Emerging Markets and Urbanization

The Global Structural Steel Market Industry is benefiting from rapid urbanization and economic development in emerging markets. Countries in Asia-Pacific, Africa, and Latin America are witnessing significant population growth, leading to increased demand for housing, infrastructure, and commercial spaces. This urban expansion necessitates the use of structural steel for its strength and adaptability. As these regions continue to develop, the market is expected to expand, driven by the need for modern construction solutions. The potential for growth in these emerging markets presents a lucrative opportunity for stakeholders in the structural steel industry.

Growth in Construction Activities

The Global Structural Steel Market Industry is significantly influenced by the expansion of construction activities across various sectors. Residential, commercial, and industrial construction projects are increasingly utilizing structural steel for its versatility and cost-effectiveness. As urban areas expand and new developments arise, the demand for structural steel is projected to rise. By 2035, the market is anticipated to grow to 224.4 USD Billion, indicating a robust growth trajectory. This growth is further supported by the adoption of advanced construction technologies that enhance the efficiency and sustainability of steel structures.

Rising Infrastructure Investments

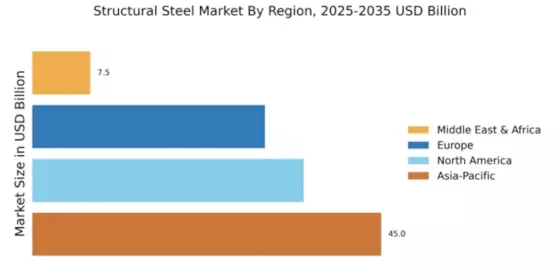

The Global Structural Steel Market Industry is experiencing a surge in demand driven by increasing investments in infrastructure projects worldwide. Governments are allocating substantial budgets for the construction of roads, bridges, and railways, which necessitate the use of structural steel due to its strength and durability. For instance, in 2024, the market is projected to reach 117.5 USD Billion, reflecting the critical role of structural steel in modern infrastructure. This trend is expected to continue, as urbanization and population growth drive the need for robust infrastructure solutions, thereby enhancing the market's growth prospects.

Sustainability and Environmental Regulations

The Global Structural Steel Market Industry is increasingly influenced by sustainability initiatives and stringent environmental regulations. Governments and organizations are prioritizing eco-friendly construction practices, leading to a heightened demand for sustainable materials, including structural steel. The recyclability of steel and its lower carbon footprint compared to other materials make it a preferred choice for environmentally conscious projects. As regulations become more stringent, the market is likely to see a shift towards greener steel production methods, further propelling growth. This trend aligns with global efforts to combat climate change and promote sustainable development.

Technological Advancements in Steel Production

Technological innovations in steel production processes are playing a pivotal role in shaping the Global Structural Steel Market Industry. The introduction of advanced manufacturing techniques, such as automation and digitalization, is enhancing production efficiency and reducing costs. These advancements not only improve the quality of structural steel but also contribute to sustainability by minimizing waste and energy consumption. As a result, manufacturers are better positioned to meet the increasing demand for high-performance steel products, thereby driving market growth. The ongoing evolution in production technologies suggests a promising future for the industry.