Expansion of Commercial Aviation

The aircraft turbofan-engine market is benefiting from the expansion of commercial aviation, especially in the US. With an increasing number of passengers traveling by air, airlines are expanding their fleets to accommodate this growth. According to the Bureau of Transportation Statistics, passenger enplanements have shown a steady increase, leading to a higher demand for new aircraft equipped with advanced turbofan engines. This trend is likely to stimulate production and sales within the aircraft turbofan-engine market, as manufacturers respond to the rising need for efficient and reliable engines that can support the growing aviation sector.

Rising Demand for Fuel Efficiency

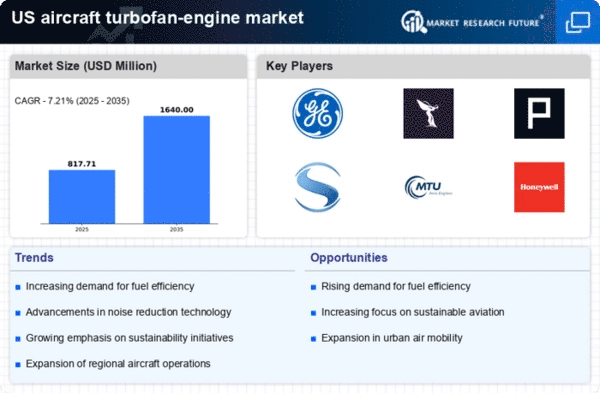

The aircraft turbofan-engine market is experiencing a notable surge in demand for fuel-efficient engines. Airlines are increasingly prioritizing operational efficiency to reduce costs and enhance profitability. As fuel prices remain volatile, the need for engines that offer superior fuel consumption rates becomes paramount. Recent data indicates that modern turbofan engines can achieve fuel savings of up to 15% compared to older models. This trend is likely to drive investments in research and development, as manufacturers strive to innovate and meet the evolving needs of airlines. Consequently, the aircraft turbofan-engine market is poised for growth as companies focus on producing engines that align with these efficiency demands.

Increased Military Spending on Aviation

The aircraft turbofan-engine market is also influenced by increased military spending on aviation capabilities, particularly in modernizing aircraft fleets. The US government has been allocating substantial budgets towards modernizing its military aircraft fleet, which includes the procurement of advanced turbofan engines. This trend is expected to bolster the aircraft turbofan-engine market as defense contractors seek to develop engines that meet the specific requirements of military applications. The growing emphasis on national security and technological superiority is likely to sustain demand for high-performance turbofan engines, thereby contributing to the overall growth of the market.

Technological Innovations in Engine Design

The aircraft turbofan-engine market is witnessing a wave of technological innovations that are reshaping engine design and performance. Advancements in materials science, aerodynamics, and engine architecture are enabling manufacturers to create engines that are lighter, more efficient, and capable of higher thrust levels. Innovations such as geared turbofan technology have demonstrated the potential to enhance fuel efficiency by up to 20%. As these technologies become more prevalent, they are likely to attract investment and drive competition within the aircraft turbofan-engine market, ultimately benefiting airlines and passengers alike.

Regulatory Compliance and Emission Standards

The aircraft turbofan-engine market is significantly influenced by stringent regulatory compliance and emission standards set by authorities. In the US, the Federal Aviation Administration (FAA) and the Environmental Protection Agency (EPA) enforce regulations aimed at reducing greenhouse gas emissions from aircraft. As a result, manufacturers are compelled to develop engines that not only meet these standards but also exceed them. The market is witnessing a shift towards engines that utilize advanced materials and technologies to minimize emissions. This regulatory landscape is expected to drive innovation and investment in cleaner technologies, thereby shaping the future of the aircraft turbofan-engine market.