Spain Smokeless Tobacco Treatment Market Overview

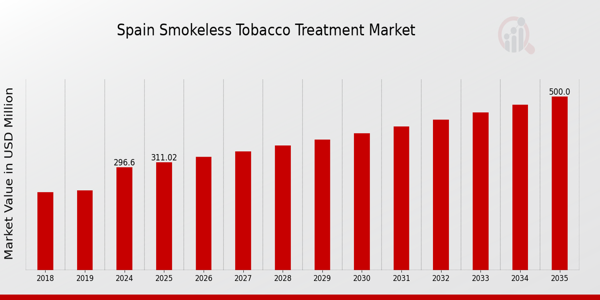

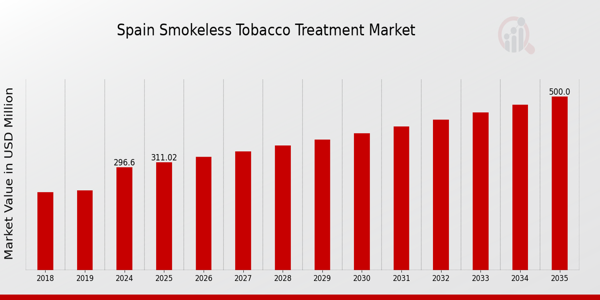

As per MRFR analysis, the Spain Smokeless Tobacco Treatment Market Size was estimated at 282.6 (USD Million) in 2023.The Spain Smokeless Tobacco Treatment Market is expected to grow from 296.6(USD Million) in 2024 to 500 (USD Million) by 2035. The Spain Smokeless Tobacco Treatment Market CAGR (growth rate) is expected to be around 4.862% during the forecast period (2025 - 2035)

Key Spain Smokeless Tobacco Treatment Market Trends Highlighted

People in Spain are becoming more conscious of the dangers smokeless tobacco products pose to their health. The government has taken the initiative to support public health programs, such as smokeless alternatives, that try to lower tobacco consumption. As more people look for help quitting, the demand for smokeless tobacco treatment options has surged due to this emphasis on health.

Additionally, users now have easier access to tools and support specifically designed to help them quit smokeless tobacco thanks to the growth of digital health platforms and mobile applications. These technical developments are a major factor in the market since they enable individualized treatment programs and encourage community support for those who want to quit using smokeless tobacco.

Furthermore, as more people realize that gradual cessation is necessary, there has been a significant increase in the acceptability of alternative nicotine products, such as nicotine replacement therapy.

A growing number of tobacco users are searching for effective cessation techniques, and Spain's health rules, which include prohibitions on tobacco product promotion and advertising, are opening up prospects for novel treatments.

Additionally, the market for smokeless tobacco therapy is expected to benefit from the continuous transition to a holistic approach to tobacco management. The environment for those trying to quit is improving with the addition of educational initiatives to educate users about the advantages of quitting and the availability of specialist support services.

This reflects a larger cultural shift towards healthier lifestyles and is consistent with Spain's aim to minimizing tobacco-related harm. All things considered, the patterns show a growing need for efficient treatment options, bolstered by legislative modifications and technological breakthroughs that collectively are transforming Spain's market for smokeless tobacco treatment.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Spain Smokeless Tobacco Treatment Market Drivers

Increasing Awareness of Health Risks Associated with Smokeless Tobacco

In Spain, the growing awareness of the health risks associated with smokeless tobacco usage is a significant driver of the Spain Smokeless Tobacco Treatment Market. The Spanish Ministry of Health has reported a rising incidence of oral cancers, with statistics showing that from 2010 to 2020, cases have increased by approximately 20%.

This spike in awareness has created higher demand for smokeless tobacco treatment options among the Spanish population. Public health campaigns initiated by agencies such as the Spanish Association Against Cancer are instrumental in educating consumers about the dangers of smokeless tobacco, urging them to seek help for cessation.

The involvement of these organizations is pivotal in shaping public perception and behavior regarding smokeless tobacco.

Government Regulations and Policies

The governmental policies in Spain aimed at reducing tobacco consumption are driving the growth of the Spain Smokeless Tobacco Treatment Market. Recent reforms implemented under the Spanish health law have increased restrictions on the sale and advertising of tobacco products, leading to a shift in consumer preferences towards cessation programs.

A report from the Spanish Ministry of Health highlighted that since the enforcement of stricter tobacco laws in 2016, there has been a 15% increase in individuals availing themselves of cessation services. This legal framework encourages the use of tobacco treatment options, bolstering market growth.

Rise in Alternative Tobacco Products and Cessation Solutions

The emergence of alternative tobacco products such as nicotine pouches and other smokeless tobacco substitutes has augmented the demand for treatments in the Spain Smokeless Tobacco Treatment Market. The Spanish market has observed a 25% growth in consumer interest in these alternatives from 2019 to 2022, as reported by local health organizations.

This trend reflects a behavioral shift among users seeking less harmful options, thereby prompting an increased interest in cessation tools and treatments. Entities like the Spanish Society of Pneumology and Thoracic Surgery are facilitating smoking cessation strategies that incorporate these new products, creating comprehensive support for individuals looking to quit.

Spain Smokeless Tobacco Treatment Market Segment Insights

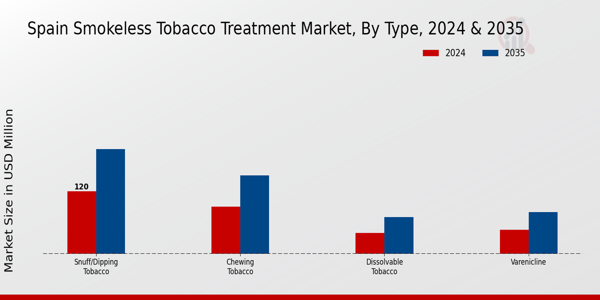

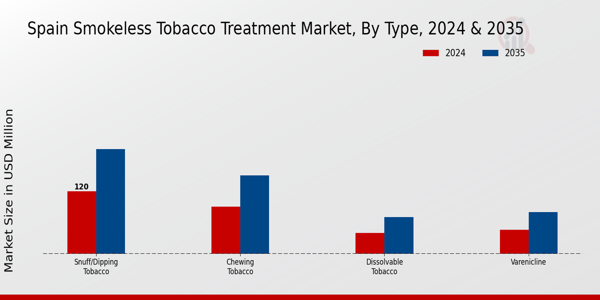

Smokeless Tobacco Treatment Market Type Insights

The Spain Smokeless Tobacco Treatment Market is characterized by a diverse classification within its Type segment, encompassing various forms of smokeless tobacco products such as chewing tobacco, snuff/dipping tobacco, dissolvable tobacco, and Varenicline.

In Spain, chewing tobacco remains a traditional form of smokeless tobacco, attracting users with its unique oral experience and strong flavor profiles, maintaining a significant presence in the market.

Snuff or dipping tobacco is also notable, especially among specific demographics and regions where its usage is culturally ingrained; this segment often generates considerable interest due to social and recreational factors.

Dissolvable tobacco, while gaining traction, is becoming increasingly popular due to its convenience and discreet usage, appealing particularly to younger consumers and those seeking alternatives to more traditional forms of tobacco.

Furthermore, Varenicline, a prescription medication aimed at aiding individuals in quitting smoking, is vital within the smokeless tobacco treatment landscape, as it plays a crucial role in addressing addiction and promoting cessation strategies.

The interplay among these types shapes the market's dynamics, influenced by consumer preferences, regulatory considerations, and shifting attitudes towards tobacco use in Spain.

Market trends indicate a growing awareness of health risks associated with smokeless tobacco, leading to heightened focus on cessation aids and treatment options, thus influencing how each product type is perceived and utilized within the country.

Given Spain's proactive public health campaigns and commitment to reducing tobacco consumption, the Spain Smokeless Tobacco Treatment Market continues to evolve, bringing both challenges and opportunities for stakeholders involved in the production and treatment of smokeless tobacco products.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Smokeless Tobacco Treatment Market Treatment Insights

The Spain Smokeless Tobacco Treatment Market, specifically focusing on the Treatment segment, has shown significant relevance in addressing the rising incidence of smokeless tobacco usage across the region. With Spain's ongoing battle against tobacco-related health issues, the demand for effective treatment options is crucial.

Treatment modalities such as nicotine replacement therapy and medication are gaining ground, contributing significantly to the overall efforts in tobacco cessation. Nicotine replacement therapy, which encompasses products like patches, gums, and lozenges, plays a vital role in easing withdrawal symptoms, thereby supporting users in their quitting journey.

Additionally, various medications prescribed to aid in smoking cessation are also critical, as they address both the physical dependencies and psychological triggers associated with tobacco use. The emphasis of the Spanish healthcare system on reducing smoking prevalence aligns with the increased adoption of these treatment methods.

Furthermore, initiatives by health organizations to promote awareness and provide support for tobacco cessation underscore the importance of these treatment strategies in improving public health outcomes in Spain, ultimately contributing to a reduction in tobacco-related morbidity and mortality.

Smokeless Tobacco Treatment Market End-user Insights

In the Spain Smokeless Tobacco Treatment Market, the End-user segment is crucial, particularly focusing on hospitals and clinics. These healthcare facilities play a significant role in the management and treatment of smokeless tobacco use, providing essential services such as counseling and medical support to individuals seeking cessation.

This segment is vital due to the increasing health awareness among the population and the rising incidence of tobacco-related health issues, which has led to a growing demand for effective treatment programs.

Hospitals and clinics offer a structured environment for intervention, often featuring comprehensive treatment plans inclusive of therapies and medication, thus facilitating higher success rates in tobacco cessation. Additionally, Spain has implemented strict regulations against tobacco use, further reinforcing the need for robust treatment solutions in healthcare establishments.

With ongoing public health campaigns and a focus on reducing nicotine addiction, hospitals and clinics are positioned as essential players in the health industry, contributing significantly to the overall growth and effectiveness of the Spain Smokeless Tobacco Treatment Market.

The emphasis on collaboration between health professionals and patients is crucial in advancing treatment methodologies, thereby enhancing recovery rates and promoting healthier lifestyles across the nation.

Spain Smokeless Tobacco Treatment Market Key Players and Competitive Insights

The competitive landscape of the Spain Smokeless Tobacco Treatment Market is characterized by a growing emphasis on innovative approaches to curbing tobacco use, along with increasing awareness regarding health risks associated with smokeless tobacco products.

Companies operating in this market are leveraging advanced technologies to develop effective treatment solutions, focusing on both pharmacological and behavioral therapies. The market dynamics are influenced by regulatory changes, shifting consumer preferences towards cessation aids, and the rising prevalence of smokeless tobacco use among various segments of the population.

As public health campaigns gain momentum, competition intensifies, pushing companies to focus on research and development initiatives to meet the evolving needs of consumers seeking effective cessation strategies.

Doppleganger has carved a niche within the Spain Smokeless Tobacco Treatment Market, focusing on innovative solutions and tailored treatment programs designed specifically for the Spanish population. The company’s strengths lie in its strong research capability and a dedicated approach to understanding local consumer behavior related to smokeless tobacco use.

By combining behavioral counseling with pharmacological options, Doppleganger has successfully positioned itself as a trusted name for those seeking to quit smokeless tobacco.

Its commitment to public health has led to collaborative efforts with local health authorities to raise awareness and enhance access to smokeless tobacco treatment resources throughout Spain. Such proactive initiatives have further solidified its reputation in the market, despite the competitive pressures existing in the sector.

Reynolds American operates within the Spain Smokeless Tobacco Treatment Market with a comprehensive strategy that focuses on the development of effective smoking cessation products and services.

The company is known for its diverse product line, which includes nicotine replacement therapies and prescription medications aimed at aiding individuals in their journey to quit smokeless tobacco. Reynolds American’s market presence is bolstered by strategic partnerships and collaborations, which enhance its distribution capabilities across Spain and provide access to a broader consumer base.

Strengths of the company include a well-established brand reputation and significant investments in research and development, which have resulted in innovative products tailored to meet the unique preferences of Spanish consumers.

Although the company has faced regulatory challenges, its proactive approach to compliance and market adaptation has helped maintain its competitiveness, with an eye toward potential future mergers and acquisitions that could further expand its influence within the market.

Key Companies in the Spain Smokeless Tobacco Treatment Market Include

- Doppleganger

- Reynolds American

- Mighty Vapors

- Liquid State

- British American Tobacco

- Cloud Nurdz

- Puff Bar

- Japan Tobacco International

- Altria Group

- Charlie's Chalk Dust

- Imperial Brands

- Philip Morris International

- Nude Nicotine

- VaporFi

- Nasty Juice

Spain Smokeless Tobacco Treatment Market Developments

Recent developments in the Spain Smokeless Tobacco Treatment Market have been notable, particularly as public health campaigns continue to emphasize the risks associated with smokeless tobacco usage. In September 2023, Philip Morris International announced a significant investment strategy focused on expanding its smokeless tobacco product lines, showcasing their commitment to a smoke-free future.

Additionally, British American Tobacco has been gaining traction with their innovative oral nicotine delivery methods, resonating with changing consumer preferences. In terms of mergers and acquisitions, Reynolds American has been reported to be in discussions regarding potential collaborations to enhance their smokeless product offerings, reflecting an ongoing trend towards consolidation in the industry.

Growth in market valuation for companies like Altria Group and Imperial Brands has been observed, tied to increasing consumer demand for alternatives to traditional tobacco products. Over the past couple of years, regulation in Spain has tightened, with the government implementing stringent controls on marketing and sales of smokeless products, ultimately aiming to mitigate health risks.

The combination of regulatory changes and shifts in consumer behavior is profoundly impacting the landscape of the smokeless tobacco treatment market in Spain.

Spain Smokeless Tobacco Treatment Market Segmentation Insights

Smokeless Tobacco Treatment Market Type Outlook

- chewing tobacco

- snuff/dipping tobacco

- dissolvable tobacco

- Varenicline

Smokeless Tobacco Treatment Market Treatment Outlook

- nicotine replacement therapy

- medication

Smokeless Tobacco Treatment Market End-user Outlook

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

282.6(USD Million) |

| MARKET SIZE 2024 |

296.6(USD Million) |

| MARKET SIZE 2035 |

500.0(USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

4.862% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Million |

| KEY COMPANIES PROFILED |

Doppleganger, Reynolds American, Mighty Vapors, Liquid State, British American Tobacco, Cloud Nurdz, Puff Bar, Japan Tobacco International, Altria Group, Charlie's Chalk Dust, Imperial Brands, Philip Morris International, Nude Nicotine, VaporFi, Nasty Juice |

| SEGMENTS COVERED |

Type, Treatment, End User |

| KEY MARKET OPPORTUNITIES |

Growing health awareness initiatives, Increased government regulations, Digital health support platforms, Availability of personalized treatment plans, Rising demand for alternative therapies |

| KEY MARKET DYNAMICS |

rising health awareness, regulatory restrictions, increasing quit initiatives, availability of treatment options, technological advancements in therapies |

| COUNTRIES COVERED |

Spain |

Frequently Asked Questions (FAQ):

The expected market size of the Spain Smokeless Tobacco Treatment Market in 2024 is valued at 296.6 million USD.

By 2035, the market size of the Spain Smokeless Tobacco Treatment Market is expected to reach 500.0 million USD.

The expected CAGR for the Spain Smokeless Tobacco Treatment Market from 2025 to 2035 is 4.862 percent.

In 2024, the chewing tobacco sub-segment is valued at 90.0 million USD.

The snuff/dipping tobacco sub-segment is projected to be valued at 200.0 million USD in 2035.

The dissolvable tobacco sub-segment is expected to be worth 40.0 million USD in 2024.

The estimated market value for Varenicline in 2035 is expected to be 80.0 million USD.

Key players include British American Tobacco, Altria Group, and Philip Morris International among others.

Emerging trends include the growing adoption of alternatives to tobacco and increasing awareness of health impacts.

Different segments display varying growth rates, with snuff/dipping tobacco projected to show significant growth in the forecast period.