Focus on Chronic Disease Management

There is a growing emphasis on chronic disease management within the Spanish healthcare system, which is likely to impact the montelukast intermediate market positively. As healthcare providers prioritize long-term treatment strategies for conditions such as asthma, the demand for effective medications like montelukast is expected to rise. This focus on chronic disease management may lead to increased prescriptions and, consequently, a higher demand for montelukast intermediates. Additionally, healthcare initiatives aimed at improving patient outcomes may further drive the montelukast intermediate market, as providers seek reliable and effective treatment options for their patients.

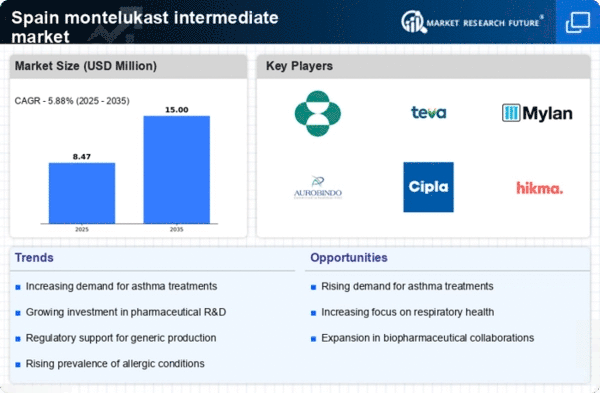

Rising Demand for Asthma Treatments

The montelukast intermediate market in Spain is experiencing a notable increase in demand due to the rising prevalence of asthma and allergic rhinitis. Recent statistics indicate that approximately 10% of the Spanish population suffers from asthma, leading to a growing need for effective treatments. This surge in demand is likely to drive the montelukast intermediate market, as montelukast is a widely prescribed medication for managing these conditions. Furthermore, the Spanish healthcare system is increasingly focusing on improving respiratory health, which may further bolster the market. As healthcare providers seek to offer better therapeutic options, the montelukast intermediate market is positioned to benefit from this trend, potentially leading to increased production and distribution of montelukast intermediates.

Regulatory Support for Generic Drugs

The montelukast intermediate market in Spain is likely to experience growth due to regulatory support for generic drugs. The Spanish Medicines Agency has implemented policies that encourage the production and distribution of generic medications, which can lead to increased availability of montelukast at lower prices. This regulatory environment may stimulate competition among manufacturers, driving down costs and making montelukast more accessible to patients. As generic versions of montelukast become more prevalent, the montelukast intermediate market may see a corresponding increase in demand for intermediates used in the production of these generics. This trend could enhance the overall market landscape, benefiting both manufacturers and consumers.

Emerging Research on Combination Therapies

Emerging research into combination therapies involving montelukast is likely to influence the montelukast intermediate market in Spain. Studies suggest that combining montelukast with other therapeutic agents may enhance treatment efficacy for asthma and allergic conditions. As clinical trials continue to explore these combinations, there may be an increased demand for montelukast intermediates to support the development of these innovative therapies. This trend could lead to a diversification of product offerings within the montelukast intermediate market, as manufacturers adapt to the evolving landscape of asthma treatment. The potential for new combination therapies may create opportunities for growth and innovation in the market.

Investment in Pharmaceutical Manufacturing

Spain's pharmaceutical sector is witnessing significant investments aimed at enhancing manufacturing capabilities. The montelukast intermediate market is likely to benefit from this trend, as increased investment can lead to improved production processes and higher quality standards. In 2023, the Spanish government announced a €500 million initiative to support pharmaceutical manufacturing, which may positively impact the montelukast intermediate market. Enhanced manufacturing capabilities could result in a more efficient supply chain, reducing costs and improving accessibility for healthcare providers. As a result, the montelukast intermediate market may see a rise in competitive pricing and availability, ultimately benefiting patients who rely on these essential medications.