Cultural Events and Wine Tourism

The fortified wine market is benefiting from the rise of cultural events and wine tourism, which are attracting consumers to explore and experience fortified wines. Festivals, tastings, and vineyard tours are becoming increasingly popular, providing opportunities for consumers to engage with fortified wine producers and learn about their offerings. This trend is supported by data showing that wine tourism has grown by approximately 12% in recent years, highlighting the increasing interest in wine-related experiences. As more consumers participate in these events, they are likely to develop a deeper appreciation for fortified wines, which could lead to increased sales and brand loyalty within the fortified wine market.

E-commerce Growth and Online Sales

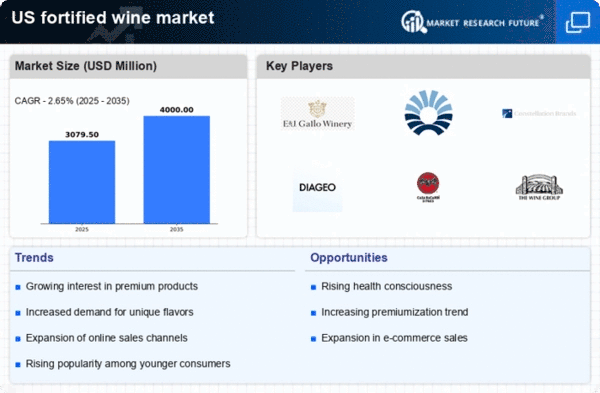

The fortified wine market is experiencing a significant transformation due to the rapid growth of e-commerce and online sales channels. As consumers increasingly turn to online platforms for their shopping needs, fortified wine producers are adapting by enhancing their digital presence. Recent statistics reveal that online wine sales have surged by over 20% in the past year, indicating a shift in purchasing behavior. This trend is particularly relevant for fortified wines, as consumers seek convenience and a wider selection. The ability to purchase fortified wines online not only expands market reach but also allows producers to engage with a broader audience, thereby driving growth in the fortified wine market.

Rising Consumer Interest in Unique Flavors

The fortified wine market is experiencing a notable shift as consumers increasingly seek unique and diverse flavor profiles. This trend is driven by a growing appreciation for artisanal and craft beverages, which has led to a surge in demand for fortified wines that offer distinctive taste experiences. According to recent data, the fortified wine segment has seen a growth rate of approximately 8% annually, reflecting this consumer preference. As more wineries experiment with innovative blends and flavor infusions, the market is likely to expand further. This rising interest in unique flavors not only enhances consumer engagement but also encourages producers to diversify their offerings, thereby contributing to the overall growth of the fortified wine market.

Increased Popularity of Wine-Based Cocktails

The fortified wine market is benefiting from the rising trend of wine-based cocktails, which are gaining traction among consumers seeking refreshing and sophisticated drink options. This trend is particularly prominent in urban areas, where mixologists are incorporating fortified wines into their cocktail menus, creating innovative and appealing beverages. Data indicates that wine-based cocktails have seen a growth of around 15% in popularity over the past year, suggesting a shift in consumer preferences towards more versatile drink options. As bars and restaurants continue to embrace this trend, the fortified wine market is likely to see increased sales and a broader consumer base, as these cocktails attract both wine enthusiasts and casual drinkers alike.

Health Consciousness and Moderate Consumption

The fortified wine market is witnessing a shift in consumer behavior towards health-conscious choices, with many individuals opting for moderate alcohol consumption. This trend is influenced by a growing awareness of health and wellness, leading consumers to seek beverages that offer lower alcohol content and potential health benefits. Fortified wines, often lower in alcohol than spirits, are becoming a preferred choice for those looking to enjoy a drink without overindulgence. Recent surveys indicate that approximately 30% of consumers are actively seeking lower-alcohol options, which bodes well for the fortified wine market. This shift not only aligns with health trends but also encourages producers to develop fortified wines that cater to this emerging consumer demand.