Growing Awareness of Soil Health

There is a rising awareness among US farmers regarding the importance of soil health, which is becoming a critical driver in the agricultural microbials market. Healthy soil is essential for sustainable agriculture, and microbial products play a vital role in enhancing soil structure, fertility, and biodiversity. The USDA has emphasized the significance of soil health in its conservation programs, encouraging farmers to adopt practices that improve soil quality. This focus on soil health is likely to increase the adoption of microbial solutions, as they are recognized for their ability to restore and maintain soil ecosystems. Consequently, this trend is expected to bolster the US agricultural microbials market.

Regulatory Support for Biopesticides

The US agricultural microbials market is benefiting from increased regulatory support for biopesticides. The Environmental Protection Agency (EPA) has streamlined the approval process for microbial products, making it easier for manufacturers to bring new biopesticides to market. This regulatory environment encourages innovation and investment in microbial solutions that are environmentally friendly and effective against pests and diseases. As farmers seek alternatives to traditional chemical pesticides, the demand for biopesticides is expected to rise. This shift not only aligns with sustainable agricultural practices but also positions the US agricultural microbials market for significant growth in the coming years.

Increasing Adoption of Organic Farming

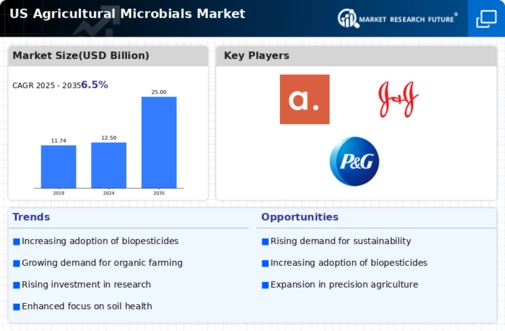

The US agricultural microbials market is experiencing a notable shift towards organic farming practices. As consumers increasingly demand organic produce, farmers are adopting microbial solutions to enhance soil health and crop yields. According to the USDA, organic farming has seen a growth rate of approximately 10% annually, indicating a robust market for agricultural microbials. These products, which include beneficial bacteria and fungi, are essential for maintaining soil fertility and promoting plant growth without synthetic chemicals. This trend not only aligns with consumer preferences but also supports environmental sustainability, making it a key driver in the US agricultural microbials market.

Rising Consumer Demand for Natural Products

The US agricultural microbials market is increasingly driven by consumer demand for natural and sustainably produced food. As consumers become more health-conscious and environmentally aware, they are seeking products that are free from synthetic chemicals. This trend is prompting farmers to adopt microbial solutions that enhance crop production while adhering to organic and sustainable practices. Market Research Future indicates that the organic food market in the US is projected to reach USD 100 billion by 2025, further fueling the demand for agricultural microbials. This consumer-driven shift is likely to encourage more farmers to integrate microbial products into their farming practices, thereby expanding the US agricultural microbials market.

Technological Advancements in Microbial Products

Technological innovations are significantly influencing the US agricultural microbials market. Advances in biotechnology have led to the development of more effective microbial formulations that can enhance crop resilience and productivity. For instance, the introduction of genetically engineered microbes has shown promise in improving nutrient uptake and disease resistance in various crops. The market for microbial products is projected to reach USD 3 billion by 2027, driven by these technological advancements. As farmers seek to optimize their yields and reduce reliance on chemical fertilizers, the demand for innovative microbial solutions is likely to grow, further propelling the US agricultural microbials market.