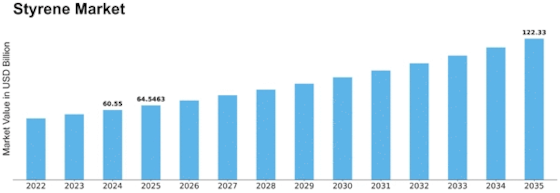

Styrene Size

Styrene Market Growth Projections and Opportunities

The styrene marketplace, a significant player in the global chemical business, is influenced by numerous market factors that shape its dynamics. One of the main drivers of the styrene industry is demand from varied end-use sectors including packaging, automobile, construction and electronics. That explains why as these fields continue growing there is always need for styrene which is a versatile compound used to make polystyrenes, ABS (Acrylonitrile Butadiene Styrene) among others essential materials.

Also, supply and demand forces play a vital role in defining market conditions for Styrene. Volatility in raw material prices particularly benzene which is a key feedstock for making styrene has far-reaching effects on overall cost structure. On top of that geopolitical events and trade wars can distort supply chains causing prices to go up and this affects stability.

Environmental legislation also plays an important role in controlling the behaviour of the Styrene market. The pressure to adopt greener production processes and mitigate environmental impacts mounts as global stakeholders increasingly insist on sustainability and eco-friendly practices. This shift has resulted in bio-based Styrene development plus recycling enhancement initiatives reflecting industries’ commitment to evolving environmental standards.

The global economy also influences the direction taken by the Styrene market. Economic growth or downturns have direct implications to major consumers of products made from Styrene. For instance during economic booms there tends to be higher consumer goods demand such as cars and building materials thereby increasing styrenic demand. Conversely, recessions lead to reduced consumption hence lower demand for styrenics.

Technological advancements are another significant factor that influences the stylus market place today. It is all about efficiency improvements in production processes for styrine globally while at the same time reducing any cost implications associated with such programs apart from improving product performance attributes through ongoing research and development activities within chemical sector . Innovations in catalyst technologies, process optimization, alternative raw materials are among the changes that contribute to the industry’s ability to adapt to market shifts and remain competitive.

Some of the global trends that influence Styrene include circular economy, light weight materials and electric vehicles. For instance, the focus on lightweight materials in automotive sector aimed at improving fuel efficiency and reducing emissions has increased the demand for ABS based materials such as styrene in car manufacturing.

The market landscape may be shaped by regulatory developments, especially in key consuming regions. Changes in safety regulations, labeling requirements or applications restrictions can determine whether there is adoption of styrenic products and their resultant demand. Market participants need to keep updated with emerging statutory frameworks so as not to fall foul of any regulations as well as any possible hurdles on their way.

Leave a Comment