Integration of Advanced Technologies

The integration of advanced technologies such as IoT and big data analytics is driving growth in the retail analytics market. Retailers in the UK are increasingly adopting these technologies to collect and analyse vast amounts of data from various sources, including online and offline channels. This integration allows for a more comprehensive understanding of customer behaviour and preferences. For instance, the use of IoT devices enables real-time tracking of inventory and customer interactions, leading to improved operational efficiency. The retail analytics market is expected to witness a significant boost as businesses leverage these technologies to enhance their analytical capabilities and deliver personalised experiences to consumers.

Focus on Enhancing Customer Experience

Enhancing customer experience is a primary driver in the retail analytics market, as UK retailers strive to meet evolving consumer expectations. The ability to analyse customer feedback, purchasing patterns, and engagement metrics is becoming essential for businesses aiming to create tailored shopping experiences. Retailers are investing in analytics solutions that enable them to understand customer preferences and behaviours more deeply. This focus on customer experience is reflected in the increasing allocation of budgets towards analytics tools, with a reported 20% increase in spending on customer analytics solutions in the past year. The retail analytics market is likely to continue growing as businesses prioritise customer-centric strategies.

Regulatory Compliance and Data Security

Regulatory compliance and data security are emerging as critical drivers in the retail analytics market. With the implementation of stringent data protection regulations in the UK, retailers are compelled to adopt analytics solutions that ensure compliance while safeguarding customer data. This necessity is prompting businesses to invest in advanced analytics tools that not only provide insights but also adhere to regulatory standards. The retail analytics market is expected to grow as companies seek to balance the need for data-driven insights with the need to maintain data security and compliance. This dual focus is likely to shape the future landscape of analytics in the retail sector.

Rising Importance of Omnichannel Retailing

The retail analytics market is being propelled by the rising importance of omnichannel retailing strategies among UK retailers. As consumers increasingly engage with brands across multiple channels, retailers are compelled to adopt analytics solutions that provide a unified view of customer interactions. This shift is reflected in the growing investment in analytics tools that facilitate seamless integration of data from physical stores, e-commerce platforms, and mobile applications. Retailers are recognising that a cohesive omnichannel strategy, supported by robust analytics, can enhance customer satisfaction and drive sales. The market is likely to expand as businesses seek to refine their omnichannel approaches through data-driven insights.

Growing Demand for Data-Driven Decision Making

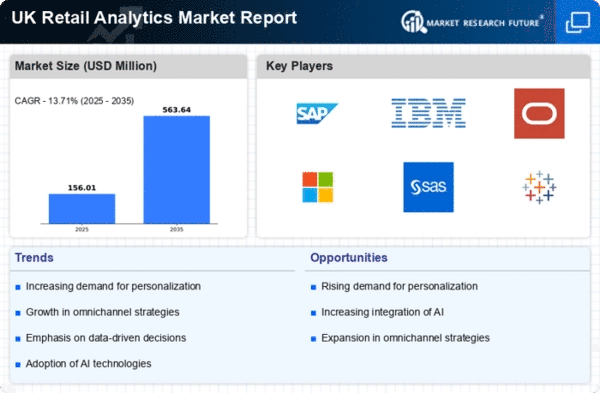

The retail analytics market is experiencing a surge in demand for data-driven decision making among retailers in the UK. As competition intensifies, businesses are increasingly relying on analytics to derive insights from consumer behaviour and sales patterns. This trend is evidenced by a reported increase in the adoption of analytics tools, with the market projected to grow at a CAGR of 15% from 2023 to 2028. Retailers are utilising these insights to optimise inventory management, enhance customer experiences, and improve operational efficiency. The ability to make informed decisions based on real-time data is becoming a critical factor for success in the retail analytics market, as companies seek to stay ahead of market trends and consumer preferences.