Rise of Telehealth Services

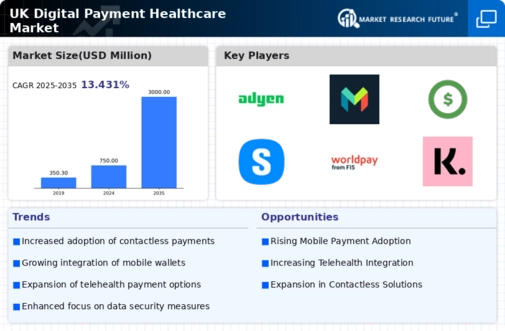

The digital payment-healthcare market is experiencing a notable rise in telehealth services, which has transformed how patients access healthcare. With the increasing acceptance of remote consultations, healthcare providers are adopting digital payment solutions to facilitate seamless transactions. In 2025, it is estimated that telehealth services will account for approximately 25% of all healthcare consultations in the UK. This shift not only enhances patient convenience but also encourages healthcare providers to invest in digital payment systems that support various payment methods. As telehealth continues to grow, the demand for efficient and secure payment solutions is likely to increase, driving innovation within the digital payment-healthcare market.

Consumer Demand for Convenience

Consumer demand for convenience is a driving force in the digital payment-healthcare market. Patients increasingly prefer quick and easy payment options, leading healthcare providers to adopt digital payment solutions that streamline the payment process. In 2025, surveys indicate that over 70% of patients in the UK express a preference for digital payment methods over traditional ones. This trend is prompting healthcare organizations to enhance their payment systems, ensuring they meet consumer expectations. As convenience becomes a priority for patients, the digital payment-healthcare market is likely to expand, with providers investing in user-friendly payment technologies.

Government Initiatives and Funding

Government initiatives aimed at enhancing digital healthcare infrastructure are significantly impacting the digital payment-healthcare market. The UK government has allocated substantial funding to promote digital health technologies, including payment systems. In 2025, it is projected that public investment in digital health will reach £1 billion, fostering the development of secure and efficient payment solutions. These initiatives not only aim to improve healthcare accessibility but also encourage the integration of digital payment methods within the healthcare ecosystem. As a result, healthcare providers are more likely to adopt advanced payment technologies, thereby propelling growth in the digital payment-healthcare market.

Increased Focus on Patient Data Security

the digital payment-healthcare market has an increased focus on patient data security., which is crucial for maintaining trust in digital payment systems. With rising concerns over data breaches, healthcare providers are prioritizing secure payment solutions that comply with regulations such as GDPR. In 2025, it is estimated that 80% of healthcare organizations in the UK will implement enhanced security measures for digital transactions. This emphasis on data protection not only safeguards patient information but also encourages the adoption of digital payment methods. As security becomes a paramount concern, the digital payment-healthcare market is likely to grow, driven by the need for secure and compliant payment solutions.

Technological Advancements in Payment Systems

Technological advancements are reshaping the digital payment-healthcare market, enabling more efficient and secure payment solutions. Innovations such as blockchain technology and artificial intelligence are being integrated into payment systems, enhancing transaction security and reducing fraud. In 2025, it is anticipated that the adoption of these technologies will increase by 30% among healthcare providers in the UK. This shift not only improves the overall patient experience but also instills greater trust in digital payment methods. As technology continues to evolve, the digital payment-healthcare market is expected to witness significant growth driven by these advancements.