Technological Advancements in 3D Printing

The 3d printed-medical-implants market is experiencing a surge due to rapid technological advancements in 3D printing techniques. Innovations such as bioprinting and the development of new materials are enhancing the capabilities of 3D printing, allowing for the creation of complex and customized implants. These advancements are not only improving the quality of medical implants but also reducing production costs. For instance, the integration of artificial intelligence in design processes is streamlining production, potentially increasing efficiency by up to 30%. As a result, healthcare providers are increasingly adopting 3D printed solutions, driving growth in the market.

Cost Efficiency and Reduced Production Time

Cost efficiency is a critical driver for the 3d printed-medical-implants market. Traditional manufacturing methods often involve high material waste and lengthy production times. In contrast, 3D printing minimizes waste and can produce implants in a fraction of the time. Reports indicate that 3D printing can reduce production costs by up to 50%, making it an attractive option for manufacturers. This cost-effectiveness is particularly appealing to healthcare providers facing budget constraints, thereby increasing the adoption of 3D printed implants. As a result, the market is likely to see continued growth as more facilities opt for these efficient solutions.

Regulatory Support for Advanced Manufacturing

Regulatory support is playing a pivotal role in shaping the 3d printed-medical-implants market. The U.S. Food and Drug Administration (FDA) has been actively working to establish guidelines that facilitate the approval of 3D printed medical devices. This regulatory evolution is crucial, as it provides manufacturers with a clearer pathway to market entry, thereby encouraging innovation. The FDA's initiatives to streamline the approval process for 3D printed implants are likely to enhance market confidence and stimulate investment. As regulatory frameworks continue to evolve, the 3d printed-medical-implants market is expected to expand, driven by increased product availability and consumer trust.

Increasing Investment in Healthcare Innovation

Investment in healthcare innovation is a significant driver for the 3d printed-medical-implants market. Venture capital and government funding are increasingly directed towards research and development in 3D printing technologies. This influx of capital is fostering innovation, leading to the development of new materials and techniques that enhance the functionality of medical implants. For example, recent funding initiatives have supported projects aimed at creating bio-compatible materials that can better integrate with human tissue. Such advancements are expected to stimulate market growth, as they expand the range of applications for 3D printed implants in various medical fields.

Rising Demand for Personalized Healthcare Solutions

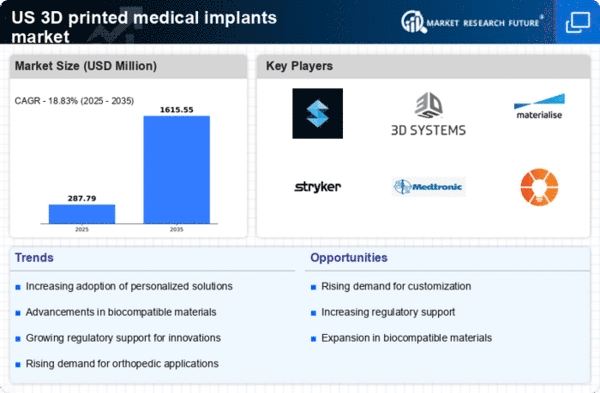

The growing emphasis on personalized medicine is significantly impacting the 3d printed-medical-implants market. Patients are increasingly seeking tailored solutions that cater to their specific anatomical needs, which 3D printing can provide. This trend is reflected in the market, where the demand for customized implants is projected to grow at a CAGR of 25% over the next five years. Healthcare professionals are recognizing the benefits of personalized implants, such as improved patient outcomes and reduced recovery times. Consequently, this shift towards personalized healthcare is likely to propel the growth of the 3d printed-medical-implants market.