Supportive Healthcare Policies and Funding

Supportive healthcare policies and funding initiatives in Spain are fostering growth in the transradial access-devices market. The Spanish government has been actively promoting the adoption of advanced medical technologies through various funding programs and incentives aimed at improving healthcare delivery. This includes financial support for hospitals to upgrade their facilities and acquire new technologies, including transradial access devices. Additionally, the emphasis on enhancing patient care and outcomes aligns with the objectives of the transradial access-devices market. As healthcare providers receive more resources to implement these technologies, the market is expected to benefit from increased adoption rates and improved access to innovative treatment options.

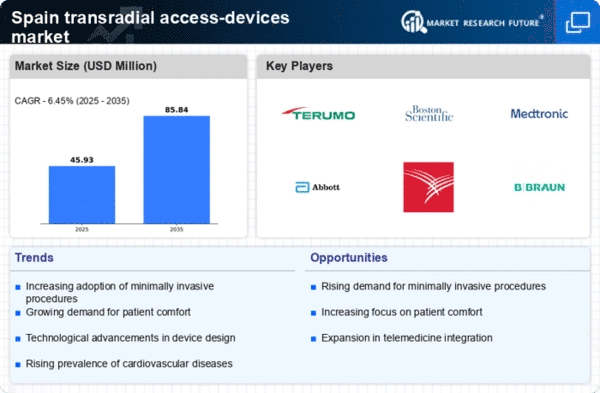

Increasing Cardiovascular Disease Prevalence

The rising incidence of cardiovascular diseases in Spain is a primary driver for the transradial access-devices market. As the population ages, the demand for minimally invasive procedures increases, leading to a greater need for transradial access devices. Reports indicate that cardiovascular diseases account for approximately 30% of all deaths in Spain, highlighting the urgency for effective treatment options. This trend suggests that healthcare providers are likely to adopt transradial access techniques more frequently, as they offer reduced complications and shorter recovery times compared to traditional methods. Consequently, the transradial access-devices market is expected to experience substantial growth, as hospitals and clinics invest in advanced technologies to meet the rising demand for cardiovascular interventions.

Technological Innovations in Medical Devices

Technological advancements in medical devices are significantly influencing the transradial access-devices market. Innovations such as improved catheter designs, enhanced imaging techniques, and the integration of digital technologies are making transradial procedures safer and more efficient. For instance, the introduction of ultra-thin catheters has reduced the risk of complications, thereby increasing the adoption rate among healthcare professionals. Furthermore, the Spanish medical device market is projected to grow at a CAGR of around 5% over the next few years, indicating a favorable environment for the development and commercialization of new transradial access devices. This technological evolution not only enhances patient outcomes but also drives competition among manufacturers, further propelling market growth.

Growing Investment in Healthcare Infrastructure

The increasing investment in healthcare infrastructure in Spain is a crucial driver for the transradial access-devices market. As the government and private sector allocate more funds towards modernizing healthcare facilities, there is a corresponding rise in the demand for advanced medical devices. This investment is particularly evident in urban areas, where hospitals are expanding their capabilities to offer a wider range of services, including transradial access procedures. Reports suggest that healthcare expenditure in Spain is projected to reach approximately €200 billion by 2026, indicating a robust environment for the growth of the transradial access-devices market. Enhanced infrastructure not only facilitates the adoption of new technologies but also improves patient access to essential healthcare services.

Rising Demand for Minimally Invasive Procedures

The growing preference for minimally invasive procedures among patients and healthcare providers is a significant driver for the transradial access-devices market. Patients are increasingly seeking options that offer reduced pain, shorter hospital stays, and quicker recovery times. In Spain, the trend towards outpatient procedures is gaining momentum, with many hospitals adopting transradial access techniques for interventions such as angioplasty. This shift is supported by studies indicating that transradial access can lead to lower complication rates and improved patient satisfaction. As a result, the transradial access-devices market is likely to expand, as healthcare facilities invest in training and equipment to accommodate this demand for less invasive treatment options.