- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

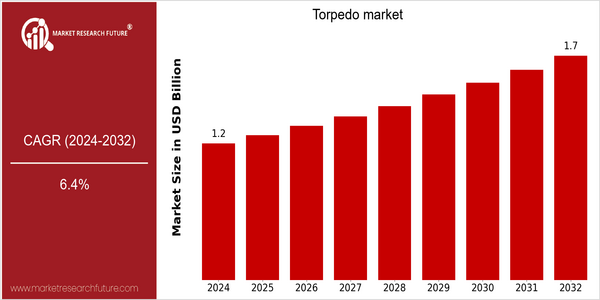

| Year | Value |

|---|---|

| 2024 | USD 1.1704 Billion |

| 2032 | USD 1.6981 Billion |

| CAGR (2024-2032) | 6.4 % |

Note – Market size depicts the revenue generated over the financial year

The world market for torpedoes is expected to increase significantly, with a current market size of $1.17 billion in 2024 projected to rise to $1.69 billion in 2032. The growth rate is 6.4% CAGR over the forecast period. This upward trend is largely due to the growing demand for naval weapons systems and the modernization of existing naval fleets. As more countries increase their maritime defense capabilities, the need for advanced torpedo technology will increase, thus driving market growth. The development of torpedo design, propulsion systems and guidance systems will also help to drive market growth. Electric propulsion and stealth technology will make torpedoes more effective and flexible in various combat conditions. The leading companies in this market, such as Raytheon, Lockheed Martin and Northrop Grumman, have been involved in strategic initiatives such as collaborations and research and development. These companies are expected to launch advanced torpedoes that meet the needs of modern naval warfare, thus strengthening their positions in the market.

Regional Market Size

Regional Deep Dive

The torpedo market is characterized by the variety of its applications and innovations in different regions. In North America, the market is driven by technological innovations and the growing emphasis on safety and efficiency in maritime operations. Europe, on the other hand, combines modern and traditional trends and is focused on compliance with regulations. Asia-Pacific is a fast-growing market, driven by the growing demand for maritime leisure and commercial activities. Middle East and Africa are unique, with a combination of geopolitical issues and the diversification of economies. Latin America is a potential growth market, driven by the increasing investments in the construction of infrastructure and tourism.

Europe

- The European Union's Green Deal is influencing the torpedo market by promoting research into sustainable materials and technologies, with organizations like the European Defence Agency facilitating collaborative projects.

- Countries like Norway and the UK are enhancing their naval capabilities through partnerships with defense contractors, focusing on next-generation torpedoes that integrate artificial intelligence for improved performance.

Asia Pacific

- China's rapid naval expansion has led to significant investments in torpedo technology, with the development of the Yu-8 torpedo, which is designed for anti-submarine warfare.

- India's 'Make in India' initiative is encouraging local production of torpedoes, with companies like Bharat Dynamics Limited working on indigenous designs to meet the country's defense needs.

Latin America

- Brazil is investing in its naval defense capabilities, with projects aimed at developing indigenous torpedo systems to bolster its maritime security.

- The growing tourism sector in coastal countries is leading to increased demand for recreational torpedoes, with local manufacturers exploring opportunities in this niche market.

North America

- The U.S. Navy has been investing heavily in advanced torpedo technology, including the development of the MK 48 Mod 7, which enhances targeting capabilities and operational efficiency.

- Regulatory changes in the maritime industry, particularly concerning environmental standards, are pushing manufacturers to innovate and produce more eco-friendly torpedoes, with companies like Raytheon leading the charge.

Middle East And Africa

- The UAE has been enhancing its naval capabilities through partnerships with international defense firms, focusing on acquiring advanced torpedo systems to secure its maritime interests.

- Geopolitical tensions in the region are driving countries like Saudi Arabia to invest in modernizing their naval fleets, which includes upgrading their torpedo systems to enhance deterrence capabilities.

Did You Know?

“The first modern torpedo was developed in the 19th century and was known as the Whitehead torpedo, named after its inventor, Giovanni Luppis, and his partner, Robert Whitehead.” — Naval History and Heritage Command

Segmental Market Size

The torpedo market is an important part of the military and maritime industries, and it is now enjoying a steady growth because of the growing tensions in the world and the technological development of naval warfare. A key driver of this market is the need for a more powerful navy and the need for more sophisticated underwater weapons, which requires the development of torpedo systems. Also, the policy of promoting the military spending in various countries also plays an important role in the market. The technology of torpedoes has been in use for a long time, and the advanced countries such as the United States and Russia have developed and used advanced torpedoes. Mark 48 and VA-111 Shkval are two of the most well-known examples. Torpedoes are used primarily in the anti-submarine warfare and in the naval combats, where they are an important tool for the naval forces. In the coming years, the development of the torpedo market will be accelerated by the increased military budgets and the modernization of the navies, and the development of advanced guidance systems and stealth properties will shape the development of the industry.

Future Outlook

From 2024 to 2032, the torpedo market will increase from $1.17 billion to $1.69 billion, a substantial compound annual growth rate (CAGR) of 6.4%. This growth is due to the fact that the defense budgets of the world's governments are increasing, especially in emerging economies, and the demand for advanced naval capabilities is growing. This will lead to a greater use of sophisticated torpedo systems, which will increase the operational efficiency and deterrence of these naval fleets. By 2032, it is expected that the penetration of advanced torpedo systems in the world's naval fleets will exceed 60%, mainly due to technological advances and the integration of artificial intelligence in targeting systems, which will increase the accuracy and reduce response times in combat situations. Moreover, the evolution of propulsion systems, such as electric and hybrid, will make it possible to increase the stealth and range of torpedoes. Also, the development of smart torpedoes, equipped with enhanced guidance systems and real-time data processing capabilities, will further revolutionize naval warfare. Strategic drivers such as international treaties and defense collaborations, which aim to improve maritime security, will also have a significant influence on the dynamics of the market. The demand for reliable and advanced torpedo systems will continue to grow, thus positioning the market for a strong transformation and sustained growth until the end of the decade.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 6.40% (2023-2030) |

Torpedo Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.