Growing Awareness of Spinal Health

There is a notable increase in public awareness regarding spinal health and the importance of timely interventions for spinal disorders. Educational campaigns and health initiatives in Spain have contributed to a greater understanding of conditions such as scoliosis and degenerative disc disease. This heightened awareness is likely to lead to more patients seeking surgical solutions, thereby driving demand for pedicle screw systems. The pedicle screw-systems market stands to benefit from this trend, as more individuals are encouraged to pursue surgical options for spinal health issues. As a result, the market may experience a surge in demand for innovative and effective pedicle screw systems that cater to the needs of this growing patient population.

Rising Incidence of Spinal Disorders

The prevalence of spinal disorders in Spain is a significant driver for the pedicle screw-systems market. Factors such as sedentary lifestyles, aging populations, and increased screen time have contributed to a rise in conditions like herniated discs and spinal stenosis. Recent studies indicate that approximately 30% of the Spanish population experiences some form of spinal disorder, leading to a growing need for surgical interventions. This trend is likely to result in an increased demand for pedicle screw systems, as they are essential for stabilizing the spine during surgical procedures. The pedicle screw-systems market must respond to this rising incidence by offering a diverse range of products that cater to various spinal conditions, thereby ensuring that healthcare providers have the necessary tools to address this pressing health issue.

Technological Innovations in Surgical Tools

The continuous evolution of surgical technologies is a key factor influencing the pedicle screw-systems market. Innovations such as 3D printing, robotic-assisted surgery, and advanced imaging techniques are enhancing the precision and effectiveness of spinal surgeries. In Spain, the integration of these technologies into surgical practices is becoming increasingly common, with hospitals investing in cutting-edge equipment. This trend is expected to drive the demand for advanced pedicle screw systems that can leverage these innovations. The pedicle screw-systems market must stay abreast of these technological advancements to provide solutions that meet the evolving needs of surgeons and patients, ensuring improved surgical outcomes and patient satisfaction.

Rising Demand for Minimally Invasive Procedures

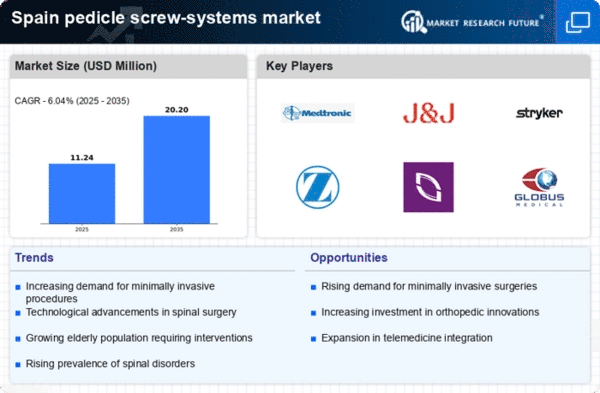

The increasing preference for minimally invasive surgical techniques is driving the growth of the pedicle screw-systems market. Surgeons and patients alike favor these procedures due to their reduced recovery times and lower complication rates. In Spain, the adoption of such techniques has been on the rise, with a reported increase of approximately 15% in minimally invasive spinal surgeries over the past few years. This trend is likely to continue, as advancements in technology enhance the efficacy and safety of these procedures. Consequently, the demand for innovative pedicle screw systems that facilitate minimally invasive approaches is expected to grow, thereby positively impacting the market. The pedicle screw-systems market must adapt to these evolving preferences to remain competitive and meet the needs of healthcare providers and patients.

Increased Investment in Healthcare Infrastructure

Spain's commitment to enhancing its healthcare infrastructure is a significant driver for the pedicle screw-systems market. The government has allocated substantial funding to improve hospital facilities and surgical equipment, which includes spinal surgery tools. Recent reports indicate that healthcare spending in Spain is projected to grow by 5% annually, with a focus on advanced surgical technologies. This investment is likely to lead to the procurement of state-of-the-art pedicle screw systems, thereby expanding the market. As hospitals upgrade their surgical capabilities, the demand for high-quality pedicle screw systems is expected to rise, creating opportunities for manufacturers and suppliers within the pedicle screw-systems market.