Increased Investment in Automotive R&D

Increased investment in automotive research and development is propelling the US Continuous Variable Transmission Market forward. Automakers are allocating substantial resources to innovate and enhance transmission technologies, including CVTs. This investment is not only aimed at improving performance but also at addressing the growing consumer demand for advanced features such as connectivity and automation. Recent data suggests that R&D spending in the automotive sector has risen by over 10% annually, with a significant portion directed towards transmission technologies. As companies strive to differentiate their products in a competitive market, the focus on CVTs is likely to intensify, leading to advancements that could redefine the capabilities of vehicles in the US Continuous Variable Transmission Market.

Consumer Preference for Fuel Efficiency

Consumer preference for fuel efficiency is a driving force in the US Continuous Variable Transmission Market. As fuel prices fluctuate and environmental awareness grows, consumers are increasingly seeking vehicles that offer better fuel economy. CVTs are recognized for their ability to provide seamless acceleration and improved fuel efficiency, making them an attractive option for buyers. Market Research Future indicates that nearly 60% of consumers consider fuel efficiency a top priority when purchasing a vehicle. This trend is prompting automakers to incorporate CVTs into a wider range of models, from compact cars to SUVs, thereby expanding the market reach of CVTs. As consumer preferences continue to evolve, the US Continuous Variable Transmission Market is poised for growth, driven by the demand for fuel-efficient vehicles.

Technological Advancements in CVT Systems

The US Continuous Variable Transmission Market is experiencing a surge in technological advancements that enhance the efficiency and performance of CVT systems. Innovations such as electronic control systems and advanced materials are being integrated into CVTs, leading to improved fuel economy and reduced emissions. For instance, the introduction of adaptive transmission control algorithms allows for real-time adjustments based on driving conditions, optimizing power delivery. This trend is supported by data indicating that vehicles equipped with CVTs can achieve fuel efficiency improvements of up to 10-15% compared to traditional automatic transmissions. As manufacturers continue to invest in research and development, the US Continuous Variable Transmission Market is likely to witness further enhancements that could redefine vehicle performance standards.

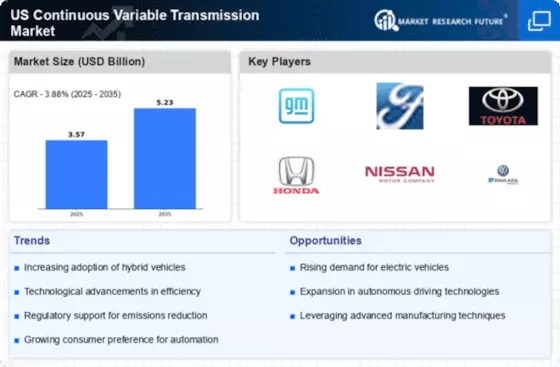

Shift Towards Hybrid and Electric Vehicles

The growing shift towards hybrid and electric vehicles is a pivotal driver for the US Continuous Variable Transmission Market. As consumers increasingly prioritize sustainability and fuel efficiency, automakers are responding by integrating CVTs into their hybrid and electric models. This is particularly evident in the rise of plug-in hybrids, which often utilize CVTs to maximize energy efficiency. According to recent market data, the sales of hybrid vehicles in the US have seen a steady increase, with projections suggesting that by 2026, hybrids could account for over 30% of total vehicle sales. Consequently, the demand for CVTs is expected to rise, as they play a crucial role in optimizing the performance of these eco-friendly vehicles within the US Continuous Variable Transmission Market.

Regulatory Pressures and Emission Standards

Regulatory pressures and stringent emission standards are significantly influencing the US Continuous Variable Transmission Market. The Environmental Protection Agency (EPA) has implemented increasingly rigorous fuel economy and emissions regulations, compelling manufacturers to adopt more efficient transmission systems. CVTs, known for their ability to provide optimal engine performance while minimizing fuel consumption, are becoming a preferred choice for automakers aiming to comply with these regulations. Data from the EPA indicates that vehicles with CVTs can reduce greenhouse gas emissions by up to 20% compared to traditional automatic transmissions. As these regulations continue to evolve, the US Continuous Variable Transmission Market is likely to see a heightened demand for CVTs as manufacturers seek to meet compliance while enhancing vehicle performance.