Growth of Smart Hospitals

The concept of smart hospitals is gaining traction within the 5g in-healthcare market. These facilities leverage advanced technologies, including 5g, to improve operational efficiency and patient care. Smart hospitals utilize connected devices and IoT applications to streamline processes, enhance patient experiences, and optimize resource management. The market for smart hospitals is expected to grow at a CAGR of 25% over the next five years, driven by the increasing adoption of 5g technology. By integrating 5g networks, hospitals can facilitate seamless communication between devices, leading to improved patient outcomes and reduced operational costs. This trend underscores the importance of 5g in transforming healthcare delivery.

Advancements in Medical Imaging

The 5g in-healthcare market is witnessing advancements in medical imaging technologies, which are becoming increasingly reliant on high-speed data transmission. 5g networks enable the transfer of large imaging files, such as MRI and CT scans, in real-time, facilitating quicker diagnoses and treatment plans. This capability is particularly beneficial in tele-radiology, where specialists can analyze images remotely without delays. The medical imaging market is projected to reach $45 billion by 2027, with 5g technology playing a pivotal role in this growth. Enhanced imaging capabilities not only improve patient care but also streamline workflows within healthcare facilities, making 5g an essential component of modern medical practices.

Enhanced Emergency Response Systems

The 5g in-healthcare market is poised to revolutionize emergency response systems. The low latency and high-speed capabilities of 5g networks allow for instantaneous communication between emergency medical services and hospitals. This capability is crucial during critical situations where every second counts. For instance, the ability to transmit high-definition video feeds from the scene of an emergency can significantly improve the preparedness of medical teams upon arrival. It is estimated that the implementation of 5g technology in emergency services could reduce response times by up to 30%. Consequently, healthcare providers are increasingly investing in 5g infrastructure to enhance their emergency response capabilities.

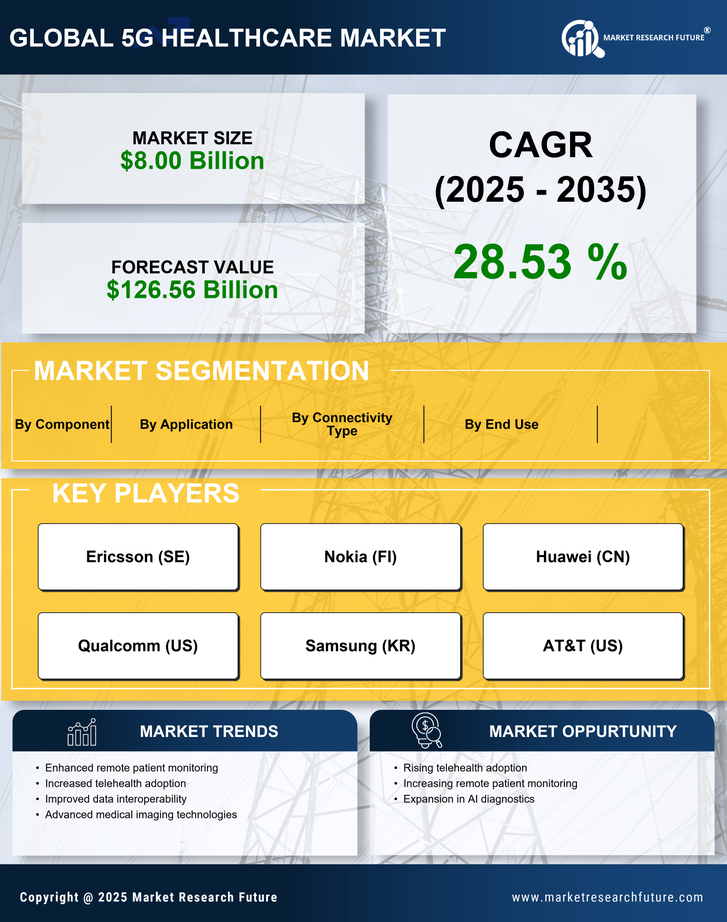

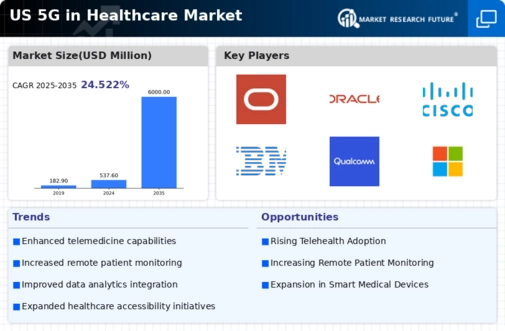

Increased Demand for Remote Patient Monitoring

The 5g in-healthcare market is experiencing a surge in demand for remote patient monitoring solutions. This trend is driven by the need for continuous health tracking, particularly for chronic conditions. With 5g technology, healthcare providers can access real-time data from patients' devices, enabling timely interventions. According to recent estimates, the remote patient monitoring market is projected to reach $2.5 billion by 2026, indicating a robust growth trajectory. The ability to monitor patients remotely not only enhances patient outcomes but also reduces hospital readmission rates, which is a critical concern for healthcare systems. As a result, the integration of 5g technology into healthcare infrastructure is becoming increasingly vital to meet this demand.

Integration of Artificial Intelligence in Healthcare

The integration of artificial intelligence (AI) in healthcare is significantly influenced by the capabilities of the 5g in-healthcare market. AI applications, such as predictive analytics and personalized medicine, require substantial data processing and real-time communication, which 5g networks can provide. The ability to analyze vast amounts of data quickly allows healthcare providers to make informed decisions and improve patient outcomes. The AI in healthcare market is expected to reach $36 billion by 2025, with 5g technology serving as a catalyst for its growth. As healthcare organizations increasingly adopt AI solutions, the role of 5g in facilitating these advancements becomes increasingly critical.