Expansion of Aftermarket Services

The automotive remote-diagnostics market benefits from the expansion of aftermarket services.. As vehicle owners increasingly seek cost-effective maintenance solutions, the demand for remote diagnostics tools that can be utilized by independent service providers is on the rise. In 2025, it is estimated that the aftermarket segment will represent over 40% of the total market share for remote diagnostics. This trend indicates a shift towards more accessible and affordable diagnostic solutions, allowing consumers to maintain their vehicles without relying solely on dealerships. The growth of this segment is likely to enhance competition and innovation within the automotive remote-diagnostics market.

Growth of Electric and Hybrid Vehicles

The automotive remote-diagnostics market is growing due to the increasing adoption of electric and hybrid vehicles.. These vehicles require specialized diagnostic tools to monitor battery health, energy consumption, and overall performance. As the US government promotes the transition to electric vehicles, the demand for remote diagnostics solutions tailored to these technologies is expected to rise. By 2025, it is projected that electric and hybrid vehicles will account for nearly 30% of new car sales in the US, creating a significant opportunity for remote diagnostics providers. This shift not only supports environmental goals but also necessitates advanced diagnostic capabilities.

Technological Advancements in Vehicle Systems

The automotive remote-diagnostics market is experiencing a surge due to rapid technological advancements in vehicle systems. Innovations such as advanced sensors, artificial intelligence, and machine learning are enhancing the capabilities of remote diagnostics. These technologies enable real-time monitoring and analysis of vehicle performance, leading to improved maintenance strategies. In 2025, it is estimated that the integration of AI in automotive diagnostics could increase efficiency by up to 30%. This shift not only reduces downtime but also enhances the overall driving experience. As vehicles become more complex, the demand for sophisticated remote diagnostics solutions is likely to grow, driving market expansion.

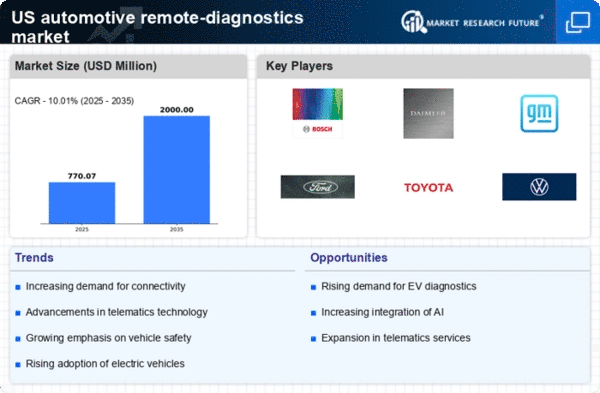

Rising Consumer Demand for Vehicle Connectivity

Consumer preferences are shifting towards greater vehicle connectivity, which is significantly impacting the automotive remote-diagnostics market. As more drivers seek seamless integration of their devices with their vehicles, the need for remote diagnostics solutions that can provide real-time data and alerts becomes paramount. In 2025, it is projected that over 60% of new vehicles sold in the US will feature some form of connectivity, creating a substantial market for remote diagnostics services. This trend indicates a growing expectation for vehicles to not only perform well but also communicate effectively with their owners, thereby driving the demand for advanced diagnostic tools.

Increased Focus on Vehicle Safety and Compliance

The automotive remote-diagnostics market is propelled by an increased focus on vehicle safety and compliance with regulatory standards.. As safety regulations become more stringent, manufacturers are compelled to implement advanced diagnostic systems to ensure compliance. In 2025, it is anticipated that the market for remote diagnostics will grow by approximately 25% as companies invest in technologies that enhance safety features. This focus on compliance not only helps in avoiding penalties but also builds consumer trust, thereby fostering a more robust market environment. The integration of remote diagnostics into safety protocols is likely to become a standard practice in the industry.