Market Share

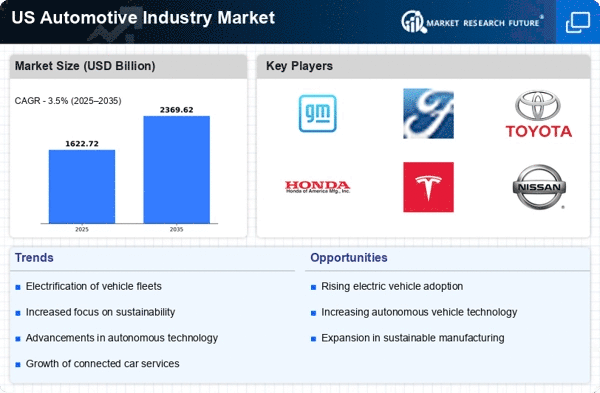

US Automotive Industry Market Share Analysis

In the dynamic landscape of the US automotive industry market, companies employ various market share positioning strategies to gain a competitive edge. One prominent strategy is differentiation, where companies emphasize unique features or qualities to distinguish themselves from competitors. For example, Tesla's focus on electric vehicles and innovative technology sets it apart in the market, appealing to environmentally-conscious consumers and tech enthusiasts. Similarly, Ford's emphasis on durability and ruggedness appeals to a segment of buyers seeking reliability and toughness in their vehicles. By carving out distinct identities, these companies attract specific segments of the market and solidify their market share.

Another key strategy is cost leadership, where companies aim to become the lowest-cost producer in the industry. This approach allows them to offer competitive prices and attract price-sensitive consumers. For instance, Toyota has long been known for its efficient manufacturing processes, enabling it to produce high-quality vehicles at relatively lower costs compared to some competitors. By keeping production costs down, Toyota can pass on savings to consumers through competitive pricing, thereby capturing a significant portion of the market share.

Furthermore, some companies pursue a niche market strategy, targeting specific segments with specialized products or services. For instance, luxury brands like Mercedes-Benz and BMW cater to affluent consumers seeking premium features, comfort, and status symbols in their vehicles. By focusing on luxury and exclusivity, these brands command higher prices and cultivate a loyal customer base within their niche. Similarly, companies like Subaru have found success by targeting outdoor enthusiasts and adventure seekers with rugged, all-wheel-drive vehicles tailored to their lifestyle preferences. By understanding and catering to the unique needs of niche markets, these companies secure a dedicated following and maintain a competitive position in the industry.

Moreover, partnerships and collaborations are increasingly utilized as strategic tools to enhance market share positioning. Companies often form alliances to leverage complementary strengths and resources, expand market reach, and drive innovation. For example, General Motors' partnership with Honda to develop electric vehicles demonstrates a shared commitment to advancing sustainable mobility while pooling expertise and resources to compete more effectively in the evolving market landscape. Similarly, Ford's collaboration with Volkswagen on electric and autonomous vehicles enables both companies to accelerate development efforts and achieve economies of scale. Through strategic partnerships, companies can strengthen their market position and adapt to emerging trends more efficiently.

In addition to these strategies, effective marketing and branding play a crucial role in shaping market share positioning. Companies invest in building strong brand identities and cultivating customer loyalty through compelling advertising campaigns, sponsorships, and brand associations. For instance, Chevrolet's "Real People, Not Actors" advertising campaign emphasizes authenticity and relatability, resonating with consumers and enhancing the brand's appeal. Similarly, Ford's long-standing association with toughness and durability is reinforced through marketing efforts that highlight the ruggedness of its vehicles in various terrains and conditions. By establishing strong emotional connections with consumers, companies can influence purchasing decisions and maintain a competitive advantage in the market.

Overall, the US automotive industry market is characterized by intense competition and evolving consumer preferences. To succeed in this dynamic environment, companies employ a variety of market share positioning strategies, including differentiation, cost leadership, niche targeting, partnerships, and effective branding. By understanding market dynamics and adopting strategies that resonate with consumers, companies can strengthen their market position, drive growth, and sustain competitiveness in the long term.

Leave a Comment