Expansion of Veterinary Practices

The expansion of veterinary practices across Spain plays a crucial role in the growth of the veterinary laboratory-testing market. As more veterinary clinics open, the demand for laboratory testing services increases correspondingly. This expansion is often accompanied by the establishment of specialized veterinary hospitals that offer advanced diagnostic capabilities. In 2025, the number of veterinary practices is expected to rise by approximately 5%, further driving the need for laboratory testing. This trend indicates a robust market environment where veterinary professionals are increasingly equipped to provide comprehensive care, including laboratory diagnostics.

Increased Focus on Animal Welfare

There is a growing emphasis on animal welfare within Spain, which positively impacts the veterinary laboratory-testing market. Pet owners and animal advocates are increasingly prioritizing the health and well-being of animals, leading to a higher demand for comprehensive testing services. This focus on welfare is reflected in the rising number of veterinary clinics that offer specialized laboratory testing to monitor and maintain animal health. In 2025, it is estimated that the market will see a 7% increase in demand for services related to preventive care and health monitoring, driven by this heightened awareness of animal welfare.

Integration of Advanced Technologies

The veterinary laboratory-testing market is significantly influenced by the integration of advanced technologies. Innovations such as artificial intelligence and machine learning are being utilized to improve diagnostic accuracy and efficiency. In Spain, veterinary laboratories are increasingly adopting automated systems that streamline testing processes, reduce human error, and enhance turnaround times. This technological evolution not only improves the quality of testing but also increases the capacity of laboratories to handle a higher volume of samples. As a result, veterinary practices are more inclined to utilize laboratory testing services, contributing to the overall growth of the market.

Rising Demand for Diagnostic Services

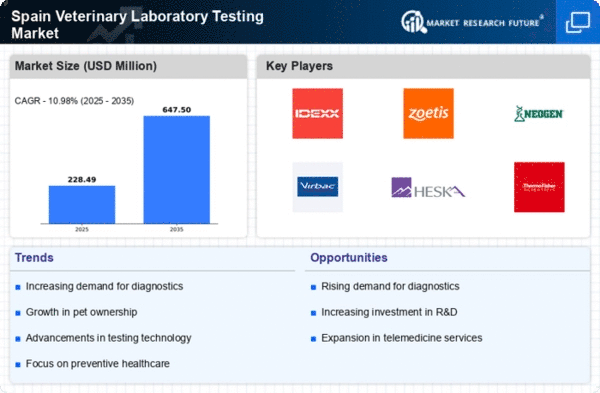

The veterinary laboratory-testing market in Spain experiences a notable increase in demand for diagnostic services. This trend is driven by a growing awareness among pet owners regarding the importance of preventive healthcare for their animals. As pet owners become more informed, they are more likely to seek out laboratory testing to ensure their pets' health. In 2025, the market is projected to grow at a CAGR of approximately 6.5%, reflecting the increasing reliance on diagnostic services. This growth is further supported by advancements in testing technologies, which enhance the accuracy and speed of results, thereby encouraging more veterinary practices to adopt laboratory testing services.

Regulatory Support for Veterinary Testing

Regulatory support for veterinary testing in Spain is a significant driver of the veterinary laboratory-testing market. The government has implemented various policies aimed at enhancing animal health standards, which include promoting laboratory testing as a critical component of veterinary care. These regulations encourage veterinary practices to adopt testing protocols that align with national health objectives. As a result, the market is likely to see a steady increase in laboratory testing services, with an anticipated growth rate of 4% in 2025. This regulatory framework not only supports the market but also ensures that animal health is prioritized across the veterinary sector.