Rising Pet Ownership

The veterinary laboratory-testing market is experiencing growth due to the increasing number of pet owners in the UK. Recent statistics indicate that approximately 50% of households in the UK own a pet, leading to a heightened demand for veterinary services. This trend is likely to drive the need for laboratory testing as pet owners seek to ensure the health and well-being of their animals. As more individuals invest in their pets' health, the veterinary laboratory-testing market is expected to expand, with a projected growth rate of around 6% annually. This rise in pet ownership not only increases the volume of tests conducted but also encourages veterinary practices to adopt advanced diagnostic tools, thereby enhancing the overall quality of care provided.

Emerging Trends in Pet Insurance

This market is also being shaped by emerging trends in pet insurance.. As more pet owners opt for insurance policies that cover diagnostic testing, there is a noticeable increase in the number of laboratory tests being conducted. Insurance providers are expanding their coverage options to include preventive care and routine testing, which encourages pet owners to utilize veterinary services more frequently. This trend is expected to drive the veterinary laboratory-testing market, with projections indicating a potential increase in testing by 15% over the next few years. The financial support provided by pet insurance is likely to alleviate the cost burden on pet owners, further promoting the use of laboratory testing for early disease detection.

Increased Awareness of Animal Health

There is a growing awareness among pet owners regarding the importance of regular health check-ups and preventive care, which significantly impacts the veterinary laboratory-testing market. Educational campaigns and initiatives by veterinary associations have contributed to this awareness, leading to a shift in consumer behavior. Pet owners are now more inclined to seek laboratory tests for early detection of diseases, which can potentially save costs associated with advanced treatments. This trend is reflected in the rising number of diagnostic tests performed annually, with estimates suggesting an increase of 10% in testing frequency over the past few years. Consequently, the veterinary laboratory-testing market is likely to benefit from this heightened focus on proactive health management.

Advancements in Diagnostic Technologies

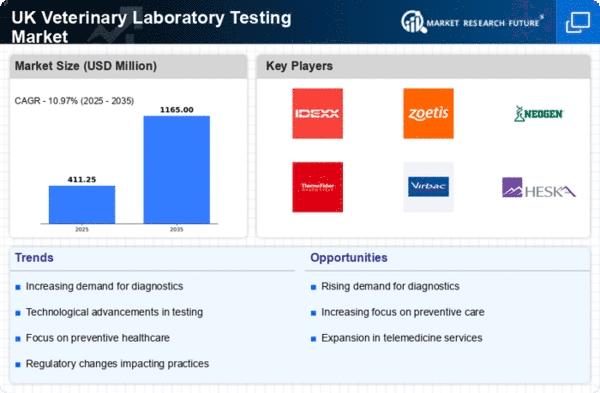

This market is being propelled by advancements in diagnostic technologies.. Innovations such as PCR (Polymerase Chain Reaction) testing and rapid antigen tests have revolutionized the way veterinarians diagnose diseases. These technologies not only enhance the accuracy of test results but also reduce the turnaround time for obtaining results. As a result, veterinary practices are increasingly adopting these advanced testing methods, which is expected to contribute to a market growth rate of approximately 8% over the next few years. Furthermore, the integration of digital platforms for test result management is streamlining operations within veterinary practices, thereby improving overall efficiency in the veterinary laboratory-testing market.

Regulatory Compliance and Quality Standards

This market is influenced by stringent regulatory compliance and quality standards set by governing bodies in the UK.. These regulations ensure that laboratory tests meet specific criteria for accuracy and reliability, which is crucial for animal health. Veterinary laboratories are required to adhere to these standards, leading to increased investment in quality assurance processes and technologies. This focus on compliance not only enhances the credibility of laboratory results but also fosters consumer trust in veterinary services. As a result, the veterinary laboratory-testing market is likely to see a steady growth trajectory, with an emphasis on maintaining high-quality testing standards.