Growing Demand for Personalized Medicine

The human genetics market is experiencing a notable shift towards personalized medicine, driven by an increasing demand for tailored healthcare solutions. Patients and healthcare providers are seeking treatments that are specifically designed to meet individual genetic profiles. This trend is reflected in the rising number of genetic tests being conducted, with estimates suggesting that the market for genetic testing in the UK could reach £1.5 billion by 2026. As healthcare systems increasingly adopt precision medicine approaches, the human genetics market is likely to expand, offering innovative therapies and interventions that align with patients' unique genetic makeups.

Increased Public Awareness and Education

Public awareness regarding genetic health and its implications is on the rise, significantly impacting the human genetics market. Educational campaigns and initiatives by health organizations are informing the public about the benefits of genetic testing and the potential for early disease detection. Surveys indicate that approximately 60% of the UK population is now aware of genetic testing options available to them. This heightened awareness is likely to drive demand for genetic services, as individuals seek proactive measures to manage their health, thereby contributing to the growth of the human genetics market.

Regulatory Support for Genetic Innovations

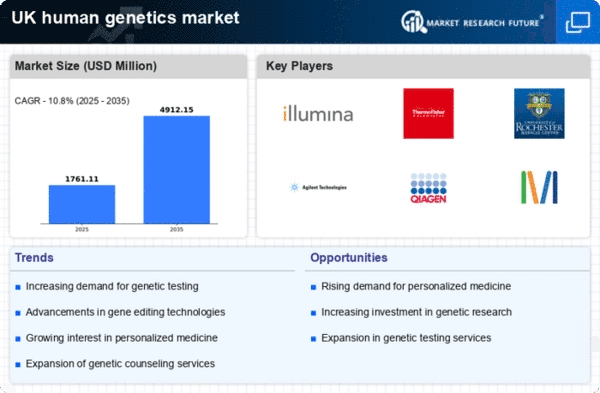

The regulatory landscape in the UK is evolving to support advancements in the human genetics market. Regulatory bodies are increasingly recognizing the importance of genetic research and are streamlining approval processes for genetic tests and therapies. Recent changes in regulations have reduced the time required for new genetic tests to reach the market, fostering innovation. This supportive environment is expected to encourage investment in genetic research and development, potentially leading to a market growth rate of 10% annually over the next five years, as companies seek to capitalize on new opportunities within the human genetics market.

Collaboration Between Academia and Industry

Collaboration between academic institutions and industry players is becoming a driving force in the human genetics market. Partnerships are facilitating the translation of research findings into practical applications, enhancing the development of genetic tests and therapies. The UK is home to numerous research institutions that are actively collaborating with biotech companies, leading to the establishment of innovative genetic solutions. This synergy is likely to accelerate advancements in the field, with projections indicating that collaborative efforts could result in a 15% increase in the number of genetic products launched in the next few years, thereby bolstering the human genetics market.

Technological Innovations in Genetic Research

Technological advancements are playing a pivotal role in the evolution of the human genetics market. Innovations such as next-generation sequencing (NGS) and CRISPR gene editing are enhancing the capabilities of genetic research, enabling more accurate and efficient analysis of genetic information. The UK has seen a surge in research funding, with government initiatives allocating over £300 million to support genetic research projects. These technological breakthroughs not only facilitate the discovery of new genetic markers but also improve the development of targeted therapies, thereby propelling the human genetics market forward.