Expansion of Cloud-Based Services

The shift towards cloud-based services is significantly impacting the wholesale telecom-carrier market in Spain. As businesses increasingly migrate to cloud solutions, the demand for reliable and high-speed connectivity is surging. This trend is prompting telecom carriers to enhance their infrastructure and service offerings to support cloud applications effectively. By 2025, it is projected that over 50% of enterprises in Spain will rely on cloud services, creating a substantial opportunity for wholesale carriers to provide tailored connectivity solutions. Additionally, partnerships with cloud service providers are likely to become more prevalent, enabling carriers to offer integrated solutions that meet the evolving needs of businesses. Therefore, the expansion of cloud-based services is a key driver shaping the future of the wholesale telecom-carrier market.

Growing Demand for IoT Connectivity

The proliferation of Internet of Things (IoT) devices is significantly influencing the wholesale telecom-carrier market in Spain. With an estimated 30 million IoT devices expected to be operational by 2025, the need for robust connectivity solutions is paramount. This surge in IoT adoption is driving carriers to enhance their service offerings, particularly in sectors such as smart cities, healthcare, and agriculture. The wholesale telecom-carrier market is likely to benefit from this trend as businesses increasingly rely on telecom providers for seamless connectivity. Moreover, the demand for low-power wide-area networks (LPWAN) is rising, which could lead to new partnerships and service models within the wholesale sector. Thus, the growing IoT ecosystem presents a substantial opportunity for carriers to expand their market presence.

Increased Focus on Cybersecurity Solutions

As the wholesale telecom-carrier market in Spain evolves, the emphasis on cybersecurity solutions is becoming increasingly critical. With the rise in cyber threats, telecom carriers are compelled to invest in advanced security measures to protect their networks and customers. The market is witnessing a shift towards offering integrated cybersecurity services alongside traditional connectivity solutions. This trend is likely to enhance customer trust and loyalty, as businesses prioritize secure communication channels. In 2025, it is anticipated that around 40% of telecom carriers will provide dedicated cybersecurity services, reflecting a strategic move to differentiate themselves in a competitive landscape. Consequently, the focus on cybersecurity is poised to reshape service offerings within the wholesale telecom-carrier market.

Regulatory Changes and Compliance Requirements

The regulatory environment in Spain is undergoing significant changes, impacting the wholesale telecom-carrier market. New compliance requirements aimed at enhancing consumer protection and promoting fair competition are being introduced. These regulations may compel carriers to adapt their business models and service offerings to align with legal standards. For instance, the implementation of data protection laws is likely to necessitate increased transparency in data handling practices. As a result, carriers may need to invest in compliance technologies and training, which could influence operational costs. However, these regulatory changes also present opportunities for carriers to build trust with consumers, potentially leading to increased market share. Thus, navigating the evolving regulatory landscape is crucial for success in the wholesale telecom-carrier market.

Technological Advancements in Network Infrastructure

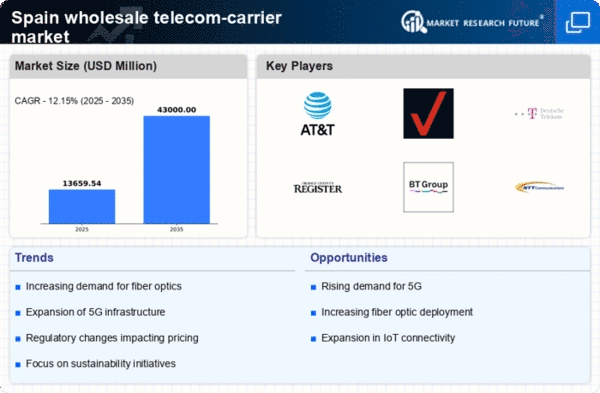

the wholesale telecom-carrier market in Spain is transforming due to rapid technological advancements in network infrastructure.. Innovations such as 5G technology and software-defined networking (SDN) are enhancing the capacity and efficiency of telecom networks. As of 2025, the deployment of 5G is projected to cover approximately 80% of the population, facilitating higher data speeds and lower latency. This shift is likely to attract more businesses seeking reliable connectivity solutions, thereby increasing demand for wholesale services. Furthermore, the integration of artificial intelligence in network management is optimizing operational efficiency, which could lead to cost reductions for carriers. Consequently, these technological developments are pivotal in shaping the competitive landscape of the wholesale telecom-carrier market in Spain.