Advancements in Medical Research

Ongoing advancements in medical research are significantly impacting the stem cell-banking market. Innovations in stem cell therapies and regenerative medicine are leading to new treatment options for conditions such as diabetes, heart disease, and neurological disorders. Research institutions in Spain are increasingly focusing on stem cell applications, which is likely to enhance the credibility and appeal of stem cell banking. The investment in research and development is expected to reach €200 million by 2026, indicating a robust commitment to exploring the therapeutic potential of stem cells. This influx of research funding may stimulate growth in the stem cell-banking market as new therapies emerge, encouraging families to bank their stem cells for future use.

Rising Incidence of Chronic Diseases

The rising incidence of chronic diseases in Spain is a significant driver for the stem cell-banking market. Conditions such as cancer, diabetes, and cardiovascular diseases are becoming increasingly prevalent, leading to a heightened demand for innovative treatment options. Stem cells have shown promise in regenerative therapies, which may offer new hope for patients suffering from these ailments. As healthcare providers and patients seek advanced solutions, the market is expected to expand, with estimates suggesting a growth rate of around 12% annually. This trend underscores the importance of stem cell banking as a proactive measure for families looking to secure potential treatments for chronic conditions, thereby reinforcing the relevance of the stem cell-banking market.

Regulatory Support for Stem Cell Banking

Regulatory support plays a crucial role in shaping the stem cell-banking market. In Spain, the government has established guidelines that facilitate the ethical collection and storage of stem cells. These regulations are designed to ensure safety and efficacy, thereby increasing public trust in stem cell banking services. The presence of a clear regulatory framework is likely to encourage more families to consider stem cell banking as a viable option. As the regulatory landscape continues to evolve, it is anticipated that the market will experience steady growth, with an expected increase in participation rates by approximately 20% over the next few years. This supportive environment is essential for the long-term sustainability of the stem cell-banking market.

Increasing Awareness of Stem Cell Benefits

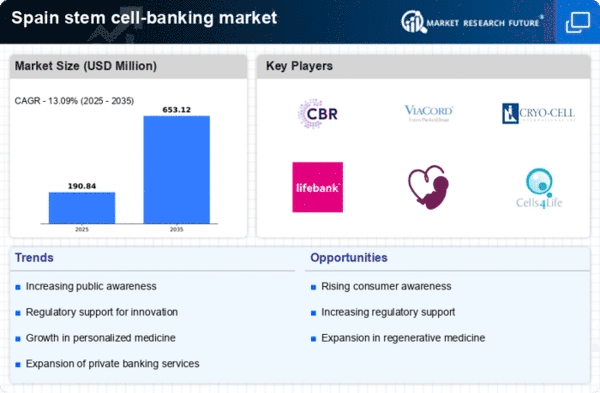

The growing awareness regarding the potential benefits of stem cells is driving the stem cell-banking market in Spain. Educational campaigns and outreach programs have been instrumental in informing the public about the therapeutic applications of stem cells in treating various diseases. As a result, more families are considering stem cell banking for future medical needs. Reports indicate that the market is projected to grow at a CAGR of approximately 15% over the next five years, reflecting a rising interest in preserving stem cells for personal use. This trend is likely to continue as more individuals recognize the importance of having access to their own stem cells for regenerative medicine, thereby enhancing the overall demand within the stem cell-banking market.

Technological Innovations in Storage Solutions

Technological innovations in storage solutions are transforming the stem cell-banking market. Advances in cryopreservation techniques and biobanking technologies are enhancing the efficiency and safety of stem cell storage. In Spain, companies are investing in state-of-the-art facilities that utilize cutting-edge technology to ensure the viability of stem cells over extended periods. This focus on technological advancement is likely to attract more customers, as families seek reliable and secure options for stem cell banking. The market is projected to see an increase in service offerings, with a potential growth of 18% in the next few years. Such innovations not only improve the quality of services but also contribute to the overall growth of the stem cell-banking market.