Rising Healthcare Expenditure

The increasing healthcare expenditure in the US is a significant driver of the atherosclerosis market. As healthcare costs continue to rise, there is a growing emphasis on preventive care and effective management of chronic diseases, including atherosclerosis. In 2025, healthcare spending in the US is projected to exceed $4 trillion, reflecting a commitment to improving health outcomes. This financial investment is likely to enhance access to a range of treatment options, including medications, surgical interventions, and lifestyle modification programs. Furthermore, the focus on value-based care is encouraging healthcare providers to adopt comprehensive strategies for managing atherosclerosis, which may lead to increased demand for innovative therapies and interventions in the market.

Advancements in Diagnostic Technologies

Technological innovations in diagnostic tools are significantly influencing the atherosclerosis market. Enhanced imaging techniques, such as high-resolution ultrasound and advanced MRI, allow for earlier detection and more accurate assessment of atherosclerotic plaques. These advancements facilitate timely intervention, which is crucial for improving patient outcomes. The US market for diagnostic imaging is projected to reach approximately $45 billion by 2026, indicating a robust demand for advanced diagnostic solutions. Furthermore, the integration of artificial intelligence in diagnostic processes is expected to streamline workflows and enhance accuracy. As healthcare providers increasingly adopt these technologies, the atherosclerosis market is likely to expand, driven by the need for precise diagnostics and personalized treatment plans.

Regulatory Support for Innovative Therapies

Regulatory bodies in the US are increasingly supportive of innovative therapies for atherosclerosis, which is positively impacting the atherosclerosis market. The Food and Drug Administration (FDA) has implemented expedited review processes for breakthrough therapies, allowing for faster access to new treatments. This regulatory environment encourages pharmaceutical companies to invest in the development of novel therapies, knowing that they may receive quicker approval. The recent approval of several new drugs targeting atherosclerosis has demonstrated the potential for rapid market entry. As regulatory support continues to evolve, the atherosclerosis market is likely to benefit from an influx of innovative treatment options, ultimately improving patient care and outcomes.

Growing Investment in Research and Development

Investment in research and development (R&D) is a critical driver of the atherosclerosis market. Pharmaceutical companies and research institutions are increasingly allocating resources to discover novel therapies and improve existing treatments. In the US, R&D spending in the healthcare sector has seen a steady increase, with estimates suggesting that it could reach $200 billion by 2025. This influx of funding is likely to accelerate the development of innovative drugs and therapies targeting atherosclerosis. Additionally, collaborations between academia and industry are fostering a conducive environment for breakthroughs in treatment modalities. As new therapies emerge, the atherosclerosis market is poised for growth, reflecting the commitment to addressing this pressing health issue.

Increasing Prevalence of Cardiovascular Diseases

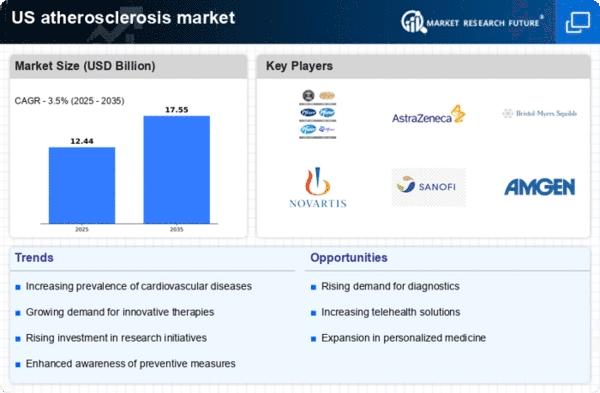

The rising incidence of cardiovascular diseases, particularly atherosclerosis, is a primary driver of the atherosclerosis market. In the US, approximately 697,000 individuals succumb to heart disease annually, highlighting the urgent need for effective treatment options. This alarming statistic underscores the necessity for innovative therapies and interventions. As the population ages, the prevalence of risk factors such as hypertension, diabetes, and obesity continues to escalate, further propelling the demand for atherosclerosis-related treatments. The atherosclerosis market is expected to witness substantial growth, with projections indicating a compound annual growth rate (CAGR) of around 5.5% over the next several years. This trend suggests that healthcare providers and pharmaceutical companies must prioritize the development of new therapies to address the increasing burden of cardiovascular diseases.