics, DHL Supply Chain, Geodis |

| Segments Covered | Delivery Mode, Services, Application |

| Key Market Opportunities | E-commerce growth driving logistics demands, Technology advancements for operational efficiency, Sustainable logistics solutions adoption, Increased cross-border trade facilitation, Supply chain resilience strengthening initiatives |

| Key Market Dynamics | e-commerce growth, regulatory compliance, technology integration, supply chain optimization, increasing transportation costs |

| Countries Covered | US |

FAQs

What was the market size of the US Freight Forwarding Market in 2024?

The US Freight Forwarding Market was valued at 42.5 USD Billion in 2024.

What are the expected market dynamics by 2035?

By 2035, the market is anticipated to grow significantly to reach 83.0 USD Billion.

What is the expected CAGR for the US Freight Forwarding Market from 2025 to 2035?

The market is expected to grow at a CAGR of 6.274% during the forecast period from 2025 to 2035.

Which mode of delivery is projected to dominate the market in 2035?

By 2035, the Airways segment is expected to dominate with a valuation of 25.0 USD Billion.

What will be the projected value of the Roadways segment in 2035?

The Roadways segment is projected to reach a value of 20.5 USD Billion by 2035.

Who are the major players in the US Freight Forwarding Market?

Key players include Panalpina, Expeditors International, C.H. Robinson, and DHL Global Forwarding among others.

How much is the Railways segment expected to grow by 2035?

The Railways segment is expected to increase to 15.0 USD Billion by 2035.

What is the anticipated market size for the Seaways segment in 2035?

The Seaways segment is projected to be valued at 22.5 USD Billion in 2035.

What opportunities exist for growth in the US Freight Forwarding Market?

There are significant opportunities driven by e-commerce growth and increasing global trade demands.

What challenges might the US Freight Forwarding Market face in the coming years?

Challenges may include regulatory changes and fluctuating fuel prices impacting logistics costs.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”