Rising Demand for Advanced Imaging Techniques

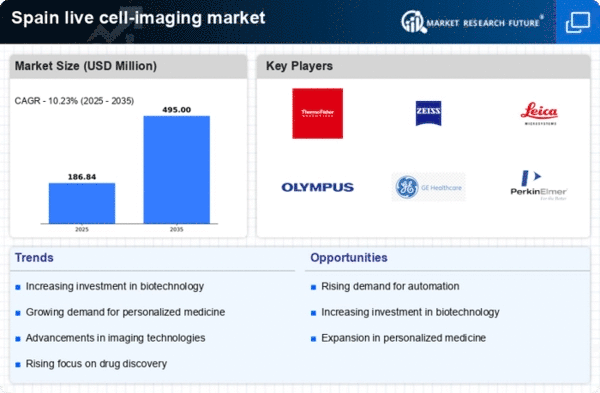

the live cell-imaging market in Spain is seeing increased demand for advanced imaging techniques.. Researchers and healthcare professionals are increasingly recognizing the value of real-time cellular analysis for understanding complex biological processes. This trend is driven by the need for more precise and efficient diagnostic tools, which are essential in both academic and clinical settings. The market is projected to grow at a CAGR of approximately 8% over the next five years, reflecting the growing interest in innovative imaging solutions. As a result, companies are investing in the development of cutting-edge technologies, such as high-resolution microscopy and automated imaging systems, to meet the evolving needs of the live cell-imaging market. This shift towards advanced imaging techniques is likely to enhance research capabilities and improve patient outcomes in Spain.

Regulatory Support for Innovative Technologies

Regulatory bodies in Spain are increasingly supportive of innovative technologies, which positively impacts the live cell-imaging market. The Spanish government has implemented policies aimed at fostering research and development in biotechnology and medical imaging. This regulatory environment encourages companies to invest in the development of new imaging technologies, as they can navigate the approval processes more efficiently. Additionally, the establishment of funding programs and grants for research initiatives further stimulates innovation in the live cell-imaging market. As regulatory support continues to grow, it is likely that more advanced imaging solutions will emerge, enhancing the capabilities of researchers and clinicians in Spain.

Growing Focus on Drug Discovery and Development

the live cell-imaging market in Spain is influenced by the growing focus on drug discovery.. Pharmaceutical companies are increasingly utilizing live cell imaging techniques to monitor cellular responses to new compounds in real-time, which is crucial for identifying potential drug candidates. This trend is supported by the increasing investment in biopharmaceutical research, which reached approximately €1.5 billion in 2025. As the demand for more efficient drug development processes rises, the live cell-imaging market is likely to expand, providing researchers with the tools necessary to conduct high-throughput screening and assess drug efficacy. The integration of live cell imaging into drug discovery workflows is expected to enhance the overall efficiency and success rates of new therapies.

Increased Collaboration Between Academia and Industry

Collaboration between academic institutions and industry players is becoming increasingly prevalent in Spain, significantly impacting the live cell-imaging market. These partnerships facilitate the exchange of knowledge, resources, and technology, leading to accelerated innovation in imaging techniques. Universities and research centers are often at the forefront of developing new methodologies, while industry partners provide the necessary funding and commercial expertise to bring these innovations to market. This synergy is expected to drive growth in the live cell-imaging market, as collaborative projects often result in the creation of advanced imaging systems tailored to specific research needs. Furthermore, such collaborations can enhance the training of researchers and technicians, ensuring a skilled workforce capable of utilizing sophisticated imaging technologies effectively.

Rising Awareness of Cellular Dynamics in Disease Research

There is a growing awareness of the importance of cellular dynamics in disease research within the live cell-imaging market in Spain. Researchers are increasingly recognizing that understanding cellular behavior in real-time can provide critical insights into disease mechanisms and treatment responses. This awareness is driving demand for live cell imaging technologies that allow for the observation of cellular processes as they occur. As a result, investments in live cell imaging systems are expected to rise, as researchers seek to incorporate these tools into their studies. The emphasis on cellular dynamics is likely to lead to advancements in imaging technologies, ultimately enhancing the understanding of various diseases and improving therapeutic strategies.