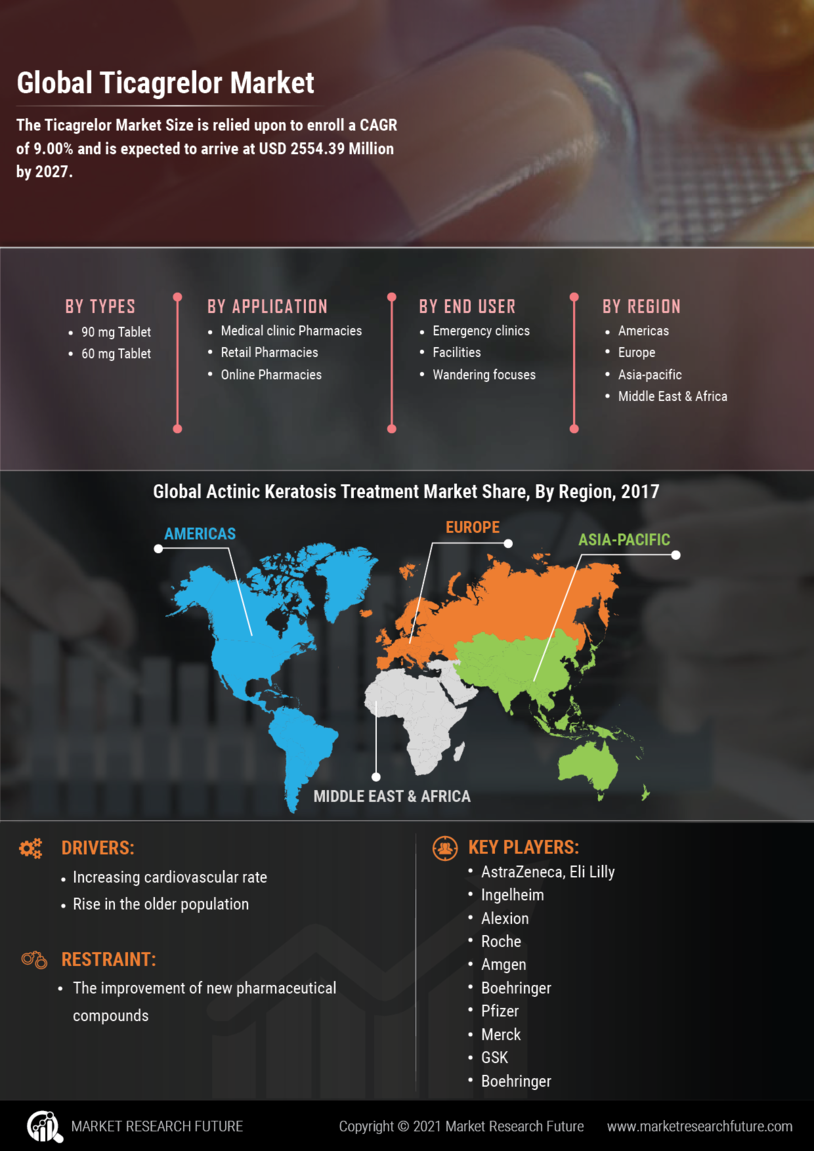

Market Growth Projections

The Global Ticagrelor Market Industry is projected to experience robust growth over the coming years. With an estimated market value of 0.97 USD Billion in 2024, the industry is on a trajectory to reach 4.0 USD Billion by 2035. This growth is underpinned by a compound annual growth rate of 13.73% from 2025 to 2035. Such projections indicate a strong demand for Ticagrelor Market, driven by factors such as increasing cardiovascular disease prevalence, advancements in drug formulations, and enhanced healthcare access in emerging markets. These metrics highlight the potential for sustained growth in the Global Ticagrelor Market Industry.

Growing Awareness and Education

The increasing awareness and education regarding the importance of antiplatelet therapy contribute significantly to the Global Ticagrelor Market Industry. Healthcare providers are actively promoting the benefits of Ticagrelor Market in preventing cardiovascular events, leading to higher prescription rates. Initiatives by organizations such as the American Heart Association emphasize the need for effective treatment options, thereby influencing patient choices. This heightened awareness is likely to drive market growth, as more patients seek out Ticagrelor Market as a viable treatment option. The anticipated compound annual growth rate of 13.73% from 2025 to 2035 further illustrates this trend.

Advancements in Drug Formulations

Innovations in drug formulations and delivery mechanisms are propelling the Global Ticagrelor Market Industry forward. Recent advancements have enhanced the efficacy and safety profiles of Ticagrelor Market, making it a preferred choice among healthcare professionals. For example, the development of fixed-dose combinations with other antiplatelet agents has shown promising results in clinical trials. These innovations not only improve patient adherence but also expand the therapeutic applications of Ticagrelor Market. As a result, the market is anticipated to experience substantial growth, potentially reaching 4.0 USD Billion by 2035, driven by these advancements.

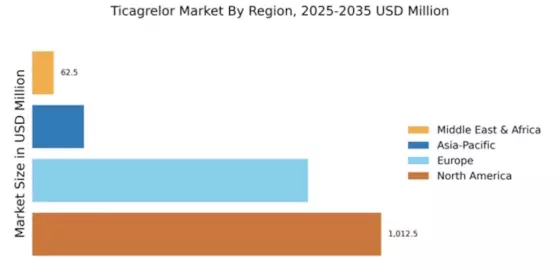

Emerging Markets and Accessibility

The expansion of healthcare infrastructure in emerging markets is a crucial driver for the Global Ticagrelor Market Industry. As countries invest in improving healthcare access, the availability of Ticagrelor Market is likely to increase, reaching a broader patient population. For example, nations in Asia and Africa are witnessing significant improvements in healthcare delivery systems, which facilitate the distribution of essential medications. This trend is expected to contribute to the overall market growth, as more patients gain access to effective antiplatelet therapies. The Global Ticagrelor Market Industry is poised to benefit from these developments, enhancing its reach and impact.

Increasing Cardiovascular Diseases

The rising prevalence of cardiovascular diseases globally is a primary driver for the Global Ticagrelor Market Industry. As heart-related ailments continue to escalate, the demand for effective antiplatelet therapies like Ticagrelor Market is expected to grow. For instance, the World Health Organization indicates that cardiovascular diseases account for approximately 32% of all global deaths. This alarming statistic underscores the urgent need for effective treatment options. Consequently, the Global Ticagrelor Market Industry is projected to reach 0.97 USD Billion in 2024, reflecting a significant response to this health crisis.

Regulatory Approvals and Guidelines

The role of regulatory approvals and clinical guidelines cannot be understated in the Global Ticagrelor Market Industry. Regulatory bodies are increasingly recognizing the efficacy of Ticagrelor Market, leading to expedited approvals for new indications. For instance, recent updates in clinical guidelines recommend Ticagrelor Market as a first-line treatment for certain patient populations. Such endorsements not only enhance the drug's credibility but also encourage healthcare providers to prescribe it more frequently. This regulatory support is expected to bolster market growth, as the industry adapts to evolving clinical practices and guidelines.