Growing Middle-Class Population

The expanding middle-class population in Thailand is a pivotal driver for the fragrance market. As disposable incomes rise, consumers are increasingly willing to invest in personal care products, including fragrances. This demographic shift is expected to lead to a surge in demand for both luxury and affordable fragrance options. In 2025, the middle-class segment is projected to account for approximately 50% of the total population, which could translate to a significant increase in fragrance sales. The fragrance market is likely to benefit from this trend, as consumers seek to express their individuality and social status through scent. Furthermore, the growing influence of social media and beauty influencers may further amplify this demand, encouraging consumers to explore diverse fragrance offerings.

Impact of Celebrity Endorsements

Celebrity endorsements are playing a significant role in shaping consumer preferences within the fragrance market in Thailand. The influence of local and international celebrities on social media platforms is substantial, as they often introduce new fragrances to their followers. This trend is likely to drive sales, as consumers are inclined to purchase products endorsed by their favorite personalities. The fragrance market may experience a boost in brand visibility and consumer engagement through strategic partnerships with celebrities. In 2025, it is projected that fragrance brands leveraging celebrity endorsements could see an increase in sales by up to 25%. This phenomenon underscores the importance of marketing strategies that harness the power of celebrity influence, particularly in a market where personal branding and social media presence are increasingly intertwined.

Influence of E-commerce Platforms

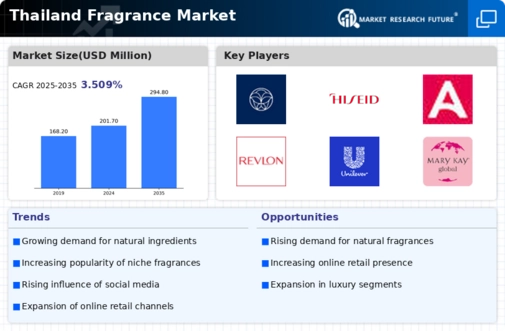

The rapid growth of e-commerce platforms in Thailand is transforming the fragrance market landscape. With the increasing penetration of the internet and mobile devices, consumers are turning to online shopping for convenience and variety. In 2025, e-commerce is expected to account for over 20% of total retail sales in Thailand, which could significantly impact fragrance sales. The fragrance market is likely to benefit from this shift, as online platforms provide access to a wider range of products, including niche and international brands. Additionally, the ability to compare prices and read reviews enhances consumer confidence in purchasing fragrances online. Brands that invest in robust online marketing strategies and user-friendly e-commerce experiences may capture a larger share of the market, catering to the evolving preferences of tech-savvy consumers.

Cultural Significance of Fragrance

In Thailand, fragrance holds a deep cultural significance, which serves as a crucial driver for the fragrance market. Traditional practices often incorporate scents, such as jasmine and sandalwood, in religious and ceremonial contexts. This cultural affinity for fragrance is likely to sustain demand for both traditional and modern scent offerings. The fragrance market may see a rise in products that blend contemporary fragrances with traditional Thai elements, appealing to both local consumers and tourists. Additionally, the increasing interest in aromatherapy and natural scents could further enhance the market, as consumers seek holistic experiences that resonate with their cultural heritage. This unique cultural landscape presents opportunities for brands to innovate and cater to the specific preferences of Thai consumers.

Rising Demand for Natural Ingredients

The increasing consumer preference for natural and organic products is a notable driver for the fragrance market in Thailand. As awareness of health and environmental issues grows, consumers are gravitating towards fragrances made from natural ingredients. This trend is reflected in the fragrance market, where brands are reformulating products to eliminate synthetic components and emphasize eco-friendly practices. In 2025, it is anticipated that the market for natural fragrances will grow by approximately 15%, driven by consumers seeking safer and more sustainable options. This shift not only aligns with global trends but also resonates with the values of Thai consumers, who are increasingly concerned about the impact of their purchases on health and the environment. Brands that prioritize transparency and sustainability in their offerings may find themselves well-positioned in this evolving market.