Increasing Environmental Regulations

The bioremediation market is experiencing growth due to the increasing stringency of environmental regulations in the US. Regulatory bodies are imposing stricter guidelines on waste management and pollution control, compelling industries to adopt sustainable practices. For instance, the Environmental Protection Agency (EPA) has established regulations that necessitate the remediation of contaminated sites, which has led to a heightened demand for bioremediation solutions. The market is projected to reach approximately $1.5 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 10%. This regulatory landscape is driving companies to invest in bioremediation technologies, thereby expanding the market's scope and potential.

Growing Public and Corporate Awareness

The bioremediation market is increasingly influenced by growing public and corporate awareness regarding environmental issues. As communities become more informed about the impacts of pollution and the benefits of bioremediation, there is a rising demand for cleaner and safer environments. Corporations are also recognizing the importance of sustainable practices, leading to a shift in their operational strategies. This heightened awareness is expected to drive market growth at a rate of 7% annually, as both public and private sectors seek effective bioremediation solutions. The convergence of public interest and corporate responsibility is likely to create a robust market environment for bioremediation services.

Rising Demand for Sustainable Solutions

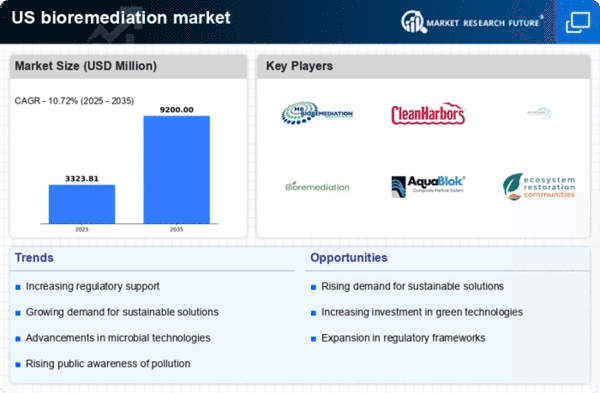

The bioremediation market is significantly influenced by the growing demand for sustainable environmental solutions. As industries face increasing pressure to minimize their ecological footprint, bioremediation offers an eco-friendly alternative to traditional remediation methods. This shift is particularly evident in sectors such as oil and gas, where the need for effective soil and water decontamination is paramount. The market is expected to grow at a CAGR of 9% over the next five years, driven by the adoption of bioremediation techniques that utilize naturally occurring microorganisms. This trend not only aligns with corporate sustainability goals but also enhances the overall market for bioremediation services.

Increased Investment in Clean-Up Projects

The bioremediation market is benefiting from increased investment in environmental clean-up projects across the US. Government initiatives and funding programs aimed at restoring contaminated sites are driving demand for bioremediation services. For instance, the Superfund program, which allocates federal funds for the cleanup of hazardous waste sites, has seen a rise in budget allocations, thereby enhancing the market's growth potential. It is estimated that the market could reach $2 billion by 2027, fueled by these investments. This influx of capital is likely to stimulate innovation and expand the range of bioremediation solutions available, further solidifying the industry's position.

Technological Innovations in Bioremediation

Technological advancements are playing a crucial role in shaping the bioremediation market. Innovations such as bioaugmentation and biostimulation are enhancing the efficiency of bioremediation processes, allowing for faster and more effective remediation of contaminated sites. The integration of biotechnology and molecular biology techniques is enabling the development of specialized microbial strains that can target specific pollutants. As a result, the market is projected to witness a growth rate of approximately 8% annually, as companies increasingly adopt these advanced technologies to meet regulatory requirements and improve remediation outcomes. This trend indicates a promising future for the bioremediation market.