Rising Demand for Personalised Care

The healthcare CRM market is experiencing a notable shift towards personalised care., driven by patients' increasing expectations for tailored healthcare experiences. This trend is reflected in the growing adoption of CRM systems that enable healthcare providers to gather and analyse patient data effectively. By leveraging insights from these systems, providers can create customised treatment plans and enhance patient satisfaction. In the UK, the demand for personalised healthcare solutions is projected to grow at a CAGR of approximately 12% over the next five years. This rising demand is likely to compel healthcare organisations to invest in advanced CRM technologies, thereby propelling the healthcare crm market forward.

Growing Importance of Data Analytics

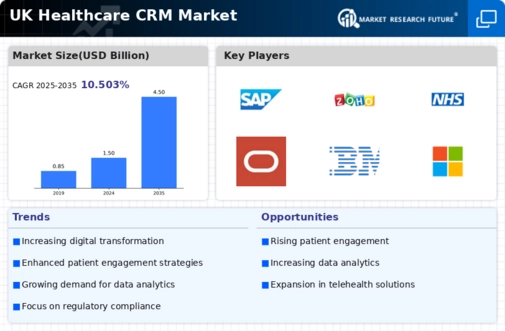

The healthcare CRM market is increasingly shaped by the growing importance of data analytics. in healthcare decision-making. As healthcare providers accumulate vast amounts of patient data, the ability to analyse this information effectively becomes crucial. CRM systems equipped with advanced analytics capabilities enable organisations to derive actionable insights, improve patient care, and optimise resource allocation. In the UK, the healthcare analytics market is projected to grow at a CAGR of 15% over the next few years, indicating a strong demand for CRM solutions that integrate data analytics functionalities. This trend underscores the potential for CRM systems to enhance operational efficiency and patient outcomes.

Shift Towards Value-Based Care Models

The healthcare CRM market is witnessing a shift towards value-based care models., which prioritise patient outcomes over volume of services provided. This transition is prompting healthcare organisations to adopt CRM systems that facilitate better patient management and engagement. By utilising CRM technologies, providers can track patient progress, measure outcomes, and adjust care plans accordingly. The UK healthcare system is increasingly aligning with value-based care principles, which could lead to a market growth rate of approximately 8% in the healthcare crm market. This shift not only enhances patient satisfaction but also encourages healthcare providers to invest in CRM solutions that support value-based care initiatives.

Increased Investment in Digital Transformation

The healthcare CRM market is benefiting from a surge in digital transformation initiatives. across the UK healthcare sector. As organisations strive to improve operational efficiency and patient outcomes, investments in CRM technologies are becoming more prevalent. The UK government has allocated substantial funding to support digital health initiatives, which is likely to stimulate the adoption of CRM systems. Reports indicate that the digital health market in the UK is expected to reach £20 billion by 2025, with a significant portion of this investment directed towards enhancing CRM capabilities. This trend suggests a robust growth trajectory for the healthcare crm market as organisations embrace digital solutions.

Regulatory Changes and Compliance Requirements

The healthcare CRM market is significantly influenced by evolving regulatory frameworks. and compliance requirements in the UK. Healthcare organisations must adhere to stringent regulations, such as the General Data Protection Regulation (GDPR), which mandates the secure handling of patient data. As a result, CRM systems that offer robust compliance features are increasingly sought after. The market is expected to witness a surge in demand for solutions that facilitate compliance with these regulations, potentially leading to a market growth rate of around 10% annually. This focus on compliance not only enhances patient trust but also drives the adoption of sophisticated CRM solutions within the healthcare sector.

Leave a Comment