Rising Pet Ownership

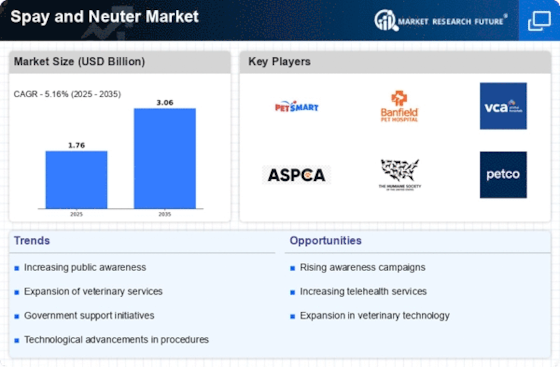

The Spay and Neuter Market is significantly influenced by the rising trend of pet ownership. As more households adopt pets, the necessity for spaying and neutering becomes increasingly apparent to prevent unwanted litters. Recent statistics indicate that pet ownership has surged by approximately 15% in the last five years, leading to a corresponding increase in demand for spay and neuter services. This trend is particularly pronounced among younger demographics, who are more likely to view spaying and neutering as a responsible practice. As a result, veterinary practices are expanding their offerings to cater to this growing clientele, thereby bolstering the market.

Public Health Concerns

The Spay and Neuter Market is increasingly influenced by public health concerns related to pet overpopulation and zoonotic diseases. As awareness grows regarding the potential health risks associated with uncontrolled pet populations, more individuals are recognizing the importance of spaying and neutering. Public health campaigns are emphasizing the role of these procedures in controlling disease transmission and reducing the burden on animal shelters. Consequently, veterinary clinics are witnessing a rise in demand for spay and neuter services, as pet owners seek to contribute to community health efforts. This trend is likely to continue shaping the market dynamics in the foreseeable future.

Increased Funding for Animal Welfare

The Spay and Neuter Market is also experiencing growth due to increased funding for animal welfare initiatives. Non-profit organizations and government agencies are allocating more resources towards spay and neuter programs, particularly in underserved communities. This funding is often directed towards subsidizing the costs of these procedures, making them more affordable for pet owners. Reports suggest that communities with active spay and neuter programs funded by grants have seen a reduction in stray animal populations by up to 30%. Such initiatives not only promote responsible pet ownership but also contribute to the overall health and well-being of animal populations, thereby enhancing the market.

Increased Legislation and Regulation

The Spay and Neuter Market is experiencing a notable increase in legislation aimed at promoting responsible pet ownership. Various jurisdictions are implementing laws that mandate spaying and neutering of pets, particularly in urban areas where overpopulation is a pressing concern. This regulatory environment is likely to drive demand for spay and neuter services, as pet owners seek compliance with these laws. For instance, some regions have reported a 20% increase in spay and neuter procedures following the introduction of such regulations. Consequently, veterinary clinics and animal welfare organizations are adapting their services to meet this growing need, thereby enhancing the overall market landscape.

Advancements in Veterinary Technology

The Spay and Neuter Market is benefiting from advancements in veterinary technology, which enhance the efficiency and safety of spay and neuter procedures. Innovations such as minimally invasive surgical techniques and improved anesthesia protocols are making these procedures more accessible and less stressful for pets. This technological evolution is likely to attract more pet owners to consider spaying and neutering, as the perceived risks diminish. Furthermore, veterinary clinics that adopt these advanced technologies may experience a competitive advantage, potentially increasing their market share. As a result, the overall growth of the Spay and Neuter Market is expected to be positively impacted.