Rising Healthcare Expenditure

The increase in healthcare spending in Spain is positively impacting the ventricular assist-devices market. With the government and private sectors investing more in healthcare, there is a greater focus on advanced medical technologies. In recent years, healthcare expenditure has risen by approximately 5% annually, reflecting a commitment to improving patient care. This trend is likely to enhance the availability and affordability of ventricular assist devices, making them more accessible to patients in need. The ventricular assist-devices market is poised for growth as healthcare providers expand their offerings to include these life-saving technologies, driven by increased funding and investment in cardiovascular health.

Increasing Geriatric Population

The demographic shift towards an aging population in Spain is a significant driver for the ventricular assist-devices market. As individuals age, the risk of developing heart-related diseases escalates, necessitating advanced medical interventions. Current projections indicate that by 2030, nearly 25% of the Spanish population will be over 65 years old. This demographic trend suggests a growing market for ventricular assist devices, as older adults are more likely to require such interventions. The ventricular assist-devices market is expected to expand in response to this demographic change, with an anticipated annual growth rate of around 9% as healthcare systems adapt to the needs of an aging society.

Rising Incidence of Heart Failure

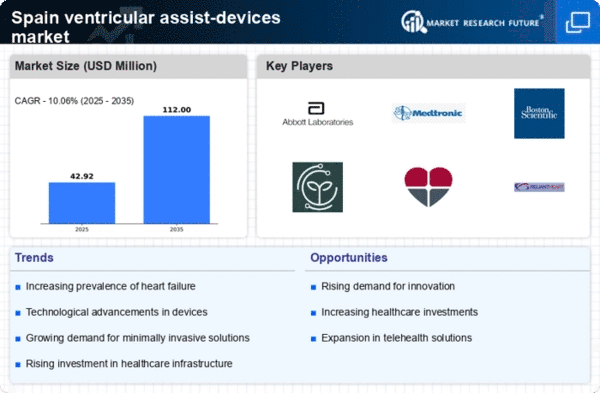

The increasing prevalence of heart failure in Spain is a primary driver for the ventricular assist-devices market. According to recent health statistics, heart failure affects approximately 1.5 million individuals in the country, leading to a growing demand for advanced treatment options. As the population ages, the incidence of heart-related conditions is expected to rise, further propelling the need for ventricular assist devices. This trend indicates a potential market growth of around 8% annually, as healthcare providers seek effective solutions to manage severe heart failure cases. The ventricular assist-devices market is thus positioned to expand significantly, driven by the urgent need for innovative therapies that can improve patient outcomes and quality of life.

Advancements in Medical Technology

Technological innovations in the field of cardiac devices are significantly influencing the ventricular assist-devices market. Recent developments in miniaturization and biocompatible materials have led to the creation of more efficient and durable devices. For instance, the introduction of wireless monitoring systems allows for real-time tracking of patient health, enhancing the management of heart failure. The market is projected to grow by approximately 10% over the next five years, as these advancements make devices more accessible and effective. The ventricular assist-devices market is likely to benefit from ongoing research and development efforts, which aim to improve device performance and patient safety.

Government Initiatives and Funding

Government support plays a crucial role in the growth of the ventricular assist-devices market. In Spain, various initiatives aimed at improving cardiovascular health have been launched, including funding for research and development of innovative medical devices. The Spanish government has allocated substantial resources to enhance healthcare infrastructure, which includes the integration of advanced technologies in hospitals. This financial backing is expected to increase the adoption of ventricular assist devices, potentially leading to a market growth rate of 7% over the next few years. The ventricular assist-devices market stands to gain from these initiatives, as they facilitate access to cutting-edge treatments for patients with severe heart conditions.