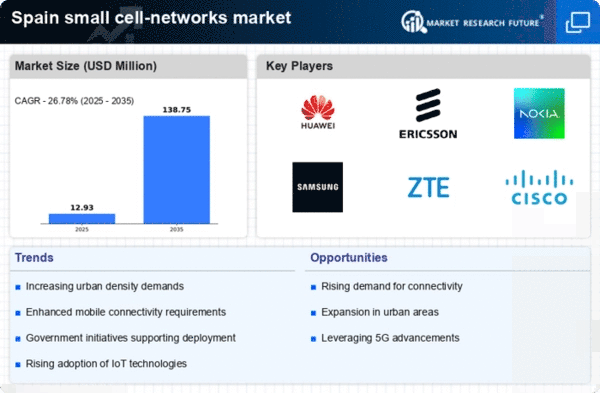

Support for 5G Rollout

The ongoing rollout of 5G technology in Spain is a significant catalyst for the small cell-networks market. As 5G networks require a denser infrastructure to deliver high-speed connectivity, small cells are essential for achieving the desired coverage and capacity. The Spanish government has set ambitious targets for 5G deployment, aiming for nationwide coverage by 2025. This initiative is expected to drive investments in small cell technology, as operators seek to enhance their networks to support advanced applications such as smart cities and autonomous vehicles. The integration of small cells into the 5G ecosystem is anticipated to create new revenue streams for telecom providers, thereby stimulating growth in the small cell-networks market.

Cost-Effective Network Expansion

The need for cost-effective network expansion strategies is driving the small cell-networks market in Spain. As telecom operators face pressure to enhance their networks without incurring substantial capital expenditures, small cells present an attractive solution. These systems are generally less expensive to deploy compared to traditional macro cell towers, allowing operators to expand coverage efficiently. Furthermore, small cells can be installed in a variety of locations, including street furniture and buildings, minimizing the need for extensive site acquisition. This flexibility is particularly beneficial in urban areas where space is limited. As operators seek to optimize their network investments, the adoption of small cell technology is likely to increase, thereby fostering growth in the small cell-networks market.

Increased Mobile Data Consumption

The surge in mobile data consumption in Spain is a primary driver for the small cell-networks market. With the proliferation of smartphones and IoT devices, data traffic is expected to increase significantly. Reports indicate that mobile data traffic in Spain could reach 10 exabytes per month by 2025, necessitating enhanced network capacity. Small cell networks provide a solution by enabling operators to offload traffic from macro cells, thereby improving user experience and network efficiency. This trend is particularly evident in urban areas where high-density populations demand robust connectivity. As a result, telecom operators are investing heavily in small cell infrastructure to meet the growing demand for mobile data services, which is likely to propel the small cell-networks market forward.

Urbanization and Smart City Initiatives

The rapid urbanization in Spain is influencing the small cell-networks market significantly. As cities expand, the demand for reliable and high-speed connectivity increases, particularly in densely populated areas. Smart city initiatives, which aim to improve urban living through technology, are further driving the need for small cell networks. These networks facilitate the deployment of various smart applications, including traffic management and public safety systems. According to estimates, urban areas in Spain could see a population increase of 15% by 2030, intensifying the need for enhanced network infrastructure. Consequently, investments in small cell technology are likely to rise, as municipalities and telecom operators collaborate to create smarter, more connected urban environments.

Enhanced Network Reliability and Coverage

The quest for improved network reliability and coverage is a crucial driver for the small cell-networks market in Spain. As users increasingly rely on mobile connectivity for both personal and professional purposes, the demand for uninterrupted service has grown. Small cells offer a solution by filling coverage gaps and enhancing signal strength in challenging environments, such as urban canyons and indoor spaces. This is particularly relevant in Spain, where diverse geographical features can hinder network performance. By deploying small cells, operators can ensure a more consistent user experience, which is essential for customer retention. The focus on network reliability is expected to lead to increased investments in small cell infrastructure, thereby propelling the small cell-networks market.