Increased Urbanization

The ongoing trend of urbanization appears to be a pivotal driver for the Transport Ticketing Market. As more individuals migrate to urban areas, the demand for efficient public transportation systems escalates. This shift necessitates advanced ticketing solutions that can accommodate a growing population. According to recent data, urban areas are expected to house approximately 68% of the world's population by 2050. This demographic change compels cities to enhance their transport infrastructure, thereby fostering the adoption of innovative ticketing systems. The Transport Ticketing Market is likely to benefit from this trend, as municipalities seek to streamline operations and improve user experiences through digital ticketing solutions.

Focus on Sustainability

The focus on sustainability is emerging as a significant driver for the Transport Ticketing Market. With increasing awareness of environmental issues, there is a growing emphasis on reducing carbon footprints associated with transportation. Many transport authorities are implementing eco-friendly ticketing solutions that promote the use of public transport over private vehicles. For instance, initiatives such as discounted fares for eco-friendly transport options are gaining traction. Data suggests that cities adopting sustainable transport policies have seen a rise in public transport usage by up to 20%. This trend not only supports environmental goals but also enhances the appeal of the Transport Ticketing Market, as it aligns with the values of environmentally conscious consumers.

Technological Advancements

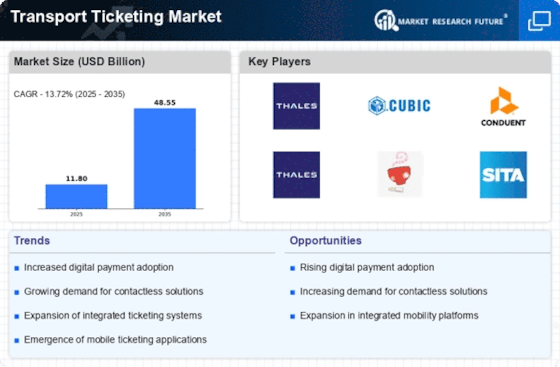

Technological advancements are reshaping the Transport Ticketing Market in profound ways. The integration of mobile applications, contactless payment systems, and real-time data analytics is revolutionizing how tickets are purchased and validated. For instance, the rise of mobile ticketing has led to a notable increase in user convenience, with studies indicating that mobile ticketing transactions could account for over 30% of total ticket sales by 2025. Furthermore, the implementation of blockchain technology is anticipated to enhance security and transparency in ticket transactions. As technology continues to evolve, the Transport Ticketing Market is poised to adapt, offering more sophisticated solutions that cater to the needs of modern commuters.

Consumer Demand for Convenience

Consumer demand for convenience is a driving force behind the evolution of the Transport Ticketing Market. As lifestyles become increasingly fast-paced, commuters seek seamless and efficient travel experiences. The preference for mobile ticketing solutions reflects this demand, as users favor the ability to purchase and store tickets on their smartphones. Recent surveys indicate that over 60% of commuters prefer mobile ticketing options due to their ease of use. This shift in consumer behavior compels transport operators to adopt more user-friendly ticketing systems. As a result, the Transport Ticketing Market is likely to witness a surge in the development of innovative solutions that prioritize customer convenience and satisfaction.

Government Initiatives and Funding

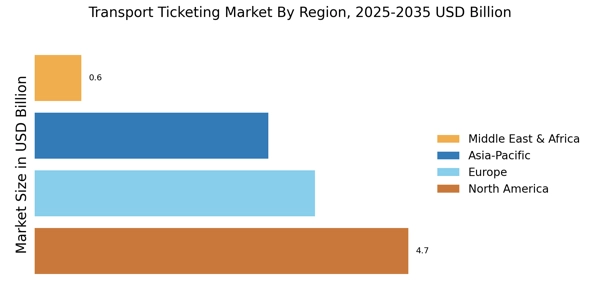

Government initiatives and funding play a crucial role in the development of the Transport Ticketing Market. Many governments are investing in public transportation infrastructure to promote sustainable mobility solutions. For example, various countries have allocated substantial budgets to enhance public transport systems, which includes upgrading ticketing technologies. In recent years, funding for public transport projects has seen a significant increase, with some regions reporting budget allocations exceeding 10 billion dollars annually. This financial support not only facilitates the implementation of advanced ticketing systems but also encourages collaboration between public and private sectors. Consequently, the Transport Ticketing Market is likely to experience growth driven by these strategic investments.