Consumer Demand for Efficiency

The growing consumer demand for efficiency and speed in service delivery is a significant driver in the ai in-insurance market. Customers increasingly expect quick responses and seamless interactions with their insurance providers. AI technologies, such as chatbots and virtual assistants, are being deployed to meet these expectations, providing instant support and information. This shift towards automation is likely to enhance customer satisfaction and retention rates. According to recent studies, companies that implement AI-driven customer service solutions can improve response times by up to 50%, indicating a strong correlation between efficiency and customer loyalty in the ai in-insurance market.

Technological Advancements in AI

The rapid evolution of artificial intelligence technologies is a primary driver in the ai in-insurance market. Innovations in machine learning, natural language processing, and data analytics are enabling insurers to enhance their operational efficiency and customer engagement. For instance, the integration of AI algorithms allows for more accurate risk assessments, which can lead to a reduction in underwriting costs by up to 30%. Furthermore, the ability to analyze vast amounts of data in real-time empowers insurers to tailor their offerings to meet specific customer needs. As a result, the ai in-insurance market is witnessing a surge in demand for AI-driven solutions that streamline processes and improve decision-making capabilities.

Integration of IoT and AI Technologies

The convergence of Internet of Things (IoT) and AI technologies is emerging as a pivotal driver in the ai in-insurance market. The proliferation of connected devices generates vast amounts of data that can be harnessed by AI systems to improve risk assessment and claims processing. For example, telematics data from vehicles can provide insurers with real-time insights into driving behavior, allowing for more accurate premium pricing. This integration is expected to enhance operational efficiencies and reduce claims costs, potentially lowering premiums for consumers. As the IoT ecosystem expands, the ai in-insurance market is likely to experience substantial growth, with projections indicating a market size increase of over 25% by 2027.

Regulatory Compliance and Data Security

In the ai in-insurance market, the increasing emphasis on regulatory compliance and data security is shaping the landscape. Insurers are required to adhere to stringent regulations regarding data protection and privacy, which necessitates the adoption of advanced AI technologies. These technologies can help in monitoring compliance and detecting fraudulent activities, thereby safeguarding sensitive customer information. The market is projected to grow as companies invest in AI solutions that not only ensure compliance but also enhance data security measures. It is estimated that by 2026, the investment in AI for compliance purposes could reach $2 billion, reflecting the critical role of regulatory frameworks in driving innovation within the ai in-insurance market.

Competitive Pressure and Market Differentiation

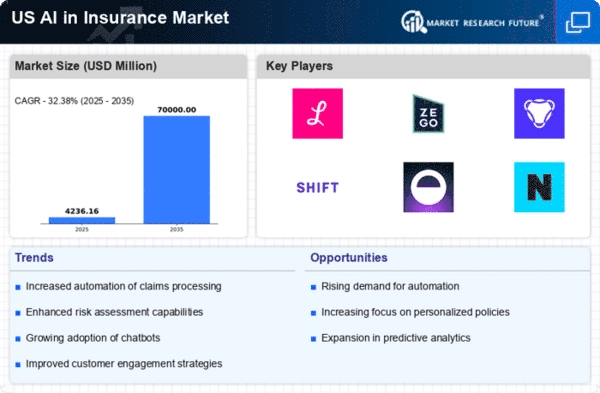

The competitive landscape in the ai in-insurance market is intensifying, prompting insurers to seek differentiation through innovative AI solutions. As more players enter the market, the need to stand out becomes paramount. Insurers are leveraging AI to develop unique products and services that cater to niche markets, thereby enhancing their competitive edge. This trend is likely to drive investment in AI technologies, as companies strive to offer personalized experiences and tailored coverage options. It is anticipated that by 2025, the market for AI-driven insurance products could account for over 40% of total insurance sales, underscoring the importance of innovation in maintaining market relevance.

.png)