Enhanced Diagnostic Capabilities

Enhanced diagnostic capabilities are transforming the landscape of the pompe disease-treatment market. In Spain, advancements in genetic testing and biomarker identification have led to earlier and more accurate diagnoses of Pompe disease. This improvement is crucial, as timely diagnosis can significantly impact treatment outcomes and patient quality of life. The availability of advanced diagnostic tools is likely to increase the number of patients identified, thereby expanding the treatment market. As healthcare providers become more adept at recognizing the symptoms and genetic markers of Pompe disease, the demand for effective therapies is expected to rise. This trend may lead to a market growth rate of approximately 10% annually, reflecting the increasing need for targeted treatments in the pompe disease-treatment market.

Rising Incidence of Pompe Disease

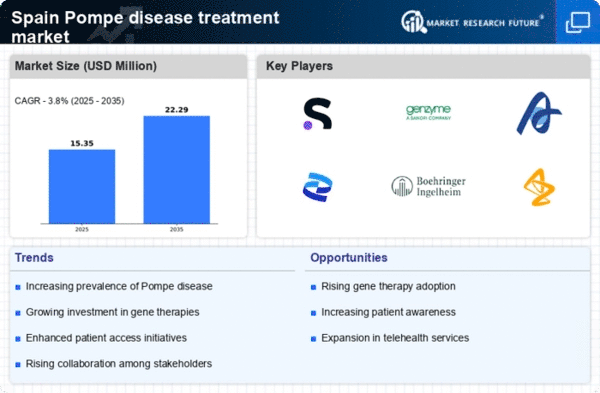

The increasing incidence of Pompe disease in Spain is a critical driver for the pompe disease-treatment market. Recent estimates suggest that the prevalence of this rare genetic disorder is approximately 1 in 40,000 live births. This rising incidence necessitates the development and availability of effective treatment options, thereby expanding the market. As more patients are diagnosed, the demand for therapies, particularly enzyme replacement therapies, is likely to grow. This trend indicates a potential increase in healthcare expenditure related to Pompe disease management, which could reach millions of euros annually. Consequently, pharmaceutical companies are motivated to invest in research and development to address this unmet medical need, further propelling the pompe disease-treatment market in Spain.

Investment in Research and Development

Investment in research and development (R&D) is a significant driver for the pompe disease-treatment market. In Spain, pharmaceutical companies and research institutions are increasingly focusing on innovative therapies, including gene therapy and novel enzyme replacement therapies. The Spanish government has been supportive of R&D initiatives, providing funding and incentives to encourage innovation in rare diseases. This investment is crucial, as it not only enhances the understanding of Pompe disease but also accelerates the development of effective treatments. The market could witness a surge in new therapies, potentially valued at over €500 million by 2030, as a result of these R&D efforts. This dynamic environment fosters collaboration between academia and industry, further strengthening the pompe disease-treatment market.

Growing Patient Advocacy and Support Groups

The emergence of patient advocacy and support groups in Spain is playing a pivotal role in the pompe disease-treatment market. These organizations are instrumental in raising awareness about Pompe disease, educating patients and families, and advocating for better access to treatments. Their efforts have led to increased visibility of the disease, prompting healthcare providers and policymakers to prioritize research and treatment options. As these groups continue to mobilize, they are likely to influence funding decisions and healthcare policies, which could enhance the availability of therapies. The impact of patient advocacy is profound, as it not only empowers patients but also drives market growth by fostering a supportive environment for the development of new treatments in the pompe disease-treatment market.

Regulatory Framework and Approval Processes

The regulatory framework and approval processes in Spain are crucial drivers for the pompe disease-treatment market. The Spanish Medicines Agency (AEMPS) has established streamlined pathways for the approval of orphan drugs, which are essential for treating rare diseases like Pompe disease. This regulatory support encourages pharmaceutical companies to invest in the development of innovative therapies, as the approval timelines are often shorter compared to traditional drugs. The potential for expedited access to the market can significantly enhance the financial viability of new treatments. As a result, the pompe disease-treatment market is likely to experience an influx of novel therapies, which could lead to a market valuation exceeding €300 million by 2028, reflecting the positive impact of a supportive regulatory environment.