Rising Geriatric Population

The increasing geriatric population in the US is a pivotal driver for the bioimplants market. As individuals age, they often experience a higher incidence of chronic conditions that necessitate surgical interventions, leading to a greater demand for bioimplants. According to recent statistics, the population aged 65 and older is projected to reach 80 million by 2040, representing a substantial market opportunity. This demographic shift is likely to propel the bioimplants market, as older adults typically require joint replacements, dental implants, and cardiovascular devices. Furthermore, the growing awareness of the benefits of bioimplants among healthcare providers and patients may enhance adoption rates, thereby contributing to market growth. The bioimplants market must adapt to the unique needs of this demographic to capitalize on the potential demand.

Consumer Awareness and Education

Consumer awareness and education regarding bioimplants are becoming increasingly important drivers for the bioimplants market. As patients become more informed about the benefits and risks associated with bioimplants, they are more likely to seek these solutions for their medical needs. Educational initiatives by healthcare providers and industry stakeholders play a vital role in disseminating information about the advantages of bioimplants, such as improved quality of life and faster recovery times. This heightened awareness is likely to lead to increased demand for bioimplants, as patients actively participate in their healthcare decisions. The bioimplants market must prioritize educational campaigns to ensure that potential patients understand the value of bioimplants, ultimately driving market growth.

Increasing Healthcare Expenditure

The rising healthcare expenditure in the US is a crucial driver for the bioimplants market. With healthcare spending projected to reach $6 trillion by 2027, there is a growing investment in advanced medical technologies, including bioimplants. This increase in funding allows for the development and adoption of innovative bioimplant solutions, which can improve patient outcomes and reduce long-term healthcare costs. Furthermore, as insurance coverage expands and reimbursement policies evolve, more patients are likely to seek bioimplants for various medical conditions. The bioimplants market stands to benefit from this trend, as healthcare providers are incentivized to adopt cutting-edge technologies that enhance surgical precision and patient recovery.

Rising Incidence of Chronic Diseases

The escalating incidence of chronic diseases in the US is a significant driver for the bioimplants market. Conditions such as diabetes, cardiovascular diseases, and orthopedic disorders are on the rise, necessitating surgical interventions that often involve the use of bioimplants. For instance, the prevalence of diabetes is expected to reach 34 million individuals by 2030, leading to an increased demand for related surgical procedures. This trend indicates a growing market for bioimplants, as healthcare providers seek effective solutions to manage these chronic conditions. The bioimplants market must focus on developing specialized implants that cater to the unique needs of patients with chronic diseases, thereby enhancing treatment outcomes and patient satisfaction.

Technological Innovations in Materials

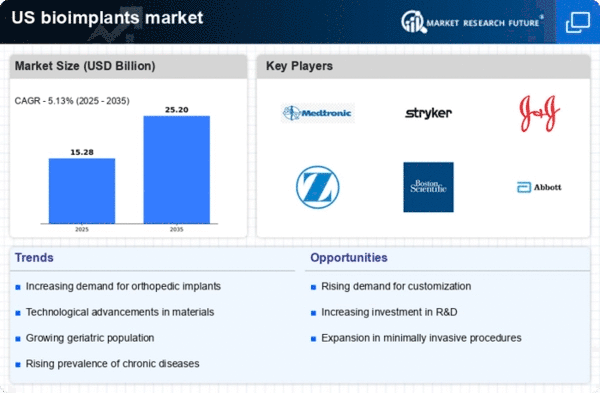

Innovations in biomaterials are significantly influencing the bioimplants market. The development of advanced materials, such as biocompatible polymers and bioactive ceramics, enhances the performance and longevity of implants. These materials are designed to integrate seamlessly with human tissue, reducing the risk of rejection and complications. The market for bioimplants is expected to witness a compound annual growth rate (CAGR) of approximately 10% over the next five years, driven by these technological advancements. Additionally, the introduction of smart implants equipped with sensors for real-time monitoring is likely to revolutionize patient care. As the bioimplants market continues to evolve, manufacturers must invest in research and development to stay competitive and meet the growing demand for innovative solutions.