Growing Automotive Sector

The US Lubricants Market is experiencing a notable boost due to the expanding automotive sector. As of January 2026, the automotive industry in the United States is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% over the next five years. This growth is likely to drive the demand for various lubricants, including engine oils and transmission fluids. The increasing number of vehicles on the road, coupled with the rising consumer preference for high-performance lubricants, suggests a robust market for automotive lubricants. Furthermore, the trend towards longer oil change intervals may also contribute to the demand for advanced synthetic lubricants, which are designed to provide superior performance and protection. Thus, the automotive sector's growth is a significant driver for the US Lubricants Market.

Industrial Growth and Manufacturing Expansion

The US Lubricants Market is significantly influenced by the growth of the industrial and manufacturing sectors. As of January 2026, the manufacturing output in the United States is expected to increase, driven by advancements in technology and increased production capacities. This growth is likely to enhance the demand for industrial lubricants, which are essential for machinery operation and maintenance. Industries such as construction, mining, and food processing are particularly reliant on high-quality lubricants to ensure operational efficiency and equipment longevity. The increasing focus on minimizing downtime and maximizing productivity in these sectors indicates a strong potential for growth in the industrial lubricants segment. Consequently, the expansion of the industrial sector serves as a critical driver for the US Lubricants Market.

Rising Demand for High-Performance Lubricants

The US Lubricants Market is witnessing a rising demand for high-performance lubricants, particularly in automotive and industrial applications. As of January 2026, the trend towards enhanced performance and efficiency in machinery and vehicles is prompting consumers and businesses to seek advanced lubricant solutions. High-performance lubricants, which offer superior protection, reduced friction, and extended service life, are becoming increasingly popular. This shift is particularly evident in sectors such as automotive racing and heavy machinery, where performance is paramount. The growing awareness of the benefits of using high-quality lubricants is likely to drive market growth, as consumers are willing to invest in products that promise better performance and longevity. Thus, the demand for high-performance lubricants is a significant driver for the US Lubricants Market.

Regulatory Compliance and Environmental Standards

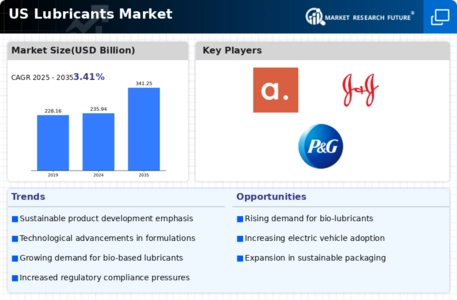

The US Lubricants Market is shaped by stringent regulatory compliance and environmental standards. As of January 2026, the Environmental Protection Agency (EPA) continues to enforce regulations that promote the use of environmentally friendly lubricants. This regulatory landscape encourages manufacturers to innovate and develop bio-based and biodegradable lubricants, which are gaining traction in various applications. The increasing awareness of environmental sustainability among consumers and businesses alike is likely to drive the demand for eco-friendly lubricants. Moreover, compliance with these regulations not only helps in reducing environmental impact but also enhances brand reputation. Therefore, the emphasis on regulatory compliance and environmental standards is a pivotal driver for the US Lubricants Market.

Technological Innovations in Lubricant Formulation

The US Lubricants Market is being propelled by technological innovations in lubricant formulation. As of January 2026, advancements in chemical engineering and materials science are leading to the development of new lubricant formulations that offer enhanced performance characteristics. Innovations such as the incorporation of nanotechnology and advanced additives are enabling the production of lubricants that provide superior protection against wear and tear, improved thermal stability, and better viscosity performance. These technological advancements are particularly relevant in sectors that require high-performance lubricants, such as aerospace and automotive. The continuous evolution of lubricant technology is likely to attract investments and drive market growth, as manufacturers strive to meet the increasing demands for efficiency and sustainability. Therefore, technological innovations in lubricant formulation represent a crucial driver for the US Lubricants Market.